How To Calculate And Understand Dean Graham's Net Worth

Dean Graham's net worth, an estimation of his total assets and liabilities, provides an understanding of his financial status. As a real-world example, Jeff Bezos, the founder of Amazon, has a net worth estimated to be around \$113 billion as of 2023.

Determining net worth is crucial for monitoring financial health and making informed decisions. It helps individuals assess their financial progress, manage debt, plan investments, and secure insurance. From a historical perspective, the concept of net worth emerged in the 16th century, initially used by merchants to track their financial standing.

This article delves into Dean Graham's net worth, explores its determinants, and analyzes its significance in understanding his financial journey and overall wealth management strategy.

- Breckie Hill Shower Video Leaked

- How Many Brothers Does Dd Osama Have

- Khazmat Without Beard

- The Most Viewed Tiktok

- Khamzat Chimaev Without Bears

Dean Graham Net Worth

Understanding the key aspects of Dean Graham's net worth provides valuable insights into his financial status and wealth management strategy.

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Debt

- Equity

- Cash flow

- Financial goals

- Tax implications

Analyzing these aspects can reveal patterns, trends, and opportunities for optimizing Dean Graham's financial well-being. For instance, tracking assets and liabilities over time can help identify areas for growth and improvement, while understanding income and expenses can provide insights into spending habits and potential savings. Furthermore, evaluating investments and their performance can assist in making informed decisions to enhance returns and mitigate risks.

Personal Details of Dean Graham

| Full Name | Dean Graham |

| Date of Birth | 1964 |

| Nationality | American |

| Occupation | Businessman, Investor |

Assets

Assets play a pivotal role in determining Dean Graham's net worth. Assets represent anything of value that Dean Graham owns, and their combined value contributes positively to his overall financial standing. The more valuable his assets, the higher his net worth. Conversely, liabilities, which represent debts and obligations, have a negative impact on net worth.

Real-life examples of assets that may contribute to Dean Graham's net worth include cash, investments, real estate, vehicles, and intellectual property. Each of these assets has a monetary value that can be quantified and added to his total net worth. For instance, if Dean Graham owns a house worth \$1 million, this asset increases his net worth by \$1 million.

Understanding the relationship between assets and net worth is crucial for effective financial management. By tracking and valuing his assets, Dean Graham can make informed decisions about how to allocate his resources, grow his wealth, and minimize his financial risks. Furthermore, this understanding can assist him in securing loans, attracting investors, and planning for his financial future.

Liabilities

Liabilities are a critical component of Dean Graham's net worth, as they represent his financial obligations and debts. Understanding the relationship between Liabilities and net worth is essential for assessing his overall financial health and making informed decisions about his wealth management strategy.

Liabilities have a negative impact on net worth, as they reduce the value of his assets. For instance, if Dean Graham has a mortgage of \$500,000 on his house, this liability decreases his net worth by \$500,000. Conversely, reducing liabilities, such as paying off debt, can increase net worth.

Common examples of Liabilities include mortgages, loans, credit card debt, and unpaid taxes. It is important for Dean Graham to carefully manage his Liabilities to ensure that they do not become overwhelming and negatively impact his financial well-being.

Understanding the connection between Liabilities and Dean Graham's net worth empowers him to make informed decisions about borrowing, debt repayment, and overall financial planning. By effectively managing his Liabilities, he can maximize his net worth, improve his financial stability, and achieve his long-term financial goals.

Investments

Investments are a crucial aspect of Dean Graham's net worth, representing the assets he holds with the expectation of generating income or capital appreciation. Understanding the types of Investments he makes and their performance is essential for evaluating his overall financial health.

- Stocks

Stocks represent ownership shares in publicly traded companies. They can provide potential for capital appreciation and dividends, but also carry risk due to market fluctuations.

- Bonds

Bonds are loans made to companies or governments. They offer fixed interest payments and are generally considered less risky than stocks, but also have lower potential returns.

- Real Estate

Real estate investments include properties such as land, buildings, and rental properties. They can generate rental income and potential capital appreciation, but also require ongoing maintenance and management.

- Alternative Investments

Alternative investments cover a wide range of assets, such as hedge funds, private equity, and commodities. They offer diversification and potential for high returns, but also carry higher risks.

Dean Graham's investment strategy, including his allocation across different asset classes, risk tolerance, and investment horizon, significantly influences his net worth. By carefully managing his Investments, he can potentially grow his wealth, generate passive income, and secure his financial future.

Income

Income plays a central role in understanding Dean Graham's net worth, as it represents the inflow of funds that contribute to his overall financial standing. A steady and substantial income is crucial for building and maintaining wealth.

