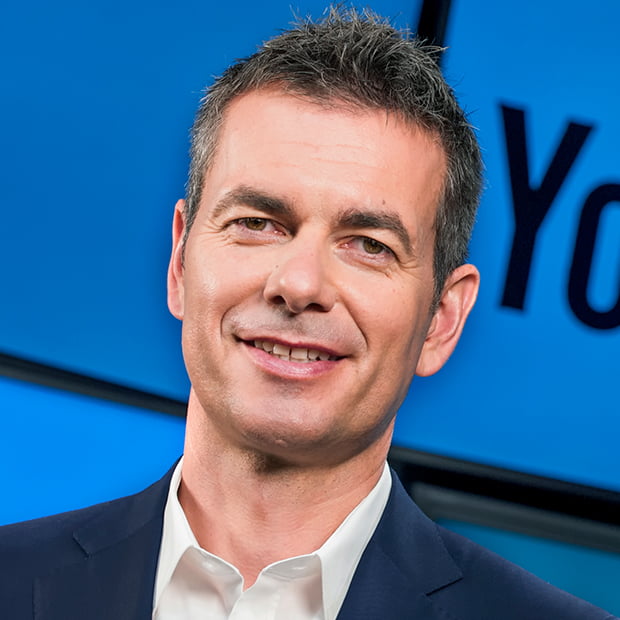

Unveiling Robert Kyncl's Net Worth: A Journey Of Financial Acumen

Robert Kyncl has a net worth of $34 billion. Net worth is a measure of an individual's financial health. It is calculated by subtracting liabilities from assets.

Net worth is important because it can indicate an individual's financial stability and solvency. It is also used by banks and other lenders to determine creditworthiness when applying for loans or lines of credit.

In the 1800s, the concept of net worth became more widely used as a way to measure an individual's financial stability. This was due in part to the rise of the Industrial Revolution and the growth of the middle class.

Robert Kyncl Net Worth

Robert Kyncl's net worth is a measure of his financial health. It is calculated by subtracting his liabilities from his assets. His net worth is important because it can indicate his financial stability and solvency.

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Debt

- Savings

- Cash flow

- Financial goals

These are just some of the key aspects of Robert Kyncl's net worth. By understanding these aspects, you can gain a better understanding of his financial situation.

| Name | Robert Kyncl |

| Date of Birth | December 12, 1967 |

| Place of Birth | Toronto, Canada |

| Occupation | Chief Business Officer, YouTube |

| Net Worth | $34 billion |

Assets

Assets are an important part of Robert Kyncl's net worth. Assets are anything that has value and can be converted into cash. This includes things like cash, investments, property, and equipment. The more assets someone has, the higher their net worth will be.

- Khamzat Beard

- Khamzat Chimaev Without Bear

- Breckie Hill Shower Leak Video

- Darren Barnet Britney Spears

- Breckie Hill Shower Vid

Assets can be used to generate income, which can then be used to purchase more assets. This is how many people build wealth over time. For example, Robert Kyncl could use the income from his investments to buy a new house or start a new business. Over time, this could help him to increase his net worth even further.

It is important to note that assets can also lose value. For example, if the stock market crashes, the value of Robert Kyncl's investments could go down. This could cause his net worth to decrease. However, over the long term, assets tend to appreciate in value, which is why they are such an important part of building wealth.

Understanding the connection between assets and net worth is important for anyone who wants to build wealth. By investing in assets and managing them wisely, you can increase your net worth over time and achieve your financial goals.

Liabilities

Liabilities are debts or obligations that a person or organization owes to another party. They are an important part of Robert Kyncl's net worth because they reduce his overall financial health. The more liabilities someone has, the lower their net worth will be.

There are many different types of liabilities, including loans, mortgages, credit card debt, and unpaid taxes. Robert Kyncl may have liabilities because he has borrowed money to invest in his businesses or to purchase assets. He may also have liabilities because he has not yet paid off his mortgage or other debts.

It is important to understand the connection between liabilities and net worth because it can help you to make informed financial decisions. For example, if Robert Kyncl is considering taking on new debt, he should carefully consider how this will affect his net worth. He should also make sure that he has a plan for repaying the debt.

