Stuart Damon Net Worth: How The Late Actor Amassed His Fortune

Stuart Damon's net worth is the total value of his financial assets and liabilities at a specific point in time. For instance, if Stuart Damon owns assets worth $10 million and has debts of $2 million, his net worth would be $8 million.

Net worth is a key indicator of financial health and can be used to track changes in wealth over time. It is also used to compare the wealth of different individuals or groups. The concept of net worth has been around for centuries and has been used by individuals, businesses, and governments to make financial decisions.

In this article, we will discuss Stuart Damon's net worth, how it has changed over time, and what factors have contributed to its growth. We will also provide tips on how to increase your own net worth.

- Khamzat Beard

- Taylor Crying On Ellen

- Stuns In New Selfie

- Khamzat Chimaev Without Beard

- How To Open Bath And Body Works Hand Soap

Stuart Damon Net Worth

Stuart Damon's net worth encompasses various aspects that contribute to his overall financial standing. These key aspects include:

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Savings

- Debt

- Cash flow

- Credit score

- Financial goals

Each of these aspects plays a role in determining Stuart Damon's net worth. For example, his assets include his house, cars, and investments. His liabilities include his mortgage and credit card debt. His income includes his salary from acting and other sources. His expenses include his living expenses and taxes. By tracking these aspects, Stuart Damon can get a clear picture of his financial situation and make informed decisions about his finances.

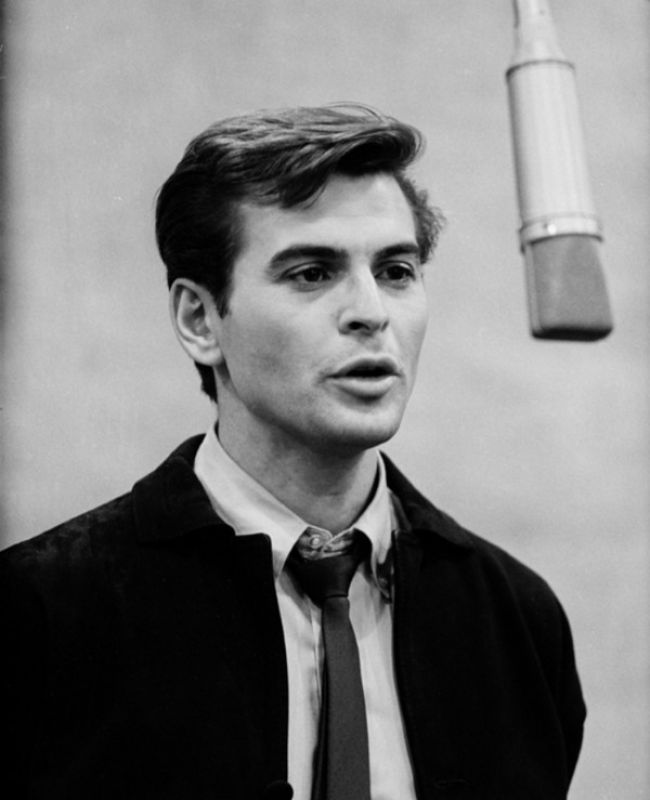

| Name | Birth Date | Birth Place | Occupation | Net Worth |

|---|---|---|---|---|

| Stuart Damon | February 5, 1939 | New York City, New York, U.S. | Actor | $10 million |

Assets

Assets play a crucial role in determining Stuart Damon's net worth. They represent the value of everything he owns, minus any liabilities or debts he may have. Some of the most common types of assets include:

- Taylor Swift Cry

- Dd Osama Brothers

- Why Does Tiktok Say No Internet Connection

- Khazmat Without Beard

- Buffet De Mariscos Cerca De Mi

- Cash and cash equivalents

This includes money in the bank, as well as short-term investments that can be easily converted into cash, such as money market accounts and Treasury bills.

- Real estate

This includes the value of any property that Stuart Damon owns, such as his house, vacation home, or rental properties.

- Stocks and bonds

These are investments in companies and governments, respectively. The value of these investments can fluctuate over time, but they can provide a source of income through dividends and interest payments.

- Personal property

This includes any other valuable items that Stuart Damon owns, such as jewelry, art, and collectibles.

The value of Stuart Damon's assets can change over time, depending on market conditions and other factors. However, by carefully managing his assets, he can increase his net worth and achieve his financial goals.

Liabilities

Liabilities are the debts and obligations that reduce Stuart Damon's net worth. They represent the money he owes to others, such as banks, credit card companies, and other lenders.

- Mortgages

A mortgage is a loan that is used to purchase real estate. The mortgage is secured by the property, which means that the lender can take possession of the property if the loan is not repaid.

- Credit card debt

Credit card debt is a type of unsecured debt that is incurred when you use a credit card to make purchases. Credit card debt can be expensive, as interest rates on credit cards are typically high.

