Unveiling The Riches Of Samantha Lewes: Exploring Her Net Worth

Samantha Lewes net worth refers to the total value of all the assets, investments, and earnings accumulated by Samantha Lewes throughout her career as an actress and producer. For example, in 1981, Lewes had an estimated net worth of approximately $5 million.

Net worth is an important metric that provides insight into an individual's financial standing. It can be used to evaluate wealth, assess creditworthiness, and make informed decisions about financial planning. The concept of net worth has evolved over time, and its calculation methods have undergone significant historical development.

This article will delve into the net worth of Samantha Lewes, exploring its components, key factors influencing its value, and how it compares to other notable figures within the entertainment industry.

- Is Dd And Notti Brothers

- Breckie Hill Shower Leaks

- Is Bloom Safe To Drink While Pregnant

- Antonio Brown Megan

- You Like My Voice It Turn You On Lyrics

samantha lewes net worth

Understanding the various aspects of Samantha Lewes' net worth provides valuable insights into her financial standing, career achievements, and overall wealth. These essential aspects include:

- Income

- Assets

- Investments

- Expenses

- Liabilities

- Cash flow

- Financial goals

- Estate planning

By examining these aspects, we can gain a comprehensive understanding of Samantha Lewes' financial situation, her sources of income and wealth, as well as her financial planning strategies.

| Name | Samantha Lewes |

|---|---|

| Birth Date | November 5, 1957 |

| Birth Place | Los Angeles, California |

| Death Date | March 12, 2022 |

| Occupation | Actress, producer |

| Net Worth | $5 million (approx.) |

Income

Income forms the foundation of Samantha Lewes' net worth, representing the various streams of revenue that contribute to her overall wealth. These include earnings from acting, producing, and any other sources such as investments or royalties.

- Breckie Hill Shower Vid

- Why Does Tiktok Say No Internet Connection

- Buffet De Mariscos Cerca De Mi

- Breckie Hill Shower Video Leaked

- How To Open Bath And Body Works Hand Soap

- Acting

Lewes' primary source of income was her acting career. She appeared in numerous films and television shows, earning a significant portion of her net worth through her performances.

- Producing

In addition to acting, Lewes also worked as a producer. She produced several films and television projects, which further contributed to her net worth.

- Investments

Lewes invested a portion of her income in stocks, bonds, and other financial instruments. These investments generated passive income and helped grow her net worth over time.

- Other Sources

Lewes may have also earned income from other sources such as royalties, endorsements, or business ventures. These additional sources contributed to her overall net worth.

Understanding the various sources of income that contributed to Samantha Lewes' net worth provides insights into her financial success and the factors that influenced her wealth accumulation.

Assets

Assets play a critical role in determining Samantha Lewes' net worth, which represents her total financial worth. Assets are anything of value that Samantha Lewes owns or controls, and they contribute directly to her overall wealth.

Assets can be categorized into different types, such as tangible assets (e.g., real estate, jewelry, art) and intangible assets (e.g., stocks, bonds, intellectual property). Samantha Lewes' assets may have included various investments, properties, and personal belongings. These assets would have contributed to her net worth's value and provided her with financial security and stability.

Understanding the composition of Samantha Lewes' assets is essential for gaining insights into her financial situation. By analyzing the types and value of her assets, we can assess her financial diversification, risk tolerance, and overall investment strategy. This understanding can also provide valuable lessons for individuals seeking to build and manage their own wealth.

Investments

Samantha Lewes' investments played a significant role in shaping her net worth, providing her with a steady stream of passive income and contributing to the growth of her overall wealth.

- Stock Portfolio

Lewes' investment portfolio likely included a diverse range of stocks, representing ownership in different companies across various industries. Dividends from these stocks would have contributed to her regular income and provided potential for long-term capital appreciation.

- Real Estate

Lewes may have invested in residential or commercial properties, generating rental income and potential capital gains through property appreciation. Real estate can provide a stable source of passive income and serve as a hedge against inflation.

- Bonds

Bonds are fixed-income securities that provide regular interest payments and a return of principal upon maturity. Lewes may have invested in bonds to diversify her portfolio, reduce risk, and generate a steady stream of income.

- Alternative Investments

Lewes could have explored alternative investments such as private equity, venture capital, or hedge funds to potentially enhance her returns. These investments offer higher risk-reward profiles and can provide diversification benefits.

By understanding the various facets of Samantha Lewes' investments, we can gain insights into her financial acumen, risk appetite, and long-term wealth management strategies. Her diversified portfolio likely contributed to the preservation and growth of her net worth, providing her with financial security and stability.

