CEO Of McDonald's Net Worth: A Comprehensive Guide

The CEO of McDonald's net worth refers to the total value of the assets owned by the chief executive officer of McDonald's Corporation. For instance, Chris Kempczinski, the current CEO, has a net worth of approximately $18.7 million.

This figure is significant because the CEO's net worth can provide insights into their financial stability, investment acumen, and overall business success. It also reflects the company's financial performance and the value it places on its top executive.

Historically, CEOs of McDonald's have had various net worths, influenced by factors such as company earnings, stock performance, and personal investments.

- Skip The Games El Paso Texas

- Buffet De Mariscos Cerca De Mi

- Teacher Crying At Wedding

- How Much Do Tommy The Clown Dancers Get Paid

- When Does Peysoh Get Out Of Jail

CEO of McDonald's Net Worth

Understanding the CEO's net worth is crucial as it provides insights into their financial stability, investment acumen, and overall business success. It also reflects the company's financial performance and the value it places on its top executive.

- Compensation and Salary

- Stock Options and Awards

- Real Estate and Investments

- Personal Assets and Wealth

- Tax Liabilities and Deductions

- Charitable Contributions

- Business Ventures and Investments

- Lifestyle and Spending Habits

- Net Worth Fluctuations

- Comparison to Industry Peers

Analyzing these aspects can reveal valuable information about the CEO's financial management, risk tolerance, and personal values. It also provides context for their decision-making and leadership style.

Compensation and Salary

Compensation and Salary form a significant part of the CEO of McDonald's net worth, reflecting their financial rewards for leading the company.

- Khamzat Chimaev With And Without Beard

- Can Pregnant Women Drink Bloom

- Khamzat Chimaev Without Beard

- Osama Brothers

- Stuns In New Selfie

- Base Salary

The annual fixed amount paid to the CEO as a core component of their compensation. - Performance-Based Bonuses

Variable payments tied to the company's financial performance, rewarding the CEO for achieving specific targets. - Stock Options and Grants

Equity-based compensation that gives the CEO the right to purchase company shares at a set price, potentially leading to substantial gains if the stock value increases. - Perks and Benefits

Non-cash benefits provided to the CEO, such as health insurance, retirement plans, and company cars, which contribute to their overall financial well-being.

These components of Compensation and Salary collectively contribute to the CEO's net worth, which is a reflection of their financial success and the value they bring to the company.

Stock Options and Awards

Stock Options and Awards play a critical role in determining the CEO of McDonald's net worth. These equity-based compensation instruments grant the CEO the right to purchase company shares at a predetermined price, offering the potential for significant financial gains if the stock value increases.

The value of Stock Options and Awards can fluctuate significantly based on the company's performance and overall market conditions. When the company performs well and its stock price rises, the value of the CEO's Stock Options and Awards increases proportionally. This can lead to substantial additions to the CEO's net worth.

For example, in 2021, Chris Kempczinski, the current CEO of McDonald's, received stock options and awards valued at approximately $12.5 million. This represented a significant portion of his total compensation for the year and contributed to his overall net worth.

Understanding the connection between Stock Options and Awards and the CEO's net worth is crucial for evaluating the CEO's financial incentives and alignment with the company's long-term goals. It also provides insights into the CEO's risk tolerance and investment strategy.

Real Estate and Investments

The connection between Real Estate and Investments and CEO of McDonald's net worth is significant. Real estate properties and investments can contribute substantially to the overall wealth and financial stability of McDonald's CEOs.

Real estate investments can provide CEOs with a steady stream of passive income through rental payments or property appreciation. Additionally, real estate can serve as a hedge against inflation and economic downturns, preserving the CEO's net worth during challenging times.

For example, former McDonald's CEO Jim Skinner owns a portfolio of commercial and residential properties in the Chicago area, estimated to be worth millions of dollars. These investments have contributed significantly to his post-retirement wealth.

Understanding the relationship between Real Estate and Investments and CEO net worth is crucial for assessing the CEO's financial diversification, investment acumen, and long-term financial planning. It also highlights the importance of considering non-salary compensation and benefits when evaluating the total value of a CEO's position.

