How To Calculate Brody Net Worth

Brody Net Worth refers to the total monetary value of the assets owned by Brody, a living individual, less any liabilities. It is calculated by adding up the cash, investments, and other assets, then subtracting any debts or financial obligations.

Understanding Brody's Net Worth is crucial for assessing financial stability, determining economic status, and making informed decisions related to financial planning, wealth management, and potential investments.

Historically, the concept of Net Worth gained significance with the advent of double-entry bookkeeping, enabling accurate tracking of assets and liabilities.

- Khamzat Chimaev Without Beard

- When Is Peysoh Getting Out Of Jail

- Why Did Bunnie Fire Haley

- When Will Stray Kids End

- Khamzat Chimaev Bald

Brody Net Worth

Brody Net Worth encompasses various essential aspects that collectively provide a comprehensive view of an individual's financial standing and economic well-being. These key aspects include:

- Assets

- Liabilities

- Investments

- Cash

- Income

- Debt

- Expenses

- Financial obligations

Understanding and analyzing these aspects offer valuable insights into a person's ability to manage their finances, make informed financial decisions, and plan for their economic future. Each aspect contributes to the overall calculation of Brody Net Worth, providing a holistic view of their financial position.

Assets

Assets are a critical component of Brody Net Worth, representing the value of everything an individual owns. These assets can take various forms, each contributing to the overall financial picture.

- Why Does Tiktok Say No Internet Connection

- Can Pregnant Women Drink Bloom

- Khamzat Chimaev Without Bears

- Brown Easley

- Nomi And Mac Miller

- Cash and Cash Equivalents

This category includes physical cash on hand, demand deposits, and other highly liquid assets that can be easily converted into cash, providing immediate access to funds. - Investments

Investments encompass a wide range of financial instruments, such as stocks, bonds, mutual funds, and real estate, representing ownership or a claim on future earnings or capital appreciation, contributing to the growth of Brody Net Worth over time. - Property and Equipment

This includes real estate, vehicles, and other tangible assets used in business operations or personal life, providing both utility and potential for appreciation or depreciation in value. - Intellectual Property

Intellectual property encompasses intangible assets such as patents, trademarks, copyrights, and other forms of creative or inventive expression, representing potential revenue streams and contributing to the overall value of Brody Net Worth.

Collectively, these assets provide a snapshot of an individual's financial strength, liquidity, and potential for future growth. Understanding and managing assets effectively are crucial for maximizing Brody Net Worth and achieving long-term financial goals.

Liabilities

Liabilities represent the financial obligations of an individual, such as debts, loans, mortgages, and other payable amounts, which reduce their net worth. Unlike assets, liabilities have a negative impact on Brody Net Worth. Effectively managing liabilities is crucial for maintaining a healthy financial position and achieving long-term financial goals.

Liabilities can arise from various sources, including personal loans, credit card debt, unpaid taxes, and outstanding mortgages. High levels of debt can strain an individual's cash flow, limit their ability to save and invest, and potentially damage their credit score, making it more challenging to secure favorable financing terms in the future.

Examples of liabilities within Brody Net Worth include unpaid bills, such as utility bills, medical expenses, and outstanding credit card balances. These liabilities represent obligations that must be fulfilled, and failure to do so can lead to late fees, penalties, and damage to one's credit rating. Understanding and managing liabilities effectively is essential for maintaining a strong financial foundation and preserving Brody Net Worth.

Investments

Investments play a significant role in shaping Brody's net worth, offering potential for growth and returns that contribute to overall financial well-being. They encompass various asset classes, each carrying its own risk and reward profile and contributing to a diversified portfolio that aligns with Brody's financial goals and risk tolerance.

- Stocks

Stocks represent ownership shares in publicly traded companies, providing potential for capital appreciation and dividends. Investing in stocks can offer high returns but also carries higher risk due to market volatility.