Expenses

Expenses play a crucial role in determining Samantha Lewes' net worth. They represent the various costs and outlays that reduce the overall value of her assets and income. Understanding her expenses provides insights into her lifestyle, financial obligations, and overall financial management.

- Living Expenses

These include basic necessities such as housing, food, transportation, utilities, and other day-to-day costs. Lewes' living expenses would have varied depending on her lifestyle and personal preferences.

- Taxes

Lewes would have been subject to various taxes, including income tax, property tax, and sales tax. These taxes reduce her disposable income and impact her net worth.

- Healthcare Costs

Lewes likely incurred expenses related to healthcare, including health insurance premiums, medical bills, and prescription medications. These costs can be significant, especially in the absence of comprehensive health insurance coverage.

- Investment Expenses

Lewes' investment activities may have involved expenses such as brokerage fees, management fees, and other costs associated with managing her portfolio. These expenses reduce her overall investment returns and impact her net worth.

Analyzing Samantha Lewes' expenses provides a comprehensive view of her financial situation. It reveals her spending habits, financial priorities, and the factors that influence her net worth. By understanding her expenses, we can gain insights into her financial management strategies and make informed decisions about her financial future.

Liabilities

Liabilities represent financial obligations that reduce Samantha Lewes' net worth and can impact her overall financial health. These obligations can take various forms, including debts, loans, and other commitments that require repayment or fulfillment.

- Outstanding Loans

Lewes may have had outstanding loans, such as mortgages, personal loans, or business loans. These loans would have reduced her net worth and required regular payments of principal and interest.

- Credit Card Debt

Lewes could have carried a balance on credit cards, which would have accrued interest charges and reduced her net worth. Excessive credit card debt can negatively impact her credit score and overall financial well-being.

- Unpaid Taxes

Lewes may have owed unpaid taxes, such as income tax, property tax, or sales tax. These unpaid taxes would have increased her liabilities and could have resulted in penalties and interest charges.

- Legal Obligations

Lewes may have had legal obligations, such as child support or alimony payments. These obligations would have reduced her disposable income and impacted her net worth.

Understanding the nature and extent of Samantha Lewes' liabilities is crucial for assessing her financial situation and making informed decisions about her financial future. Liabilities can significantly impact her cash flow, creditworthiness, and overall wealth accumulation strategies.

Cash Flow

Cash flow plays a crucial role in shaping Samantha Lewes' net worth by providing insights into her liquidity, financial stability, and overall financial health. Cash flow management involves tracking and managing the movement of money in and out of her financial accounts.

- Operating Cash Flow

This refers to the cash generated or used in the day-to-day operations of Lewes' businesses or income-generating activities. Positive operating cash flow indicates a company's ability to cover its expenses and generate profits.

- Investing Cash Flow

This measures the cash used to purchase or sell assets, such as real estate, equipment, or investments. Investing cash flow can impact Lewes' net worth by influencing the value of her assets and her long-term financial growth.

- Financing Cash Flow

This involves the cash received or repaid from borrowing or lending activities. Positive financing cash flow indicates that Lewes is using debt to fund her operations or investments, while negative cash flow suggests she is repaying debt or issuing dividends.

- Free Cash Flow

This represents the cash available to Lewes after accounting for all expenses, investments, and financing activities. Positive free cash flow indicates financial flexibility and the potential for growth or dividends.

Analyzing Samantha Lewes' cash flow provides valuable insights into her financial management strategies and overall financial well-being. By understanding the sources and uses of her cash, we can assess her ability to meet financial obligations, fund growth initiatives, and maintain a healthy net worth.

Financial goals

Financial goals play a significant role in shaping Samantha Lewes' net worth by providing direction and purpose to her financial decisions. By establishing clear financial objectives, she can prioritize her spending, saving, and investment strategies to achieve her desired financial outcomes.

- Retirement Planning

Lewes may have set financial goals related to retirement planning, ensuring a secure financial future. These goals could involve saving a specific amount of money, investing in retirement accounts, or planning for potential healthcare expenses in retirement.

- Wealth Accumulation

Lewes may have had the goal of accumulating wealth over time. This could involve setting targets for increasing her net worth, investing in growth-oriented assets, or exploring business ventures to generate additional income streams.

- Financial Security

Lewes may have prioritized financial security as a goal. This could involve maintaining an emergency fund, managing debt effectively, and ensuring adequate insurance coverage to protect her assets and income.