Personal Assets and Wealth

The "Personal Assets and Wealth" of the CEO of McDonald's play a significant role in determining their overall financial well-being and net worth. These personal assets extend beyond their salary, stock options, and other forms of company compensation, providing a diversified portfolio that contributes to their financial stability and long-term wealth accumulation.

- Real Estate Portfolio

Many CEOs of McDonald's hold substantial real estate portfolios, including residential properties, commercial buildings, and land. These investments provide passive income through rent and potential appreciation in value.

- Stock Market Investments

CEOs often invest a portion of their wealth in the stock market, diversifying their portfolio and seeking potential returns on their investments. They may invest in a range of stocks, bonds, and mutual funds.

- Private Equity and Venture Capital

Some CEOs engage in private equity or venture capital investments, providing funding to early-stage companies and potentially generating significant returns if these companies succeed.

- Art and Collectibles

Certain CEOs have invested in art, rare collectibles, and other luxury assets. While these investments can be risky, they can also appreciate in value over time, contributing to the CEO's overall net worth.

The composition and value of a CEO's Personal Assets and Wealth can vary greatly depending on their individual financial goals, risk tolerance, and investment strategies. Understanding the role of Personal Assets and Wealth is crucial for assessing the CEO's financial health, diversification, and long-term financial planning.

Tax Liabilities and Deductions

The relationship between "Tax Liabilities and Deductions" and "CEO of McDonald's net worth" is multifaceted, with tax liabilities posing both financial obligations and opportunities for wealth management. Understanding this connection is crucial for evaluating a CEO's overall financial health and net worth.

CEOs of McDonald's, like all high-income earners, are subject to significant tax liabilities, including federal income taxes, state income taxes, and various other levies. These tax liabilities can eat into their gross income, reducing their overall net worth. However, CEOs can also utilize various tax deductions and credits to minimize their tax burden, thereby preserving and enhancing their net worth.

For instance, CEOs may deduct expenses related to their work, such as travel, meals, and entertainment. They can also take advantage of retirement savings plans, such as 401(k)s and IRAs, which offer tax-deferred growth. By carefully managing their tax liabilities and maximizing deductions, CEOs can optimize their net worth and achieve long-term financial success.

Understanding the interplay between Tax Liabilities and Deductions is essential for understanding the financial landscape of CEOs and their overall wealth management strategies.

Charitable Contributions

Charitable Contributions made by CEOs of McDonald's impact their net worth while also reflecting their values and philanthropic goals. Understanding this connection offers insights into the financial and social responsibilities shouldered by business leaders.

CEOs of McDonald's, like other high-net-worth individuals, often engage in charitable giving, donating to various causes and organizations. These contributions can take the form of monetary donations, in-kind gifts, or volunteering time and resources. While charitable contributions reduce the CEO's net worth in the short term, they can have long-term benefits for both the CEO and the recipient organizations.

For example, Warren Buffett, a renowned investor and philanthropist who once served on McDonald's board of directors, has pledged to donate the majority of his wealth to charitable causes. Such contributions not only reduce his net worth but also align with his personal values and commitment to giving back to society.

Understanding the relationship between Charitable Contributions and CEO net worth is crucial for assessing the social impact and philanthropic endeavors of business leaders. It highlights the importance of considering not just financial wealth but also the broader contributions made by CEOs to their communities and the world at large.

Business Ventures and Investments

Business Ventures and Investments significantly contribute to the CEO of McDonald's net worth, demonstrating their entrepreneurial spirit and diversification strategies. Understanding this connection offers insights into the financial acumen and risk appetite of business leaders.

CEOs of McDonald's often engage in various business ventures and investments beyond their primary role at the company. These ventures may include personal investments in startups, real estate, or other industries. By diversifying their portfolios, CEOs can potentially increase their overall wealth and reduce the risk associated with relying solely on their McDonald's compensation.

For example, former McDonald's CEO Steve Easterbrook invested in several real estate ventures, including a portfolio of rental properties and a development project. These investments contributed to his net worth outside of his McDonald's salary and stock options.

Understanding the practical applications of this connection is crucial for evaluating the financial savvy and long-term wealth management strategies of CEOs. It highlights the importance of considering not just a CEO's compensation from McDonald's but also their broader business ventures and investments when assessing their overall net worth and financial well-being.

