Understanding Sutton's Husband: Legal And Ethical Implications

"Sutton's Husband", a term applied in the legal field, refers to a spouse or partner who provides financial support and assistance to their partner engaged in legal or political activities.

This concept is particularly relevant in cases where the supported partner's career significantly impacts their family's financial well-being. Historically, the term "Sutton's Husband" emerged in the 1960s as a legal precedent relating to political contributions and personal income tax deductions.

This article delves into the significance, legal implications, and modern applications of the concept of "Sutton's Husband" in the context of financial support for legal and political endeavors.

- Brian Easley Daughter Now

- Dd Osama Brothers

- Khamzat Chimaev Without Bear

- What The French Toast Commercial

- You Like My Voice It Turn You On Lyrics

Sutton's Husband

Understanding the various aspects of "Sutton's Husband" is essential for a comprehensive grasp of the term's legal and practical implications. These key aspects encompass the definition, historical context, legal significance, financial implications, and modern applications of the concept.

- Definition: Spouse or partner providing financial support for legal or political activities.

- Historical Context: Originated in the 1960s as a legal precedent related to political contributions and tax deductions.

- Legal Significance: Impacts tax liability and campaign finance regulations.

- Financial Implications: Can involve substantial financial contributions and potential tax benefits.

- Modern Applications: Extends beyond traditional political campaigns to include legal advocacy and social justice movements.

- Legal Protections: May have legal protections and rights regarding financial contributions and decision-making.

- Ethical Considerations: Raises questions about conflicts of interest and the influence of financial support.

- Global Variations: Concept may vary across different jurisdictions and legal systems.

- Recent Developments: Ongoing legal and policy debates surrounding the role of "Sutton's Husbands" in political funding.

- Future Implications: Potential impact on campaign finance reform and political transparency.

These key aspects provide a framework for understanding the multifaceted nature of "Sutton's Husband." They highlight the legal, financial, ethical, and practical considerations associated with this concept, making them essential for anyone seeking a deeper understanding of its significance.

Definition

This definition encapsulates the core concept of "Sutton's Husband." It highlights the crucial role of financial support provided by a spouse or partner in enabling individuals to engage in legal or political activities. Without such support, many individuals may face significant financial barriers to pursuing their legal or political aspirations.

- Breckie Hill Shower Leaked

- Taylor Crying On Ellen

- Baja Blast Pie

- Brekie Hill Shower Leaks

- Is Lana Rhoades Pregnant

Real-life examples abound. In the landmark case of Sutton v. United States (1966), the plaintiff sought to deduct legal expenses incurred by his wife in her unsuccessful bid for a congressional seat. The Supreme Court ruled that these expenses were not deductible, establishing the legal precedent for the term "Sutton's Husband." More recently, the concept has been applied to individuals supporting spouses or partners involved in political campaigns, legal advocacy, and social justice movements.

Understanding this definition is essential for grasping the broader implications of "Sutton's Husband." It sheds light on the financial dynamics and legal considerations surrounding individuals engaged in legal or political activities. Moreover, it highlights the potential influence and impact of financial support on the political process and legal system.

This understanding has practical applications in various contexts. For example, it can inform campaign finance regulations, tax laws, and ethical guidelines related to conflicts of interest. Additionally, it can help individuals and organizations navigate the complex financial and legal landscape surrounding political and legal activities.

Historical Context

In understanding "Sutton's Husband," its historical context is paramount. The 1960s marked a pivotal era in the shaping of this concept, establishing a legal precedent that continues to influence modern applications.

- Supreme Court Ruling

The Supreme Court's decision in Sutton v. United States (1966) set the legal foundation for "Sutton's Husband." The Court ruled that legal expenses incurred by a spouse in pursuit of political office were not tax-deductible.

- Campaign Finance Regulations

The concept of "Sutton's Husband" has implications for campaign finance regulations. It raises questions about the permissibility of indirect campaign contributions through financial support to spouses or partners.