- Bonds

Bonds are fixed-income securities issued by governments or corporations, offering regular interest payments and eventual repayment of the principal amount at maturity. Bonds generally provide lower returns than stocks but carry less risk.

- Mutual Funds

Mutual funds are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer instant diversification and lower investment minimums.

- Real Estate

Real estate investments involve purchasing property, such as land, buildings, or rental units, with the potential for rental income, capital appreciation, and tax benefits. Real estate can be a lucrative investment but requires significant capital and ongoing maintenance.

The combination of these investment types contributes to Brody's overall net worth, providing a balance between risk and return. By carefully selecting and managing investments, Brody can potentially increase their net worth over time and secure their financial future.

Cash

Cash, an essential element of Brody Net Worth, encompasses liquid assets readily available for immediate use. It serves as a foundation for financial stability and flexibility, enabling prompt financial transactions and serving as a buffer against unexpected expenses.

- Currency

Physical cash, including bills and coins, represents the most basic form of cash, offering immediate purchasing power and wide acceptance. - Demand Deposits

Checking accounts and savings accounts with no restrictions on withdrawals provide easy access to funds, facilitating everyday transactions and financial management. - Money Market Accounts

These accounts offer higher interest rates than traditional demand deposits while maintaining high liquidity, providing a balance between accessibility and returns. - Cash Equivalents

Short-term, highly liquid investments, such as treasury bills and commercial paper, can be quickly converted into cash, providing a safe haven for excess funds and maintaining liquidity.

Understanding and managing cash effectively are crucial for Brody Net Worth. Maintaining an adequate cash balance ensures financial stability, while excessive cash holdings may indicate missed opportunities for investment and growth. Balancing liquidity and returns is essential for optimizing cash management and maximizing Brody Net Worth.

Income

Income, a pivotal aspect of Brody Net Worth, represents the inflow of financial resources that increase an individual's overall wealth. It encompasses various streams of earnings and plays a crucial role in determining financial stability, purchasing power, and the ability to accumulate assets over time.

- Employment Income

Derived from regular employment, wages, salaries, bonuses, and commissions constitute a significant portion of income for most individuals. Employment income provides a steady and predictable cash flow, forming the backbone of Brody Net Worth.

- Investment Income

Returns generated from investments, such as dividends, interest, and capital gains, contribute to Brody Net Worth. Investment income can provide passive income streams, enhancing overall financial well-being and potentially leading to exponential growth.

- Business Income

For entrepreneurs and business owners, income generated from business operations, including profits, sales revenue, and service fees, directly impacts Brody Net Worth. Business income offers opportunities for substantial wealth creation but also carries inherent risks and responsibilities.

- Other Income

Additional sources of income, such as royalties, rental income, and freelance work, can supplement Brody Net Worth. These diverse income streams provide flexibility and resilience, mitigating the risks associated with relying solely on a single income source.

Understanding and managing income effectively are crucial for optimizing Brody Net Worth. Diversifying income streams, maximizing earning potential, and exploring tax optimization strategies can significantly contribute to long-term financial growth and stability. Moreover, balancing income with responsible spending and wise investment decisions is essential for preserving and increasing Brody Net Worth over time.

Debt

Debt, an essential consideration in assessing Brody Net Worth, represents financial obligations that reduce an individual's overall wealth. It encompasses various forms and sources, each with its own implications for financial stability and long-term financial growth.

- Outstanding Loans

Unpaid balances on personal loans, mortgages, and business loans contribute significantly to Debt. These obligations require regular payments and can strain cash flow, limit investment opportunities, and negatively impact credit scores.

- Credit Card Debt

Revolving debt on credit cards, if not managed responsibly, can accumulate high interest charges and damage creditworthiness. It is a common form of Debt that can hinder Brody Net Worth if not addressed effectively.

- Unpaid Taxes

Outstanding tax liabilities, such as income taxes or property taxes, can result in penalties, legal issues, and liens on assets. Timely tax payments are crucial for maintaining a positive Brody Net Worth.

