Navigating Your Property Value With The Tarrant County Appraisal District

Understanding your property's value is, you know, a pretty big deal, especially when it comes to figuring out what you owe in taxes. For folks living in Tarrant County, the place you'll want to get familiar with is the Tarrant County Appraisal District. This organization plays a really important part in how your property is valued each year, and knowing a bit about what they do can save you some headaches, that's for sure.

The Tarrant Appraisal District, often called TAD, is a political subdivision of the state of Texas. It came into being on January 1, 1980, so it's been around for quite a while now. Its main job is to appraise all taxable property within Tarrant County, and this appraisal forms the basis for local property taxes, as a matter of fact.

The rules and how TAD operates are very clearly laid out in the Texas Property Tax Code. This code governs everything from how they value properties to the steps taxpayers can take if they have questions or concerns about their appraisal. It's really the core document guiding their work, so it is.

- Marine Brian Brown Easley

- Florida Baseball Coach Scandal

- Brekie Hill Shower Leaks

- Does Tiktok Have Seen

- Brian Easley Daughter Now

Table of Contents

- Understanding the Tarrant County Appraisal District

- Keeping Up with Your Property Information

- Important Updates and Applications

- Getting in Touch with TAD

- Frequently Asked Questions About Tarrant County Appraisal District

- Your Next Steps with the Appraisal District

Understanding the Tarrant County Appraisal District

The Tarrant County Appraisal District is, in a way, the central hub for property valuation within the county. Their work affects every property owner, whether you have a home, a business, or land. They are responsible for making sure that all properties are valued fairly and consistently, which, you know, is a really big job.

- Osama Brothers

- Is Ddot And Dd Osama Brothers

- Nomi And Mac Miller

- Donkey Fall

- Breckie Hill Shower Leak Video

This district's role is to value property for tax purposes, not to collect taxes. That's an important distinction, really. They provide the valuation, and then local taxing units, like cities, school districts, and the county, use those values to calculate your property tax bill. So, it's a bit like they set the base, and others build on it, in some respects.

What TAD Does for You

TAD's main function is to appraise all properties within its boundaries. This includes homes, businesses, and even mineral interests. The goal is to determine the market value of each property as of January 1st of each year. This value is what your property taxes will be based on, usually.

They also process applications for various exemptions, like homestead exemptions, which can help reduce the taxable value of your primary residence. These exemptions are quite helpful for property owners, actually. They also handle property ownership changes and keep records of all properties in the county, so it's a very busy place.

The Texas Property Tax Code and Your Rights

The operations of the Tarrant Appraisal District are strictly guided by the provisions of the Texas Property Tax Code. This legal framework dictates how properties are valued, how notices are sent, and what options property owners have if they disagree with an appraisal. It's a comprehensive set of rules, clearly.

This code also outlines your rights as a property owner. For example, it explains how you can protest your property's value, how to apply for exemptions, and how to interact with the Appraisal Review Board (ARB). Knowing your rights under this code is pretty important for every property owner, that's for sure.

Keeping Up with Your Property Information

Staying informed about your property's details and its appraisal is, well, it's just good practice. The Tarrant Appraisal District provides several ways for property owners to access information and keep an eye on things. This access is designed to be as straightforward as possible, usually.

It's always a good idea to check your property's information regularly, not just when appraisal notices come out. This can help you catch any potential issues early on. Being proactive about this sort of thing can save you a lot of trouble down the road, it really can.

Using the Interactive Mapping Tool

The Tarrant Appraisal District offers an interactive mapping application. This tool lets you view parcel ownership information and valuation details for informational purposes. It's a really neat way to see your property, and others nearby, on a map, actually.

You can use this application to look up specific properties, see their boundaries, and get a general idea of their appraised value. It's a handy resource for anyone wanting to understand property layouts and ownership in the county. It's more or less like having a digital map of all properties, you know.

New Appraisal Notices for 2025

Property owners in Tarrant County who received their 2025 appraisal notices may have seen a change in the format this year. This is a recent development, announced around April 14, 2025, from Fort Worth, TX. It's a clear sign that the district is always looking to improve how they communicate, apparently.

These format changes are typically made to make the notices clearer and easier to understand for property owners. It's a step towards better transparency, which is always a good thing. So, if your notice looked a bit different, that's why, basically.