- Tax Implications

The tax treatment of financial contributions to spouses or partners engaged in legal or political activities remains a subject of debate. The IRS has issued rulings on the deductibility of such expenses, shaping the financial implications for "Sutton's Husbands."

- Political Influence

The financial support provided by "Sutton's Husbands" can potentially influence political outcomes. It highlights the role of financial contributions in shaping the political landscape.

Examining the historical context of "Sutton's Husband" provides insights into its legal, financial, and political implications. The Supreme Court ruling, campaign finance regulations, tax considerations, and potential for political influence all contribute to a comprehensive understanding of this concept.

Legal Significance

The legal significance of "Sutton's Husband" lies in its impact on tax liability and campaign finance regulations. The concept raises important questions about the tax treatment of financial contributions made to spouses or partners engaged in legal or political activities. Additionally, it has implications for campaign finance laws, which seek to regulate the sources and uses of funds in political campaigns.

A critical component of "Sutton's Husband" is the tax liability associated with financial support. The Internal Revenue Service (IRS) has issued rulings on the deductibility of such expenses, shaping the financial implications for individuals providing support. For example, legal expenses incurred by a spouse in pursuit of political office are generally not tax-deductible. This distinction highlights the legal significance of "Sutton's Husband" in determining the tax liability of individuals engaged in political activities.

Furthermore, "Sutton's Husband" has implications for campaign finance regulations. Indirect campaign contributions through financial support to spouses or partners raise questions about the permissibility of such contributions. Campaign finance laws aim to ensure transparency and accountability in political funding. Understanding the legal significance of "Sutton's Husband" is crucial for navigating the complex web of campaign finance regulations and ensuring compliance with the law.

In conclusion, the legal significance of "Sutton's Husband" lies in its impact on tax liability and campaign finance regulations. The concept highlights the legal considerations surrounding financial support for legal or political activities. Understanding these legal implications is essential for individuals, organizations, and policymakers involved in such activities.

Financial Implications

The financial implications of "Sutton's Husband" can be significant, involving substantial financial contributions and potential tax benefits. The financial contributions made by spouses or partners can play a crucial role in supporting legal or political activities. These contributions can cover a wide range of expenses, including legal fees, campaign costs, and other associated expenses.

The potential tax benefits associated with "Sutton's Husband" are also noteworthy. In some cases, financial contributions made to spouses or partners engaged in legal or political activities may be tax-deductible. This can provide a financial incentive for individuals to provide support for such activities. However, it is important to note that the tax treatment of these contributions can vary depending on the specific circumstances and applicable tax laws.

Real-life examples of the financial implications of "Sutton's Husband" abound. In the United States, many political candidates rely on financial support from their spouses or partners to fund their campaigns. This support can be particularly important for candidates who do not have access to traditional sources of campaign funding. Additionally, financial contributions made to legal defense funds or advocacy organizations by spouses or partners can have a significant impact on the ability of these organizations to pursue their objectives.

Understanding the financial implications of "Sutton's Husband" is essential for individuals, organizations, and policymakers involved in legal or political activities. This understanding can help in planning and managing financial resources, as well as navigating the complex legal and tax landscape surrounding such activities.

Modern Applications

The concept of "Sutton's Husband" has evolved beyond its traditional association with political campaigns. In recent years, it has expanded to encompass financial support for legal advocacy and social justice movements. This modern application stems from the recognition that legal and social justice causes often require significant financial resources to pursue their objectives.

In the context of legal advocacy, "Sutton's Husbands" provide financial support to individuals and organizations engaged in legal battles to advance social and environmental causes. This support can be crucial for covering legal fees, expert witness costs, and other expenses associated with litigation. For example, in the United States, "Sutton's Husbands" have played a vital role in funding lawsuits challenging environmental regulations, discrimination, and other forms of injustice.