Income directly impacts Dean Graham's net worth by increasing the value of his assets and reducing his liabilities. For example, if Dean Graham earns \$100,000 in a year and saves \$20,000, his net worth increases by \$20,000. Conversely, if he spends all of his income, his net worth remains unchanged or may even decrease if his expenses exceed his income.

Real-life examples of Income that contribute to Dean Graham's net worth include his earnings from his business ventures, investments, and any other sources of regular income. Understanding the relationship between Income and Dean Graham's net worth is essential for effective financial planning, as it allows him to make informed decisions about how to allocate his resources, grow his wealth, and achieve his financial goals.

By maximizing his Income through strategic investments, increasing his earning potential, and managing his expenses effectively, Dean Graham can positively impact his net worth and secure his financial future.

Expenses

Expenses represent a critical component of Dean Graham's net worth, as they directly impact the value of his assets and liabilities. Expenses are the costs incurred in generating income and maintaining a certain lifestyle, and they have a negative effect on net worth by reducing the amount of funds available for savings and investments.

Real-life examples of Expenses that affect Dean Graham's net worth include business operating costs, personal living expenses, and taxes. For instance, if Dean Graham spends \$10,000 on business expenses in a month, his net worth decreases by \$10,000. Conversely, reducing unnecessary Expenses and optimizing spending can increase net worth.

Understanding the relationship between Expenses and Dean Graham's net worth is crucial for effective financial management. By tracking and analyzing his Expenses, Dean Graham can identify areas where he can cut back, negotiate better deals, or explore alternative cost-saving strategies. This knowledge empowers him to make informed decisions about his spending habits, prioritize his financial goals, and maximize his net worth.

In summary, Expenses play a significant role in determining Dean Graham's net worth. By carefully managing his Expenses, he can increase his savings, reduce debt, and build wealth over time. Understanding this relationship is essential for achieving long-term financial success.

Debt

Understanding Debt is crucial in assessing Dean Graham's net worth, as it represents obligations that reduce his overall financial standing. It is the total amount owed to creditors, such as banks, credit card companies, and individuals.

- Outstanding Loans

Outstanding Loans include mortgages, personal loans, and business loans. They represent a significant portion of Debt and can impact Dean Graham's net worth by reducing the value of his assets.

- Credit Card Debt

Credit Card Debt refers to unpaid balances on credit cards. High levels of Credit Card Debt can lead to high-interest charges and negatively affect Dean Graham's net worth.

- Unpaid Taxes

Unpaid Taxes represent outstanding tax obligations to government entities. They can accumulate interest and penalties, potentially reducing Dean Graham's net worth.

- Contingent Liabilities

Contingent Liabilities are potential financial obligations that may arise from lawsuits, guarantees, or other uncertain events. These can pose risks to Dean Graham's net worth if they materialize.

Managing Debt effectively is essential for Dean Graham to maintain a healthy net worth. By reducing unnecessary Debt, negotiating favorable interest rates, and prioritizing Debt repayment, he can improve his financial standing and increase his wealth over time.

Equity

Equity, in the context of Dean Graham's net worth, refers to the value of his assets that are not offset by liabilities or debts. It represents the ownership interest in his properties and investments and directly contributes to his overall financial standing.

Equity is a critical component of Dean Graham's net worth as it provides a cushion against unforeseen financial obligations. A higher level of Equity indicates a stronger financial position and resilience to economic downturns or market volatility. Conversely, a low level of Equity may increase financial risks and limit his ability to access credit or investments.

Real-life examples of Equity within Dean Graham's net worth could include the value of his house, stocks, and bonds. The value of these assets, minus any outstanding mortgages or loans, contributes to his overall Equity. Understanding this relationship empowers Dean Graham to make informed decisions about his investments and financial strategy.

In summary, Equity plays a significant role in determining Dean Graham's net worth and provides valuable insights into his financial health. By actively managing his Equity, he can increase his financial resilience, access more favorable financing options, and achieve his long-term wealth-building goals.

Cash flow

Cash flow, the movement of money into and out of Dean Graham's financial accounts, is a critical component of his net worth analysis. It provides insights into his short-term financial liquidity and the sustainability of his wealth. A steady and positive cash flow is essential for Dean Graham to maintain and grow his overall net worth.

Understanding the cause-and-effect relationship between cash flow and Dean Graham's net worth is crucial. Positive cash flow, when income exceeds expenses and investments generate returns, directly contributes to a higher net worth. Conversely, negative cash flow, where expenses and investment losses outpace income, can erode net worth over time. Therefore, managing and optimizing cash flow is paramount for Dean Graham to sustain his wealth and achieve long-term financial goals.