Important Updates and Applications

The Tarrant Appraisal District often introduces new ways for property owners to interact with them and manage their property information. These updates are usually aimed at making processes more convenient and accessible. It's all about trying to make things simpler for everyone, you know.

Keeping an eye on these updates can really help you take advantage of new features or improved services. They are designed to benefit property owners by streamlining common tasks. So, staying informed is pretty smart, as a matter of fact.

The Online Homestead Application

One significant improvement the Tarrant Appraisal District has introduced is a new online homestead application. This is a fantastic development for homeowners. It means you can apply for your homestead exemption from the comfort of your own home, which is very convenient, truly.

Applying online can save you time and hassle compared to traditional paper applications. It's a more modern approach that fits with how many people manage their affairs today. This kind of digital service is often appreciated by many property owners, you know.

Mineral Interest Accounts: What You Should Know

The district also provides new important information concerning mineral interest accounts. These accounts deal with the value of subsurface mineral rights, which can be a bit different from surface property values. It's a specialized area of appraisal, in a way.

If you own mineral interests, or think you might, it's worth checking out this information. Understanding how these are appraised and what details are needed can be quite helpful. It's a topic that sometimes gets overlooked, but it's important for those affected, you know.

Property Value Notices and Improvements

Beyond the format change for 2025, the Tarrant Appraisal District also works on other improvements to property value notices. These changes are often about making the information clearer and more actionable for property owners. It's all part of an effort to be more user-friendly, really.

These improvements might include better explanations of how values were determined, or clearer instructions on how to protest an appraisal. The goal is to make sure property owners have all the details they need to understand their notice. So, they're always trying to make things a little better, it seems.

Getting in Touch with TAD

Sometimes, you just need to talk to someone directly or send a specific inquiry. The Tarrant Appraisal District makes it pretty straightforward to contact them. They understand that property owners will have questions or need to provide information, which is why they have clear contact methods, you know.

Whether you have a question about your appraisal, need to update information, or want to discuss an exemption, reaching out is the first step. They are there to help with property tax related appraisal matters, basically.

When to Contact the Appraisal District

If you need to contact the Tarrant Appraisal District, they ask that you fill out their contact form. This helps them direct your inquiry to the right department and get back to you as quickly as they can. It's a pretty efficient way to manage inquiries, you know.

You might contact them for various reasons: perhaps you have questions about your appraisal notice, want to apply for a homestead exemption, need to report a change in ownership, or have questions about a mineral interest account. They are the go-to place for anything related to your property's appraisal value. Remember, whatever county your property is located in, that's the appraisal district and appraisal review board for taxpayers to do business with, so it is.

Frequently Asked Questions About Tarrant County Appraisal District

Many property owners have similar questions about their appraisals and how the district works. Here are a few common ones that might come up, as a matter of fact.

How does the Tarrant County Appraisal District determine my property's value?

The district uses mass appraisal techniques to determine the market value of properties as of January 1st each year. They look at sales of similar properties, property characteristics, and other factors that influence value. It's a complex process, but they aim for fairness, you know.

What should I do if I disagree with my appraisal notice?

If you don't agree with your appraisal notice, you have the right to protest it. The notice itself usually includes instructions on how to file a protest and the deadline for doing so. It's important to act quickly once you receive your notice, usually.

Can I apply for a homestead exemption online with Tarrant Appraisal District?

Yes, the Tarrant Appraisal District has introduced a new online homestead application. This makes it much easier to apply for this important exemption, which can help reduce the taxable value of your primary home. It's a really convenient option, that's for sure.

Your Next Steps with the Appraisal District

Staying informed and engaged with the Tarrant County Appraisal District is a smart move for any property owner. By understanding their role, utilizing their online tools, and knowing how to contact them, you can feel much more in control of your property's tax situation. It's all about being prepared, really.

If you've received your 2025 appraisal notice, take a good look at it, especially with the new format. If anything seems off, or if you have questions, don't hesitate to reach out to the district. They are there to help guide you through the process, so it's worth connecting with them.

For more detailed information on property tax laws in Texas, you might want to look at the official Texas Property Tax Code. It's a comprehensive resource for understanding the legal framework behind property appraisals and taxes, you know.

Learn more about property valuation on our site, and for additional resources, you can also link to this page here.