In the realm of social justice movements, "Sutton's Husbands" provide financial support to organizations working to address a wide range of social issues, such as poverty, homelessness, and racial inequality. This support can enable these organizations to expand their programs, hire staff, and advocate for policy changes that promote social justice. For instance, in the United Kingdom, "Sutton's Husbands" have supported organizations providing legal aid to low-income families and advocating for affordable housing.

Understanding the modern applications of "Sutton's Husband" is crucial for several reasons. First, it highlights the growing importance of financial support for legal advocacy and social justice movements. Second, it demonstrates the adaptability of the concept to evolving social and political landscapes. Third, it provides a framework for analyzing the role of individuals in supporting causes they believe in, beyond traditional political campaigns.

Legal Protections

The concept of "Sutton's Husband" encompasses legal protections and rights regarding financial contributions and decision-making. These protections are crucial for ensuring the financial and legal well-being of individuals providing support to spouses or partners engaged in legal or political activities.

One significant legal protection is the right to make independent financial decisions. "Sutton's Husbands" have the legal authority to manage their own finances and make decisions about how their funds are used. This autonomy ensures that individuals are not coerced or pressured into providing financial support against their will.

Real-life examples abound. In the United States, the Supreme Court has ruled that spouses have the right to make independent financial contributions to political campaigns, even if their spouse is a candidate. This ruling highlights the legal protections afforded to "Sutton's Husbands" regarding financial decision-making.

Understanding the legal protections associated with "Sutton's Husband" has practical applications in various contexts. It can empower individuals to confidently provide financial support to their spouses or partners without fear of legal repercussions. Additionally, it can help prevent conflicts of interest and ensure that financial contributions are made transparently and ethically.

Ethical Considerations

The concept of "Sutton's Husband" raises ethical considerations that question potential conflicts of interest and the influence of financial support in legal and political activities. Understanding these ethical implications is crucial for maintaining fairness, transparency, and accountability.

- Conflicts of Interest

Financial support from spouses or partners may create conflicts of interest if the supported individual has decision-making authority that could benefit their supporter. For example, a politician receiving campaign contributions from a spouse working in a regulated industry may face pressure to make decisions favoring that industry.

- Undue Influence

Substantial financial support from spouses or partners can potentially give them undue influence over the supported individual's decisions. This influence may extend beyond the legal or political realm, potentially affecting personal and familial relationships.

- Transparency and Accountability

The ethical implications of "Sutton's Husband" highlight the need for transparency and accountability in financial support for legal and political activities. Disclosure of such support and potential conflicts of interest is essential for maintaining public trust and preventing undue influence.

- Legal and Ethical Guidelines

Addressing the ethical considerations surrounding "Sutton's Husband" often involves establishing legal and ethical guidelines. These guidelines can provide frameworks for managing conflicts of interest, ensuring transparency, and promoting ethical decision-making in the context of financial support for legal and political activities.

In conclusion, the ethical considerations embedded within the concept of "Sutton's Husband" underscore the importance of balancing financial support with maintaining fairness, transparency, and accountability. Navigating these ethical implications requires careful attention to potential conflicts of interest, undue influence, and the establishment of appropriate legal and ethical guidelines.

Global Variations

The principle of "Sutton's Husband" exhibits global variations, influenced by the diverse legal systems and cultural contexts across different jurisdictions. This variability arises from the interplay of legal frameworks, societal norms, and political landscapes that shape the concept's interpretation and application.

In countries with common law systems, such as the United Kingdom and the United States, the concept of "Sutton's Husband" is predominantly rooted in case law and judicial precedents. Legal rulings, like the landmark Sutton v. United States case, have established the parameters and limitations of financial support provided by spouses or partners in legal and political endeavors.

Conversely, in civil law jurisdictions, such as France and Germany, the concept of "Sutton's Husband" is more explicitly codified in statutes and legal codes. These jurisdictions often have specific provisions outlining the rights, responsibilities, and potential conflicts of interest that arise when spouses or partners provide financial support for legal or political activities.