- Personal loans

A personal loan is a type of unsecured debt that is used to cover a variety of expenses, such as medical bills, home repairs, or debt consolidation. Personal loans typically have lower interest rates than credit cards, but they may have longer repayment terms.

- Taxes

Taxes are a type of debt that is owed to the government. Taxes can be federal, state, or local.

Liabilities can have a significant impact on Stuart Damon's net worth. By managing his liabilities effectively, he can improve his financial health and increase his net worth.

Income

Income is a crucial aspect of Stuart Damon's net worth. It represents the money he earns from his various sources, which can then be used to cover his expenses, invest for the future, or increase his net worth.

- Acting

Stuart Damon's primary source of income is his acting career. He has starred in numerous television shows and movies, and his performances have earned him critical acclaim and financial success.

- Endorsements

Stuart Damon also earns income from endorsements. He has partnered with various brands to promote their products and services.

- Investments

Stuart Damon has invested a portion of his earnings in various assets, such as stocks, bonds, and real estate. These investments provide him with a source of passive income.

- Other sources

Stuart Damon may also earn income from other sources, such as royalties from his acting work or speaking engagements.

Stuart Damon's income is essential to his financial well-being. By managing his income effectively, he can increase his net worth and achieve his financial goals.

Expenses

Expenses are fundamental to understanding Stuart Damon's net worth. They represent the costs associated with maintaining his lifestyle and financial obligations. Managing expenses effectively is crucial for preserving and growing his wealth.

- Cost of Living

This includes essential expenses such as housing, food, transportation, and healthcare. These expenses can vary significantly depending on location and lifestyle choices.

- Taxes

Taxes are mandatory payments made to government entities. Stuart Damon's tax obligations can impact his net worth, as they reduce his disposable income.

- Debt Repayments

Debt repayments include mortgage payments, credit card payments, and other loan repayments. Managing debt effectively can improve Stuart Damon's credit score and financial stability.

- Investments

While investments can generate income and increase net worth, they also involve expenses such as management fees and transaction costs. Balancing investments and expenses is crucial for optimizing Stuart Damon's financial health.

By carefully managing his expenses, Stuart Damon can increase his net worth and achieve his financial goals. Expenses are an integral part of financial planning, and their impact on net worth should be carefully considered.

Investments

Investments are a crucial aspect of Stuart Damon's net worth, representing the allocation of his financial resources with the aim of generating income or capital appreciation.

- Stocks

Stocks represent ownership in publicly traded companies. Stuart Damon may hold stocks in companies he believes have potential for growth and dividends.

- Bonds

Bonds are debt instruments issued by governments and corporations. Damon may invest in bonds for regular interest payments and preservation of capital.

- Real Estate

Real estate investments involve properties such as land, buildings, and rental properties. They can offer potential rental income and long-term appreciation.

- Private Equity

Private equity involves investments in privately held companies, often with the goal of fostering their growth and eventually selling them for a profit.

These investments contribute to Stuart Damon's net worth by potentially generating passive income, diversifying his portfolio, and providing opportunities for long-term wealth accumulation. Understanding the dynamics of investments is essential for analyzing and interpreting his financial standing.

Savings

Savings represent a critical component of Stuart Damon's financial health and contribute significantly to his overall net worth. They reflect the portion of his income set aside for future financial needs, emergencies, and long-term goals. By analyzing the various aspects of Stuart Damon's savings, we gain valuable insights into his financial management strategies and preparedness for the future.

- Emergency Fund

An emergency fund serves as a safety net for unexpected expenses, such as medical bills or car repairs, preventing the need to rely on debt. Stuart Damon's emergency savings provide a buffer against financial shocks and contribute to his overall financial stability.

- Retirement Savings

Stuart Damon's retirement savings are crucial for ensuring his financial security in his later years. Contributions to retirement accounts, such as 401(k) plans or IRAs, grow over time through compounding interest and tax advantages, providing a nest egg for his future.

- Short-Term Savings

Short-term savings are earmarked for near-term financial goals, such as a down payment on a house or a vacation. These savings are typically kept in easily accessible accounts, such as high-yield savings accounts or money market accounts, for easy access when needed.

- Long-Term Investments

Stuart Damon's long-term investments, such as stocks or bonds, are intended for long-term growth and wealth accumulation. These investments have the potential to generate passive income and outpace inflation, further contributing to his net worth over time.

By carefully managing his savings across these different categories, Stuart Damon demonstrates a prudent approach to financial planning. His savings provide him with peace of mind, financial resilience, and the foundation for future financial success. Understanding the role and components of savings is essential for a comprehensive analysis of Stuart Damon's net worth and overall financial well-being.

Debt

Debt plays a significant role in understanding Stuart Damon's net worth. It represents the amount of money he owes to creditors, reducing his overall financial standing. Debt can arise from various sources, such as mortgages, loans, and credit card balances.