Lifestyle and Spending Habits

Lifestyle and Spending Habits play a significant role in shaping the net worth of CEOs of McDonald's. The lavish lifestyles and extravagant spending habits of some CEOs can have a direct impact on their overall financial well-being, both positively and negatively.

CEOs with high net worths often indulge in luxurious lifestyles, including expensive homes, private jets, and exclusive vacations. These expenditures can significantly reduce their net worth in the short term. However, they can also enhance their social status, provide personal satisfaction, and potentially lead to new business opportunities.

For example, former McDonald's CEO Jim Skinner spent a considerable portion of his wealth on art and real estate, amassing a substantial collection of valuable paintings and luxury properties. While these investments contributed to his overall net worth, they also reflected his personal interests and lavish lifestyle.

Understanding the connection between Lifestyle and Spending Habits and CEO net worth is crucial for evaluating the financial prudence and long-term wealth management strategies of business leaders. It highlights the importance of considering not just a CEO's compensation and investments but also their personal expenses and consumption patterns when assessing their overall financial well-being.

Net Worth Fluctuations

Net worth fluctuations are an inherent aspect of the CEO of McDonald's net worth, influenced by various factors that can impact their financial well-being and overall wealth. The relationship between these two concepts is dynamic, with fluctuations playing a critical role in shaping the CEO's financial trajectory.

Net worth fluctuations can arise from changes in the stock market, which can significantly impact the value of stock options and awards held by the CEO. The performance of McDonald's as a company also directly affects the CEO's net worth, as their compensation and bonuses are often tied to the company's financial results. Economic conditions and industry trends can further influence the CEO's net worth, as they can impact the overall value of their investments and assets.

Understanding the connection between net worth fluctuations and the CEO of McDonald's net worth is crucial for evaluating their financial resilience and long-term wealth management strategies. It highlights the dynamic nature of their financial well-being and the need to consider both positive and negative fluctuations when assessing their overall financial health.

Comparison to Industry Peers

"Comparison to Industry Peers" holds significance in understanding the CEO of McDonald's net worth as it provides a benchmark against which their financial well-being and performance can be measured. Analyzing the CEO's net worth relative to their peers within the industry offers valuable insights into their compensation structure, overall wealth management strategies, and alignment with industry standards.

- Compensation Structure

Comparing the CEO's salary, bonuses, and stock options to those of CEOs in similar industry roles reveals the company's compensation philosophy and the CEO's individual negotiation skills.

- Wealth Diversification

Assessing the diversification of the CEO's wealth beyond their McDonald's compensation provides insights into their investment acumen, risk tolerance, and long-term financial planning.

- Performance-Based Incentives

Evaluating the CEO's net worth growth in relation to the company's financial performance indicates the effectiveness of performance-based incentives and the CEO's ability to drive shareholder value.

- Industry Benchmarks

Comparing the CEO's net worth to industry averages and top performers helps determine their position within the competitive landscape and highlights potential areas for improvement or recognition.

By analyzing these facets of "Comparison to Industry Peers," investors, stakeholders, and the general public can gain a deeper understanding of the factors influencing the CEO of McDonald's net worth. This comparative analysis provides valuable context for evaluating the CEO's overall financial health, decision-making, and alignment with industry practices.

In conclusion, the exploration of "CEO of McDonald's Net Worth" unveils a multifaceted tapestry of financial factors, compensation structures, and investment strategies that shape the wealth and financial well-being of these business leaders.

Key findings reveal the interplay between compensation packages, stock options, real estate investments, and personal spending habits in determining the CEO's net worth. The role of tax liabilities and charitable contributions further highlights the complexity of financial management and the impact on overall wealth accumulation.

Understanding the dynamics of CEO net worth is not merely an academic exercise but a valuable tool for evaluating leadership performance, assessing risk tolerance, and gaining insights into the financial ecosystem of corporate America. It underscores the significance of responsible financial stewardship and the alignment between executive compensation and shareholder interests.