Real-life examples of cash flow within Dean Graham's net worth include the inflow of funds from his business ventures, investment dividends, and rental income. Effective management of these cash flows allows him to pay expenses, reinvest in his businesses, and maintain a positive financial position. By tracking and analyzing cash flow, Dean Graham can identify patterns, optimize financial decisions, and make strategic investments that contribute to his overall net worth growth.

Financial goals

Financial goals are aspirations and targets that guide Dean Graham's financial decisions and contribute to the trajectory of his net worth. Understanding his financial goals is crucial for assessing his financial well-being and evaluating the effectiveness of his wealth management strategies.

- Retirement planning

Preparing for retirement involves setting aside funds and making investments to ensure financial security during his post-work years. This goal impacts his net worth by guiding his savings and investment strategies.

- Wealth accumulation

Growing his net worth over time is a common financial goal for Dean Graham. It involves making prudent investments, managing risks, and maximizing returns to increase his overall financial standing.

- Financial independence

Achieving financial independence means having sufficient assets and passive income to cover his expenses without relying on active employment. This goal influences his investment decisions and risk tolerance.

- Legacy planning

Preserving and distributing his wealth in a manner that aligns with his values and provides for his family's future is a key financial goal for Dean Graham. It involves estate planning and charitable giving strategies.

In summary, Dean Graham's financial goals play a pivotal role in shaping his financial journey and determining his net worth. By setting clear and achievable financial goals, he can make informed decisions, prioritize his investments, and align his wealth management strategies with his long-term aspirations.

Tax implications

Tax implications play a significant role in shaping Dean Graham's net worth. Understanding these implications is crucial for effective financial planning and wealth management. Various tax-related factors can impact his overall financial standing, affecting the growth and distribution of his assets.

- Taxable income

Determining Dean Graham's taxable income involves identifying all sources of income subject to taxation. This includes income from his businesses, investments, and any other sources. Understanding his taxable income helps him estimate his tax liability and plan his financial strategies accordingly.

- Tax deductions and credits

Tax deductions and credits are provisions within the tax code that allow Dean Graham to reduce his taxable income or claim tax refunds. Utilizing these deductions and credits effectively can minimize his tax liability and increase his after-tax income.

- Tax rates

The applicable tax rates determine the percentage of Dean Graham's taxable income that he owes in taxes. Understanding the different tax brackets and rates can help him optimize his financial decisions and minimize his tax burden.

- Tax planning strategies

Effective tax planning involves implementing strategies that reduce Dean Graham's tax liability while staying within the legal boundaries. This may include utilizing tax-advantaged accounts, such as retirement accounts or charitable trusts, to defer or minimize taxes.

In summary, tax implications encompass a range of factors that can significantly impact Dean Graham's net worth. By understanding his taxable income, utilizing tax deductions and credits, navigating tax rates, and implementing tax planning strategies, he can optimize his financial position and maximize his after-tax wealth.

In conclusion, this comprehensive analysis of Dean Graham's net worth has illuminated the multifaceted nature of financial well-being. Understanding the interplay between assets, liabilities, income, expenses, and other factors provides a holistic view of his financial status and wealth management strategies.

Two key takeaways emerge from this examination. Firstly, Dean Graham's net worth is a dynamic concept influenced by numerous financial decisions and market conditions. Secondly, effective wealth management involves a comprehensive approach that considers not only asset accumulation but also liability reduction, income optimization, and prudent financial planning.

As Dean Graham navigates the ever-changing financial landscape, this analysis serves as a reminder of the importance of ongoing financial monitoring, strategic planning, and the pursuit of financial goals. By embracing these principles, he can continue to build and sustain a strong financial foundation for the future.