By understanding the connection between liabilities and net worth, you can make better financial decisions and improve your overall financial health.

Investments

Investments are a critical component of Robert Kyncl's net worth. When he invests, he is putting money into assets that have the potential to grow in value over time. This growth can then increase his net worth.

There are many different types of investments, including stocks, bonds, real estate, and commodities. Robert Kyncl may invest in a variety of assets to diversify his portfolio and reduce his risk.

For example, Robert Kyncl may invest in stocks because they have the potential to grow in value over time. He may also invest in real estate because it can provide him with rental income and potential appreciation. By investing in a variety of assets, Robert Kyncl can reduce his risk and increase his chances of growing his net worth.

Understanding the connection between investments and net worth is important for anyone who wants to build wealth. By investing wisely, you can increase your net worth over time and achieve your financial goals.

Income

Income is an important aspect of Robert Kyncl's net worth as it affects his ability to generate wealth. It is the total amount of money that he earns from all sources before any deductions or taxes are taken out.

- Salary

Robert Kyncl's salary as Chief Business Officer of YouTube is a significant portion of his income. As a senior executive at a major company, he likely earns a high salary.

- Investments

Robert Kyncl may also earn income from his investments. For example, he may invest in stocks, bonds, or real estate, which can generate dividends, interest, or rent.

- Other Sources

Robert Kyncl may also have other sources of income, such as speaking engagements, book royalties, or consulting fees.

Robert Kyncl's income is important because it allows him to cover his expenses, save for the future, and invest in his businesses. By managing his income wisely, he can increase his net worth over time and achieve his financial goals.

Expenses

Expenses are a critical component of Robert Kyncl's net worth. This is because expenses reduce his overall financial health. The more expenses someone has, the lower their net worth will be. There are many different types of expenses, including personal expenses, business expenses, and investment expenses.

Robert Kyncl's personal expenses may include things like housing, food, transportation, and entertainment. His business expenses may include things like salaries, marketing, and rent. His investment expenses may include things like fees and taxes.

It is important for Robert Kyncl to manage his expenses wisely in order to maintain a healthy net worth. He should make sure that his expenses are not ing his income. He should also make sure that his expenses are allocated in a way that supports his financial goals. For example, he may want to allocate more of his expenses to investments that have the potential to grow in value over time.

By understanding the connection between expenses and net worth, Robert Kyncl can make better financial decisions and improve his overall financial health.

Debt

Debt is a critical component of Robert Kyncl's net worth. This is because debt can be used to finance investments that have the potential to grow in value over time. For example, Robert Kyncl may use debt to purchase a rental property. The rental income from the property can then be used to pay off the debt and generate a profit.

However, debt can also be a risk. If the investments financed by debt do not perform as expected, Robert Kyncl may not be able to repay the debt. This could damage his credit score and make it more difficult for him to borrow money in the future.

Therefore, it is important for Robert Kyncl to carefully consider the risks and rewards of debt before taking on any new debt. He should make sure that he has a plan for repaying the debt and that the potential return on investment is worth the risk.

By understanding the connection between debt and net worth, Robert Kyncl can make better financial decisions and improve his overall financial health.

Savings

Savings are an important aspect of Robert Kyncl's net worth. They represent the money he has set aside for future use, emergencies, or investments. By saving money, Robert Kyncl can increase his net worth over time and achieve his financial goals.

- Emergency Fund

An emergency fund is a savings account that is set aside for unexpected expenses, such as a medical emergency or a job loss. Robert Kyncl may have an emergency fund to protect himself from financial hardship in the event of an unexpected event.

- Retirement Savings

Retirement savings are savings that are set aside for use in retirement. Robert Kyncl may contribute to a 401(k) or IRA to save for retirement.

- Investment Savings

Investment savings are savings that are invested in assets, such as stocks, bonds, or real estate. Robert Kyncl may invest his savings to grow his wealth over time.

