What Pegging Means: A Comprehensive Guide

What does it mean to peg? It refers to the process of fixing the exchange rate of a currency to another currency or a commodity such as gold. For instance, a country might peg its currency to the U.S. dollar, meaning that the value of the domestic currency will fluctuate in line with the value of the dollar.

Pegging exchange rates can provide stability to a country's economy, reducing the risk of currency fluctuations. It can also make it easier for businesses to engage in international trade. Historically, the gold standard was a widely used form of pegging, where currencies were pegged to the price of gold.

In this article, we will explore the different meanings of pegging, its advantages and disadvantages, as well as its implications for monetary policy and economic growth.

- Skip The Games El Paso Texas

- How To Open Bath And Body Works Hand Soap

- Breckie Hill Showers

- Osama Brothers

- Taylor Crying On Ellen

What does it mean to peg

Understanding the concept of pegging is crucial for comprehending exchange rate mechanisms and their impact on international economies.

- Currency stability

- Reduced exchange rate risk

- Facilitation of international trade

- Monetary policy independence

- Inflation control

- Capital inflows

- Speculation

- Balance of payments

- Economic growth

- Historical context

These aspects not only highlight the significance of pegging but also provide a framework for analyzing its implications and evaluating its effectiveness in different economic contexts.

Currency stability

Currency stability, a central goal of monetary policy, is closely intertwined with the concept of pegging. Pegging an exchange rate involves fixing the value of one currency to another currency or a commodity, typically resulting in greater exchange rate stability. This stability is crucial for nurturing a predictable and favorable economic environment.

- Brekie Hill Shower Video

- Teacher Crying At Wedding

- Is Lana Rhoades Pregnant

- Breckie Hill Shower Video Leaked

- What Is Ddot Real Name

Currency stability fosters confidence among businesses and consumers, encouraging investment and spending. Reduced exchange rate volatility makes it easier for businesses to plan and engage in international trade, knowing that currency fluctuations will not drastically impact their bottom line. Stable exchange rates also protect consumers from sudden price changes for imported goods, contributing to overall economic stability.

Real-life examples abound. Hong Kong's currency, the Hong Kong dollar, has been pegged to the US dollar since 1983. This peg has contributed to Hong Kong's remarkable economic growth and stability, making it a global financial hub. Similarly, many countries peg their currencies to major currencies like the US dollar or the euro to maintain stability and promote economic integration.

Understanding the connection between currency stability and pegging is vital for policymakers and economists. Stable exchange rates provide a solid foundation for economic growth and development. However, it is essential to consider the specific economic circumstances and policy goals when contemplating pegging arrangements.

Reduced exchange rate risk

Within the realm of pegging exchange rates, reduced exchange rate risk emerges as a significant advantage. By stabilizing the exchange rate between two currencies or a currency and a commodity, pegging effectively mitigates the uncertainties associated with currency fluctuations.

- Predictable cash flows

Businesses engaged in international trade often face the challenge of managing cash flows denominated in foreign currencies. Pegging exchange rates eliminates the risk of unpredictable currency movements, allowing businesses to plan and budget more effectively.

- Protection against currency devaluation

In countries where the domestic currency is prone to devaluation, pegging to a stronger currency can protect businesses and individuals from the negative consequences of a falling exchange rate.

- Reduced transaction costs

Currency fluctuations can lead to increased transaction costs for businesses operating across borders. Pegging exchange rates reduces these costs, making international trade more efficient.

- Stable investment environment

A stable exchange rate environment encourages foreign direct investment and portfolio inflows, contributing to economic growth and development.

In summary, reduced exchange rate risk associated with pegging exchange rates plays a crucial role in promoting international trade, protecting against currency devaluation, reducing transaction costs, and fostering a stable investment environment. These advantages highlight the importance of pegging as a monetary policy tool in achieving economic stability and growth.

Facilitation of international trade

Within the context of "what does it mean to peg", facilitation of international trade emerges as a central advantage. By stabilizing exchange rates, pegging removes the uncertainties associated with currency fluctuations, making it easier and more predictable for businesses to engage in cross-border trade.

- Reduced transaction costs

Pegging exchange rates reduces transaction costs for businesses involved in international trade, as they no longer need to factor in currency conversion fees and can avoid potential losses due to unfavorable exchange rate movements.

- Increased market access

Stable exchange rates encourage businesses to expand into new markets, as they can be more confident in the stability of their costs and revenues when operating in different currencies.

- Enhanced competitiveness

Pegging exchange rates can enhance the competitiveness of domestic businesses in the global marketplace by reducing the risk of exchange rate fluctuations and making their products and services more attractive to foreign buyers.

In essence, the facilitation of international trade through pegging exchange rates fosters a more stable and predictable environment for businesses, leading to increased trade volumes, economic growth, and improved living standards.

Monetary policy independence

Monetary policy independence refers to the ability of a central bank to set and implement monetary policy without undue influence from the government or other political actors. This independence is crucial for maintaining price stability and achieving macroeconomic objectives such as low inflation and sustainable economic growth.