Understanding these global variations is crucial for navigating the complex legal and ethical landscape surrounding "Sutton's Husband." It enables individuals, organizations, and policymakers to adapt the concept to their specific contexts, ensuring compliance with local laws and regulations while upholding the principles of fairness, transparency, and accountability.

Recent Developments

In the evolving landscape of political funding, the concept of "Sutton's Husband" continues to ignite legal and policy debates. These discussions center around the role of spouses or partners in providing financial support for political activities, raising questions about transparency, accountability, and potential conflicts of interest.

- Campaign Finance Regulations

Recent developments involve legal challenges to campaign finance regulations that seek to limit or regulate the influence of "Sutton's Husbands." These debates examine the balance between protecting the rights of individuals to support political causes and ensuring transparency in political funding.

- Tax Implications

The tax treatment of financial contributions made by "Sutton's Husbands" remains a subject of ongoing policy discussions. Debates revolve around whether such contributions should be tax-deductible and the potential implications for tax equity and campaign finance.

- Ethical Concerns

Legal and policy debates also address ethical concerns surrounding the role of "Sutton's Husbands." These discussions explore the potential for conflicts of interest and the need for safeguards to prevent undue influence on political decision-making.

- Transparency and Disclosure

Recent developments emphasize the importance of transparency and disclosure in political funding. Policymakers are considering measures to enhance the public's access to information about the sources and amounts of financial contributions made by "Sutton's Husbands."

These ongoing debates underscore the growing recognition of the significance of "Sutton's Husband" in political funding. Legal and policy developments in this area aim to strike a balance between protecting individual rights, ensuring transparency, and mitigating potential conflicts of interest, ultimately contributing to the integrity and fairness of political processes.

Future Implications

The future implications of "Sutton's Husband" have significant bearing on campaign finance reform and political transparency. Ongoing legal and policy debates surrounding the role of spouses or partners in political funding are shaping the future landscape of campaign finance regulations and disclosure requirements.

One potential implication is the implementation of stricter campaign finance regulations to mitigate the influence of "Sutton's Husbands" in political campaigns. These regulations may involve limiting the amount of financial support that spouses or partners can contribute, increasing transparency requirements for such contributions, or exploring alternative funding models that reduce reliance on private donations.

Another potential implication is the enhancement of political transparency measures to shed light on the sources and amounts of financial contributions made by "Sutton's Husbands." This may involve expanding public access to campaign finance data, requiring more detailed reporting of contributions, or implementing real-time disclosure systems to promote greater accountability.

Understanding these future implications is crucial for policymakers, campaign finance regulators, and the public at large. By addressing the potential impact on campaign finance reform and political transparency, it becomes possible to develop comprehensive strategies that safeguard the integrity of political processes, enhance public trust, and promote a more equitable and transparent political system.

In conclusion, our exploration of "Sutton's Husband" has shed light on the complexities and nuances of financial support in legal and political endeavors. The concept has evolved beyond its traditional association with political campaigns, extending to legal advocacy and social justice movements. Understanding the legal implications, financial considerations, and ethical dimensions of "Sutton's Husband" is crucial for navigating the legal and political landscape.

Two main points emerge from our analysis. First, the legal protections and rights afforded to "Sutton's Husbands" ensure their financial and legal well-being while providing support to their spouses or partners. Second, the ethical considerations surrounding potential conflicts of interest and undue influence highlight the need for transparency, accountability, and appropriate legal and ethical guidelines.

As the concept of "Sutton's Husband" continues to evolve, it is imperative to engage in thoughtful discussions about its implications for campaign finance reform and political transparency. By addressing these issues, we can work towards a more equitable, transparent, and just political system that safeguards the integrity of our democratic processes.