- Brown Easley

- Buffet De Mariscos Cerca De Mi

- What Is Ddot Real Name

- Teacher Crying At Wedding

- You Like My Voice It Turn You On Lyrics

African American executives file lawsuit alleging racial discrimination

McDonald’s fire CEO after relationship with employee Page 4 Sports

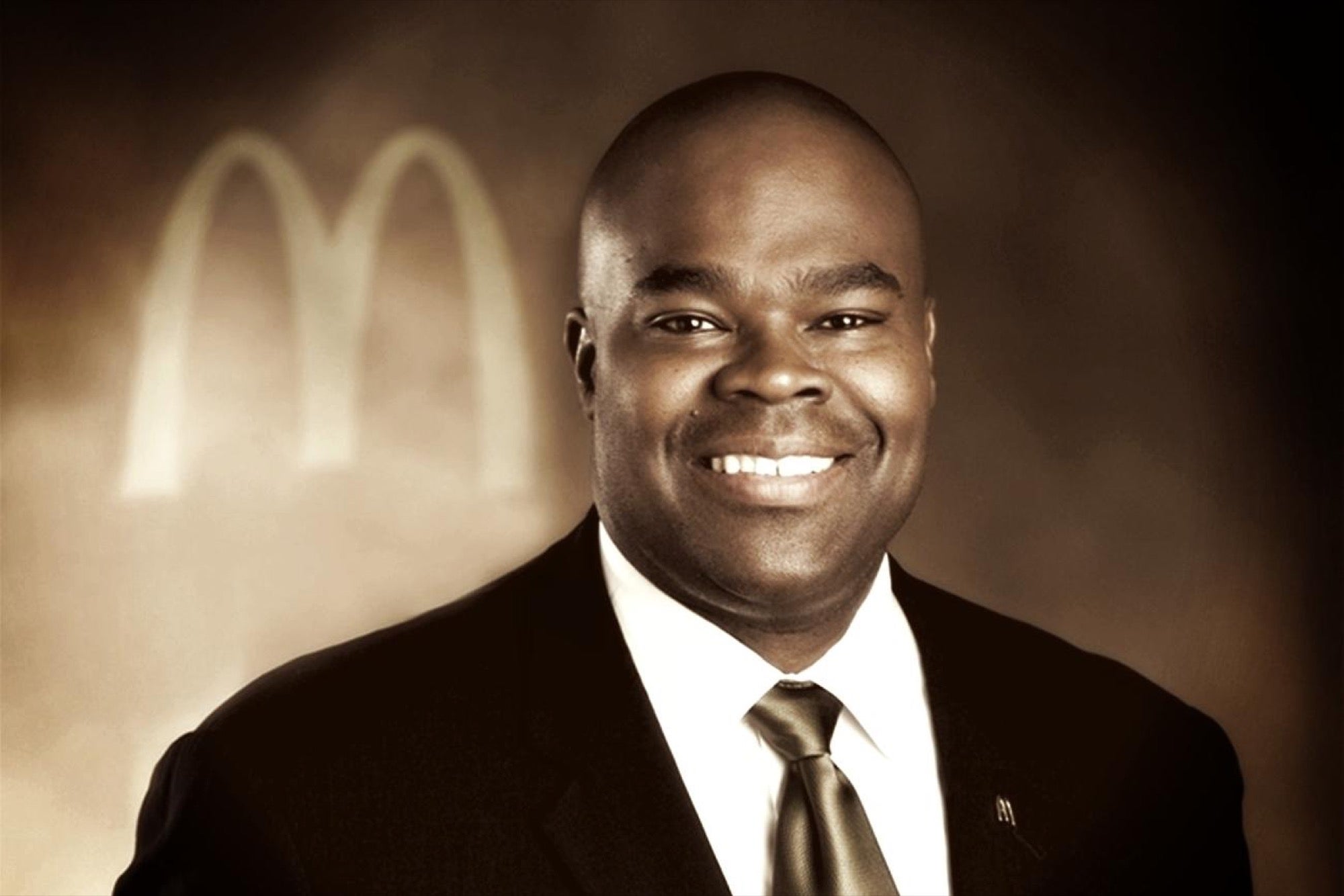

McDonald's CEO Don Thompson resigns; replaced by Steve Easterbrook