Pegging an exchange rate can have significant implications for monetary policy independence. When a country pegs its currency to another currency or a commodity, it must align its monetary policy with the monetary policy of the reference currency or commodity. This can limit the central bank's ability to respond to domestic economic conditions and pursue independent monetary policy objectives.

For example, if a country pegs its currency to the US dollar, it must maintain a similar interest rate to the US Federal Reserve. This may not be appropriate if the country's economic conditions differ from those of the United States. As a result, the country may have to sacrifice domestic economic goals to maintain the peg.

In conclusion, monetary policy independence is an important consideration when evaluating the implications of pegging an exchange rate. While pegging can provide benefits such as exchange rate stability and reduced uncertainty, it can also limit the central bank's ability to pursue independent monetary policy objectives. Therefore, policymakers must carefully weigh the costs and benefits before deciding whether to peg their currency.

Inflation control

Inflation control is a critical component of macroeconomic policy, and pegging an exchange rate can have significant implications for inflation control. When a country pegs its currency to another currency or a commodity, it must maintain a similar inflation rate to the reference currency or commodity. This can limit the central bank's ability to pursue independent monetary policy objectives, including inflation control.

For example, if a country pegs its currency to the US dollar, it must maintain a similar interest rate to the US Federal Reserve. If the US Federal Reserve raises interest rates to control inflation, the country that has pegged its currency to the US dollar must also raise interest rates. However, this may not be appropriate if the country's inflation rate is lower than that of the United States. As a result, the country may have to sacrifice domestic price stability to maintain the peg.

In conclusion, inflation control is an important consideration when evaluating the implications of pegging an exchange rate. While pegging can provide benefits such as exchange rate stability and reduced uncertainty, it can also limit the central bank's ability to pursue independent inflation control objectives. Therefore, policymakers must carefully weigh the costs and benefits before deciding whether to peg their currency.

Capital inflows

Capital inflows, the movement of capital into a country from abroad, play a significant role in the context of pegged exchange rates. When a country pegs its currency to another currency or a commodity, it creates an environment that can attract capital inflows. This is because investors may perceive the pegged currency as a safe haven, especially during periods of economic uncertainty.

The stability provided by a pegged exchange rate reduces the risk of currency devaluation, making it more attractive for foreign investors to invest in the country's financial markets. These inflows can contribute to economic growth by providing additionalfor investment and consumption. However, it is important to note that excessive capital inflows can also lead to challenges such as asset price bubbles and inflation.

Real-life examples of capital inflows within pegged exchange rate regimes include the inflows experienced by Hong Kong during the Asian financial crisis. Hong Kong's currency peg to the US dollar provided stability and confidence to investors, resulting in significant capital inflows that helped the economy weather the storm.

Understanding the connection between capital inflows and pegged exchange rates is crucial for policymakers and investors. By carefully managing capital inflows, policymakers can harness their potential benefits while mitigating potential risks. This understanding also helps investors make informed decisions when considering investments in countries with pegged exchange rates.

Speculation

Speculation, the act of engaging in financial transactions with the expectation of profiting from fluctuations in prices, is closely intertwined with the concept of pegging exchange rates. When a country pegs its currency to another currency or a commodity, it creates a relatively stable and predictable exchange rate environment. This stability, however, can also attract speculators who seek to profit from any perceived misalignment between the pegged rate and the market's assessment of the currency's fair value.

Speculators may engage in various strategies within a pegged exchange rate system. One common strategy is to buy the pegged currency when it is undervalued relative to the reference currency or commodity and sell it when it is overvalued. This type of speculation can put pressure on the central bank to adjust the peg or implement other measures to maintain the peg. For instance, in the case of a currency peg, the central bank may need to intervene in the foreign exchange market by buying or selling its own currency to defend the peg.

Understanding the connection between speculation and pegged exchange rates is crucial for policymakers and market participants. By carefully managing speculative activity, policymakers can mitigate the potential risks to the peg while harnessing the potential benefits of speculation, such as increased liquidity and market efficiency. Market participants, on the other hand, can make informed decisions by considering the potential impact of speculation on the pegged exchange rate.

Balance of payments

The balance of payments (BOP) is a crucial concept closely intertwined with the topic of "what does it mean to peg." The BOP summarizes the economic transactions between a country and the rest of the world over a specific period, typically a calendar year. It comprises three main components: the current account, the capital account, and the financial account. By analyzing the BOP, economists and policymakers can gain insights into a country's economic health, trade patterns, and foreign exchange reserves.

The relationship between the BOP and pegging exchange rates is significant. When a country pegs its currency to another currency or a commodity, it must carefully manage its BOP to maintain the peg. For example, if a country pegs its currency to the US dollar, it must ensure that its BOP with the United States remains balanced. This means that the value of goods and services exported by the country to the United States should be roughly equal to the value of goods and services imported from the United States. If there is a persistent imbalance, the country may experience pressure on its foreign exchange reserves and may need to adjust its peg or implement other measures to maintain the stability of its currency.

Understanding the connection between the BOP and pegging exchange rates has practical applications for policymakers and businesses. Policymakers can use BOP data to assess the sustainability of their currency peg and to make informed decisions about monetary and fiscal policies. Businesses can use BOP data to understand the potential impact of exchange rate fluctuations on their operations and to make informed decisions about hedging strategies.