High levels of debt can negatively impact Stuart Damon's net worth. Interest payments on debt obligations reduce his disposable income, limiting his ability to save and invest. Additionally, excessive debt can damage his credit score, making it more difficult and expensive to obtain future loans. Managing debt effectively is crucial for maintaining a healthy financial profile and preserving net worth.

Real-life examples of debt within Stuart Damon's net worth include mortgages on his properties and any outstanding loans he may have. By analyzing the terms and conditions of these debts, as well as his debt-to-income ratio, financial analysts can assess the impact of debt on his overall financial health.

Understanding the relationship between debt and Stuart Damon's net worth is essential for informed decision-making. It enables him to develop strategies to reduce debt, improve his creditworthiness, and maximize his net worth over time. Prudent debt management can contribute to his long-term financial stability and success.

Cash Flow

Cash flow is the movement of money in and out of a business, individual, or organization. It is a critical component of Stuart Damon's net worth because it provides insights into his financial health and ability to generate wealth. Positive cash flow indicates that more money is coming in than going out, while negative cash flow suggests the opposite. Analyzing Stuart Damon's cash flow can reveal patterns, trends, and areas for improvement in his financial management.

Real-life examples of cash flow within Stuart Damon's net worth include his income from acting, investments, and endorsements, as well as his expenses such as living costs, taxes, and debt repayments. By tracking his cash flow, Stuart Damon can identify opportunities to increase his income, reduce his expenses, and optimize his financial performance.

Understanding the connection between cash flow and Stuart Damon's net worth is crucial for making informed financial decisions. It can help him identify areas where he can improve his cash flow, increase his savings, and grow his net worth over time. For instance, if Stuart Damon's cash flow is consistently negative, he may need to consider reducing his expenses or finding additional sources of income. By proactively managing his cash flow, Stuart Damon can enhance his financial stability and achieve his long-term financial goals.

Credit score

Credit score is a numerical representation of an individual's creditworthiness. It is used by lenders to assess the risk of lending money and to determine the interest rates and terms of loans. Stuart Damon's credit score is an important component of his net worth because it affects his ability to borrow money at favorable rates.

A higher credit score indicates that Stuart Damon is a lower risk to lenders. This means that he is more likely to be approved for loans and lines of credit, and he may qualify for lower interest rates. As a result, Stuart Damon can save money on interest payments and increase his net worth. Conversely, a lower credit score can make it more difficult and expensive to borrow money.

There are a number of factors that affect credit score, including payment history, amounts owed, length of credit history, and new credit. By managing his credit responsibly, Stuart Damon can improve his credit score and increase his net worth. Real-life examples of how credit score impacts Stuart Damon's net worth include his ability to obtain a mortgage with a favorable interest rate, qualify for a credit card with rewards and benefits, and secure a personal loan to consolidate debt.

Understanding the connection between credit score and net worth is essential for making informed financial decisions. By maintaining a good credit score, Stuart Damon can save money on interest payments, increase his borrowing capacity, and build his net worth over time.

Financial goals

Stuart Damon's financial goals play a crucial role in determining his net worth. They serve as a roadmap for how he manages his finances and makes investment decisions. By setting clear financial goals, Stuart Damon can prioritize his spending, saving, and investment strategies to achieve his desired financial outcomes.

For instance, if Stuart Damon has a goal of retiring comfortably, he may choose to invest a portion of his income in a retirement account and adjust his spending habits to maximize his contributions. This goal-oriented approach helps him stay focused and disciplined in his financial management. Conversely, without financial goals, Stuart Damon's financial decisions may be more haphazard and less likely to contribute to his long-term financial success.

Understanding the relationship between financial goals and Stuart Damon's net worth is essential for making informed financial decisions. It allows him to align his financial actions with his long-term aspirations and make choices that will help him achieve his desired financial future.

In conclusion, our exploration of Stuart Damon's net worth reveals the multifaceted nature of financial well-being. Stuart Damon's net worth is not merely a monetary figure but rather a reflection of his financial habits, investment strategies, and long-term goals. Key factors such as assets, liabilities, income, expenses, and investments all play a crucial role in determining his net worth. By understanding the interconnections between these elements, Stuart Damon can make informed financial decisions that will help him achieve his financial aspirations.

It is important to remember that net worth is a dynamic concept that can change over time. As Stuart Damon's financial situation evolves, so too will his net worth. By regularly reviewing his financial standing and making adjustments as needed, Stuart Damon can ensure that his net worth continues to grow and support his financial goals.

- Can Pregnant Women Drink Bloom

- Florida Baseball Coach Scandal

- Bryan Easley

- Teacher Crying At Wedding

- Breckie Hill Showers

Stuart Damon Biography, Age, Height, Wife, Net Worth, Wiki Wealthy Spy

Stuart Damon, Bio, Net Worth, Salary, Age, Relationship, Height, Ethnicity

Stuart Damon Net Worth At The Time Of His Death