- Darren Barnet Britney Spears

- Breckie Hill Showers

- Khamzat Chimaev Bald

- Why Did Bunnie Fire Haley

- Florida Baseball Coach Scandal

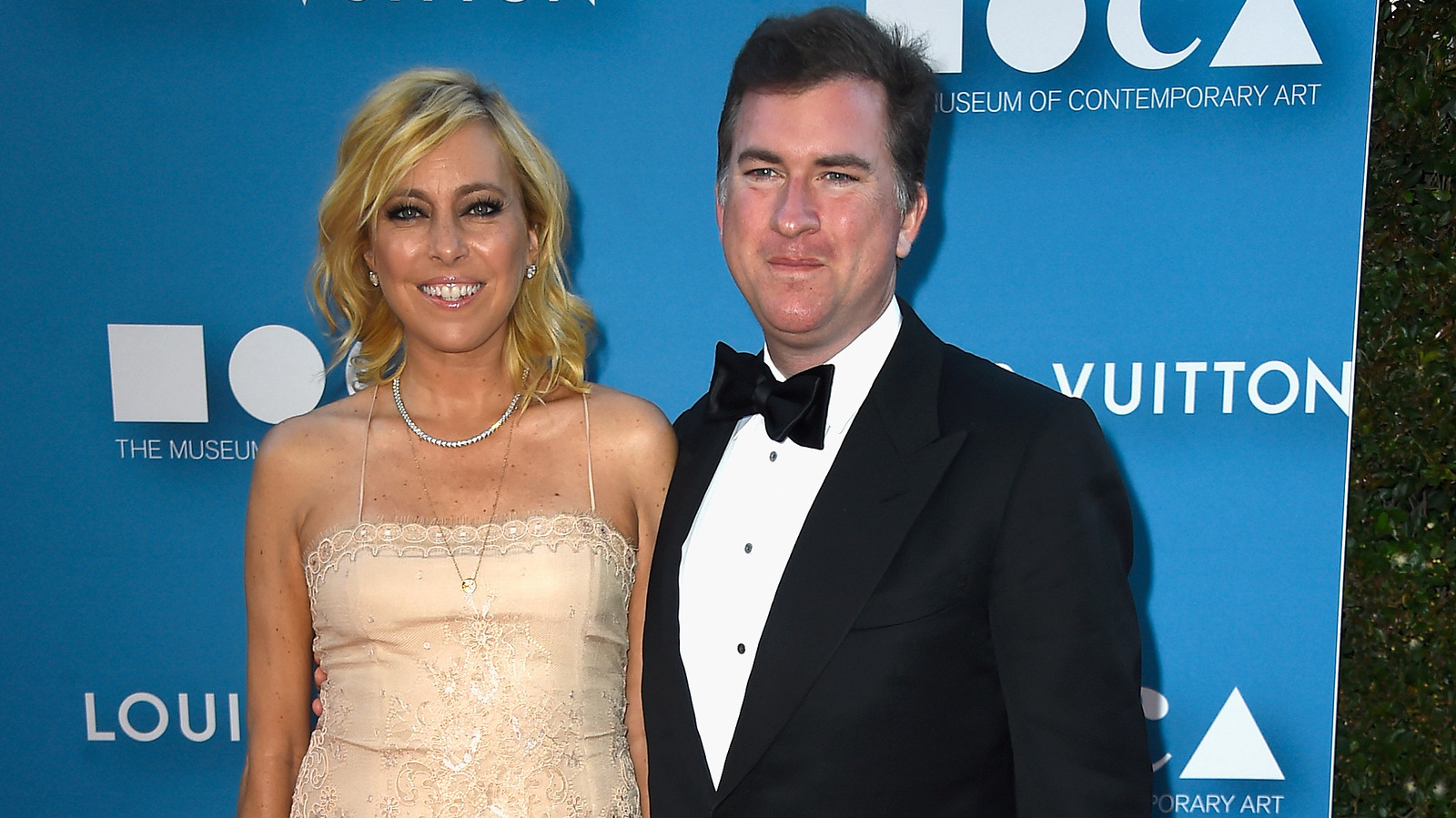

What We Know About Sutton Stracke's ExHusband, Christian

Who is Sutton ex husband?

RHOBH’s Sutton Stracke claims she was demoted from castmate to ‘friend