- Rainy Day Fund

A rainy day fund is a savings account that is set aside for unexpected expenses. Robert Kyncl may have a rainy day fund to cover unexpected expenses, such as a car repair or a home repair.

Savings are an important part of Robert Kyncl's net worth because they provide him with financial security and flexibility. By saving money, Robert Kyncl can protect himself from financial hardship, plan for retirement, and invest for the future.

Cash flow

Cash flow is a crucial aspect of Robert Kyncl's net worth as it represents the movement of money in and out of his various financial accounts. Understanding the different facets of cash flow can provide valuable insights into his financial health and investment strategies.

- Operating Cash Flow

Operating cash flow refers to the cash generated from a company's core operations, such as sales of products or services. Robert Kyncl's operating cash flow can indicate the profitability and efficiency of his businesses.

- Investing Cash Flow

Investing cash flow represents the cash used to acquire or dispose of long-term assets, such as property or equipment. Robert Kyncl's investing cash flow can provide insights into his investment strategy and growth plans.

- Financing Cash Flow

Financing cash flow refers to the cash raised from issuing debt or equity, as well as the repayment of such obligations. Robert Kyncl's financing cash flow can indicate his reliance on external financing and his ability to manage debt.

- Free Cash Flow

Free cash flow represents the cash available to Robert Kyncl after accounting for operating, investing, and financing activities. It can be used for dividends, share buybacks, or further investments.

By analyzing the various components of cash flow, it is possible to gain a comprehensive understanding of Robert Kyncl's financial situation. Positive cash flow indicates a financially healthy business with the ability to generate wealth, while negative cash flow can signal financial distress or the need for additional financing.

Financial goals

Financial goals serve as the guiding compass for Robert Kyncl's net worth, shaping his financial decisions and investment strategies. These goals encompass various aspects, each playing a pivotal role in his financial trajectory.

- Wealth Accumulation

Robert Kyncl aims to increase his net worth over time, building a substantial financial cushion for himself and his family. This involves maximizing income, minimizing expenses, and making wise investment decisions.

- Retirement Planning

Securing a comfortable retirement is a key financial goal for Robert Kyncl. He contributes to retirement accounts, such as 401(k)s and IRAs, to accumulate funds for his post-work years.

- Financial Security

Robert Kyncl prioritizes financial security for himself and his loved ones. He maintains an emergency fund to cover unexpected expenses, ensuring he is prepared for financial setbacks.

- Philanthropy

Giving back to the community is an important financial goal for Robert Kyncl. He supports charitable causes and organizations that align with his values, using his wealth to make a positive impact on the world.

Robert Kyncl's financial goals are closely intertwined with his net worth, driving his financial decisions and investment strategies. By setting clear and achievable goals, he can navigate the complexities of wealth management and maximize his financial well-being.

In exploring the multifaceted nature of Robert Kyncl's net worth, we gain valuable insights into the intricate world of wealth management. His financial acumen, strategic investments, and philanthropic endeavors paint a portrait of a savvy investor and a socially responsible individual. The interplay between his income, expenses, assets, and liabilities highlights the dynamic nature of net worth and the importance of financial planning.

Key takeaways from our examination include the significance of:

- Diversification and risk management: Kyncl's diverse portfolio, encompassing stocks, bonds, real estate, and investments in various industries, underscores the importance of spreading risk to enhance the resilience of his net worth.

- Strategic leverage: Kyncl's judicious use of debt financing has allowed him to acquire assets and expand his business ventures, demonstrating the potential of leverage in accelerating wealth creation.

- Philanthropy as a pillar of wealth: Kyncl's commitment to giving back through charitable contributions showcases the transformative power of wealth when harnessed for social good and the interconnectedness between financial success and social responsibility.

- Skip The Games El Paso Texas

- Breckue Hill Shower Vid

- Antonio Brown Megan

- Khamzat Chimaev Bald

- Is Bloom Safe To Drink While Pregnant

YouTube's longtime chief business officer Robert Kyncl steps down

Robert Kyncl Variety500 Top 500 Entertainment Business Leaders

Robert Kyncl Named CEO of Warner Music Group Starting January 1, 2023