- You Like My Voice It Turn You On Lyrics

- How To Open Bath And Body Works Hand Soap

- Katherine Knight Body

- Brekie Hill Shower Leaks

- Teacher Crying At Wedding

Graham Dean is fundraising for Sustrans

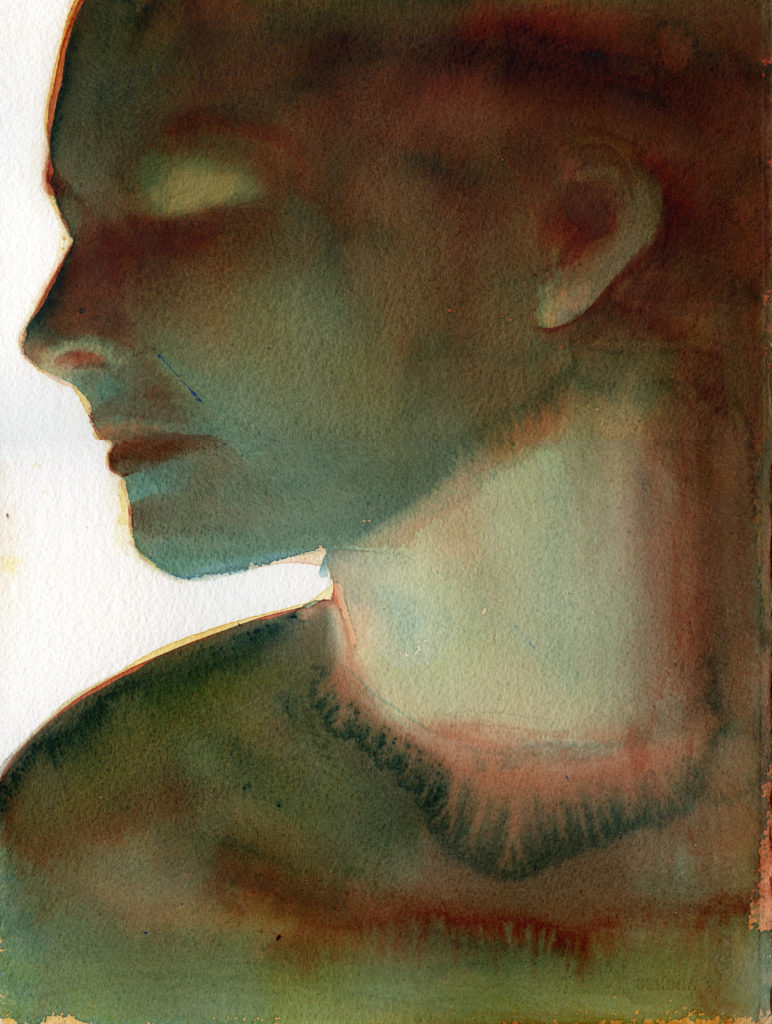

img0001 Graham Dean

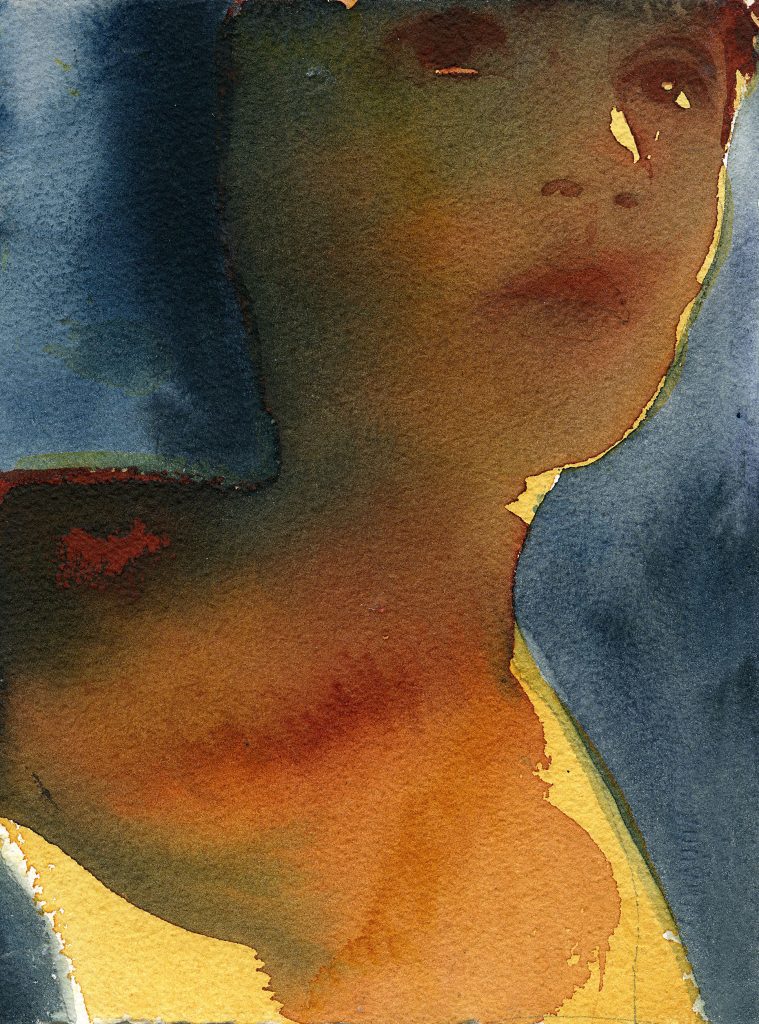

L&B013 Graham Dean