- Philanthropy

Lewes may have incorporated philanthropic goals into her financial planning. This could involve setting aside funds for charitable donations, supporting specific causes, or establishing a foundation to make a lasting impact.

Understanding Samantha Lewes' financial goals provides valuable insights into her financial priorities, risk tolerance, and long-term aspirations. By aligning her financial decisions with her goals, she can effectively manage her net worth and achieve her desired financial outcomes.

Estate planning

Estate planning and Samantha Lewes' net worth are inextricably connected, as it ensures the preservation and distribution of her assets after her passing, ultimately impacting her net worth. Estate planning involves creating legal documents that outline an individual's wishes for the management and distribution of their assets upon their death, including wills, trusts, and powers of attorney. These documents help ensure that her assets are distributed according to her wishes, minimizing estate taxes and avoiding probate, a legal process that can be both time-consuming and costly.

Establishing a comprehensive estate plan allows Samantha Lewes to make informed decisions about how her assets will be distributed, reducing the risk of disputes among heirs and ensuring that her legacy is preserved. By appointing an executor to manage her estate, she can provide clear instructions on how her assets should be handled, ensuring that her wishes are carried out.

Understanding the importance of estate planning is crucial for individuals seeking to protect their net worth and ensure the well-being of their loved ones after their passing. It provides peace of mind, knowing that their assets will be managed and distributed according to their wishes, minimizing the potential impact on their net worth and ensuring a smooth transition of their legacy.

Samantha Lewes' net worth serves as a multifaceted indicator of her financial success, encompassing her income, assets, investments, expenses, liabilities, cash flow, financial goals, and estate planning strategies. By examining these components, we gain valuable insights into her financial management, risk tolerance, and long-term wealth accumulation strategies.

Key takeaways from this exploration include the significance of diversification in her investment portfolio, her commitment to financial security through estate planning, and the impact of expenses and liabilities on her overall net worth. Understanding these interconnections highlights the importance of comprehensive financial planning and management in building and preserving wealth.

- Does Tiktok Have Seen

- Nomi Mac Miller

- How Much Does Tommy The Clown Charge

- Hobby Lobby Wood Arch Backdrop

- Khamzat Chimaev With No Beard

Wat is der bard mei Samantha Lewes? Celebrity.fm 1 Offisjele

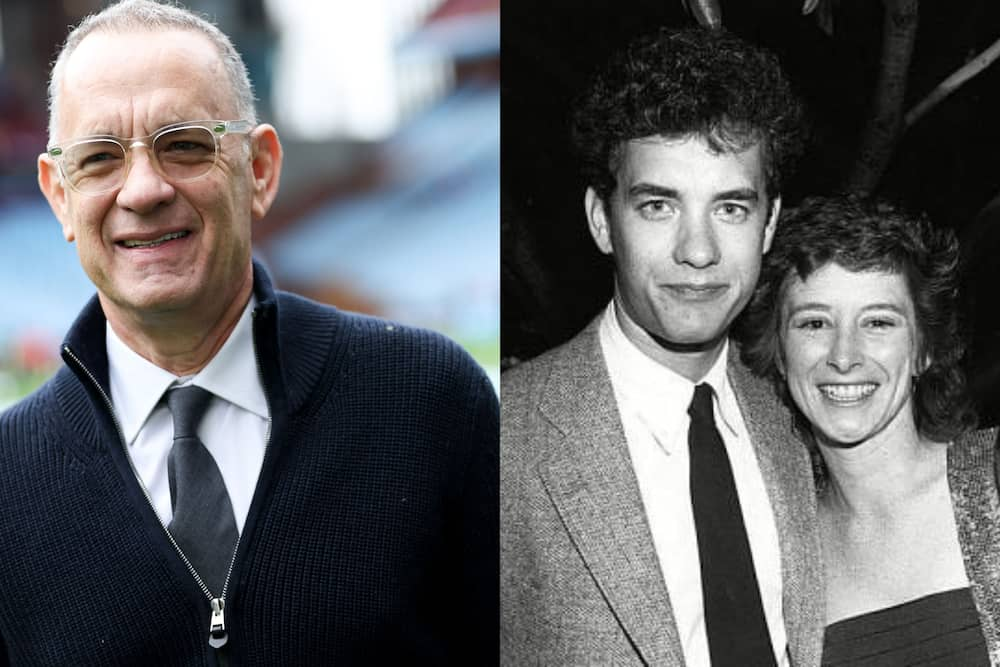

Actress Samantha Lewes, Tom Hanks’ exwife Wiki Cause of Death, Net

Samantha Lewes Tom Hanks' divorce story and her cause of death Tuko