- How To Open Bath And Body Works Hand Soap

- Khamzat Chimaev Without Beard

- Donkey Fall

- What The French Toast Commercial

- Khamzat Chimaev Without Bear

Tarrant County Appraisal District

Tarrant Appraisal District - Fort Worth Report

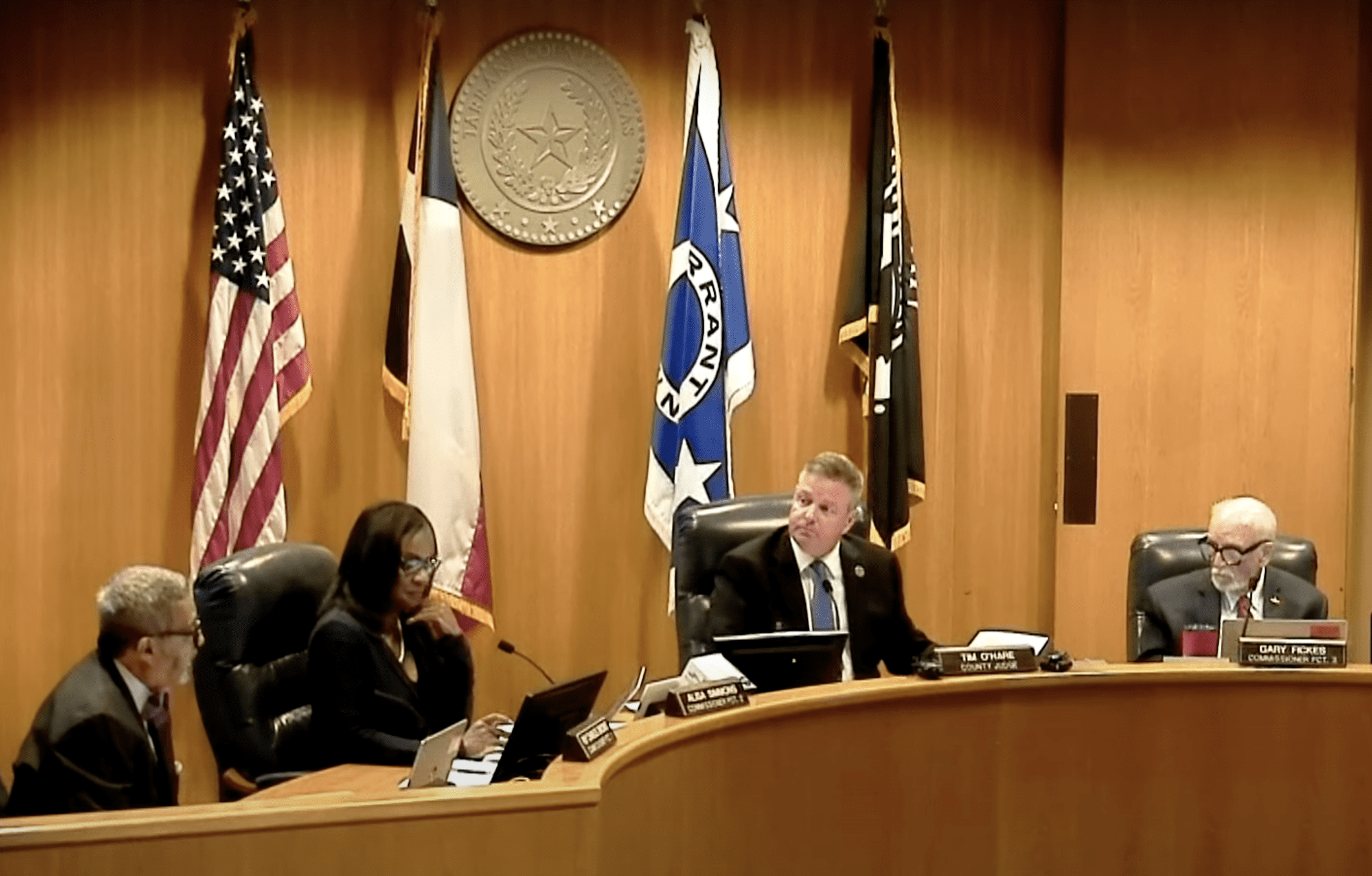

Tarrant County Votes ‘No Confidence’ in Appraisal District Chief