In conclusion, the BOP is a critical component of understanding "what does it mean to peg." By analyzing the BOP, economists and policymakers can gain insights into a country's economic health and its ability to maintain a pegged exchange rate. This understanding has important practical applications for policymakers and businesses alike.

Economic growth

Economic growth, a central goal of macroeconomic policy, encompasses the expansion of a country's productive capacity and the improvement of the well-being of its citizens. In the context of "what does it mean to peg," economic growth is significantly influenced by the stability and predictability provided by a pegged exchange rate.

- Increased trade and investment

Pegging exchange rates reduces currency fluctuations, making it easier for businesses to engage in international trade and attract foreign direct investment. This can lead to increased economic activity and job creation.

- Lower inflation

By stabilizing the exchange rate, pegging can help control inflation by preventing sharp increases in the prices of imported goods.

- Improved business confidence

Businesses are more likely to invest and expand when they have confidence in the stability of the exchange rate, contributing to economic growth.

- Increased foreign exchange reserves

Pegging exchange rates can help countries accumulate foreign exchange reserves, which can be used to support the peg or to intervene in the foreign exchange market to smooth out fluctuations.

In conclusion, economic growth is a critical aspect of "what does it mean to peg." Pegging exchange rates can promote economic growth by increasing trade and investment, lowering inflation, improving business confidence, and increasing foreign exchange reserves. However, it is important to note that pegging exchange rates can also have potential drawbacks, such as reduced monetary policy independence and the risk of speculative attacks. Therefore, policymakers must carefully weigh the costs and benefits before deciding whether to peg their currency.

Historical context

The historical context plays a pivotal role in understanding the concept of pegging exchange rates. Throughout history, countries have adopted pegging mechanisms for various reasons, shaping the evolution of the international monetary system.

One significant historical context is the gold standard. Under the gold standard, countries pegged their currencies to gold, maintaining a fixed exchange rate between their currency and the price of gold. This system provided stability and facilitated international trade during the late 19th and early 20th centuries. However, it also limited countries' ability to pursue independent monetary policies.

Another historical context is the Bretton Woods system, established after World War II. Under this system, countries pegged their currencies to the US dollar, which was in turn pegged to gold. The Bretton Woods system promoted global economic cooperation and stability but eventually collapsed in the early 1970s due to various economic pressures.

Understanding the historical context of pegging exchange rates provides valuable insights into the motivations, challenges, and consequences of pegging. It helps policymakers and economists evaluate the potential benefits and drawbacks of pegging in different economic circumstances.

In conclusion, exploring "what does it mean to peg" reveals the multifaceted nature and implications of pegging exchange rates. Pegging can provide stability, reduce exchange rate risk, and facilitate international trade. However, it can also limit monetary policy independence, affect inflation control, and influence capital inflows. The balance of payments and economic growth are deeply intertwined with pegging mechanisms.

Understanding the historical context of pegging, from the gold standard to the Bretton Woods system, provides valuable insights into the motivations and consequences of pegging. Policymakers must carefully consider the specific economic circumstances and policy goals when contemplating pegging arrangements. The choice of whether or not to peg, and the choice of the appropriate peg, is a complex one that requires careful analysis and ongoing monitoring.

- Skip The Games El Paso Texas

- Katherine Knight Body

- You Like My Voice It Turn You On Lyrics

- Khamzat Chimaev With No Beard

- Skipthe Games El Paso

A Beginner’s Guide to Pegging 22 Tips, Toys, Techniques, and More

What Does Peg Mean In TikTok? PEG Slang Meaning In Text and Urban

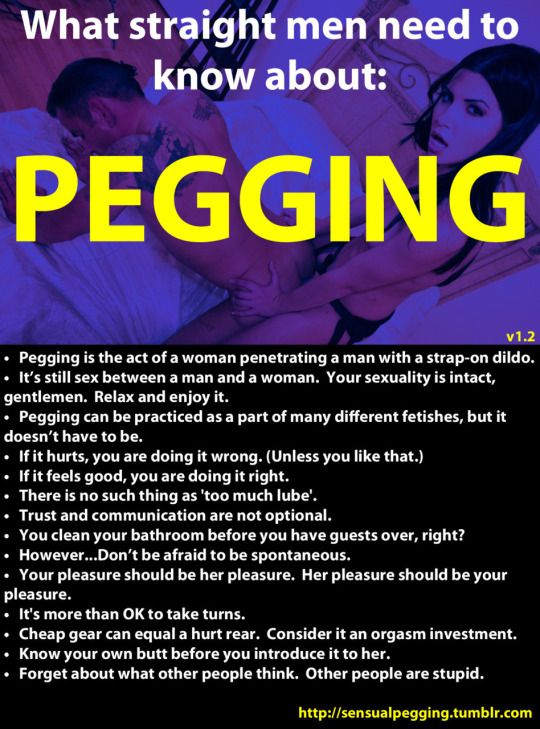

What straight men need to know about PEGGING! Scrolller