- Other Liabilities

Additional forms of Debt may include medical bills, legal judgments, and contractual obligations. These liabilities can arise from unforeseen circumstances or poor financial decisions and can significantly impact Brody Net Worth if not managed properly.

Understanding and managing Debt effectively is paramount for optimizing Brody Net Worth. High levels of Debt can limit financial flexibility, increase financial risk, and hinder the accumulation of wealth. By carefully monitoring Debt, exploring debt consolidation or repayment strategies, and making informed financial decisions, Brody can improve their Net Worth and achieve long-term financial well-being.

Expenses

Expenses form a crucial aspect of Brody Net Worth, representing the outflow of financial resources that decrease an individual's overall wealth. Understanding and managing expenses effectively are essential for preserving and growing Net Worth over time.

- Fixed Expenses

These are regular, predictable expenses that remain relatively constant over time, such as rent or mortgage payments, insurance premiums, and car payments. They provide a stable baseline for financial planning and budgeting.

- Variable Expenses

These expenses fluctuate from month to month, such as groceries, entertainment, and transportation costs. Managing variable expenses effectively can help optimize cash flow and reduce discretionary spending.

- Discretionary Expenses

These expenses are non-essential and can be adjusted or eliminated without significantly impacting an individual's lifestyle, such as dining out, travel, and hobbies. Consciously managing discretionary expenses can contribute to long-term financial growth.

- Debt Repayments

Repayments towards outstanding loans and credit card balances are considered expenses that reduce Net Worth. Timely debt repayments are crucial for maintaining a healthy credit score and improving overall financial well-being.

Effective expense management involves tracking expenses, identifying areas for potential savings, and making informed decisions about spending. By minimizing unnecessary expenses, optimizing variable expenses, and prioritizing debt repayment, Brody can increase their Net Worth and achieve long-term financial stability.

Financial obligations

Financial obligations encompass various commitments and responsibilities that can significantly impact Brody's net worth. Understanding and effectively managing these obligations are crucial for maintaining financial stability and achieving long-term financial goals.

- Outstanding Loans

Loans, such as mortgages, personal loans, and student loans, represent significant financial obligations that affect Brody's net worth. Timely loan repayments are essential to avoid late fees, penalties, and damage to credit scores. - Credit Card Debt

Unpaid credit card balances accumulate interest charges and can hinder Brody's ability to save and invest. Managing credit card debt effectively involves making regular payments, avoiding excessive spending, and consolidating or refinancing debt when possible. - Taxes

Taxes, including income tax, property tax, and sales tax, are legal obligations that reduce Brody's net worth. Understanding tax laws and planning accordingly can help minimize tax liability and optimize financial resources. - or Child Support

or Child support payments are court-ordered financial obligations that contribute to the support of dependents. These payments can have a substantial impact on Brody's cash flow and overall net worth.

Effectively managing financial obligations requires careful planning, budgeting, and discipline. By prioritizing debt repayment, controlling spending, and seeking professional financial advice when necessary, Brody can minimize the impact of financial obligations on their net worth and improve their overall financial well-being.

In summary, "Brody Net Worth" encompasses a comprehensive analysis of an individual's financial standing, providing valuable insights into their overall economic well-being. The article delved into various aspects that contribute to net worth, including assets, liabilities, income, debt, expenses, and financial obligations. By understanding the interconnections between these elements, individuals can make informed financial decisions, optimize their financial resources, and work towards achieving their long-term financial goals.

Key takeaways from this exploration include the significance of asset diversification to mitigate risk, the importance of managing debt effectively to avoid financial strain, and the role of prudent expense management in preserving and growing wealth. Understanding "Brody Net Worth" goes beyond mere calculation; it empowers individuals to take control of their financial future, prioritize their financial objectives, and make informed choices that contribute to their overall financial success.

- What Is Dd Osama Real Name

- Taylor Crying On Ellen

- Nomi Mac Miller

- Taylor Swift Crying On Ellen

- What The French Toast Commercial

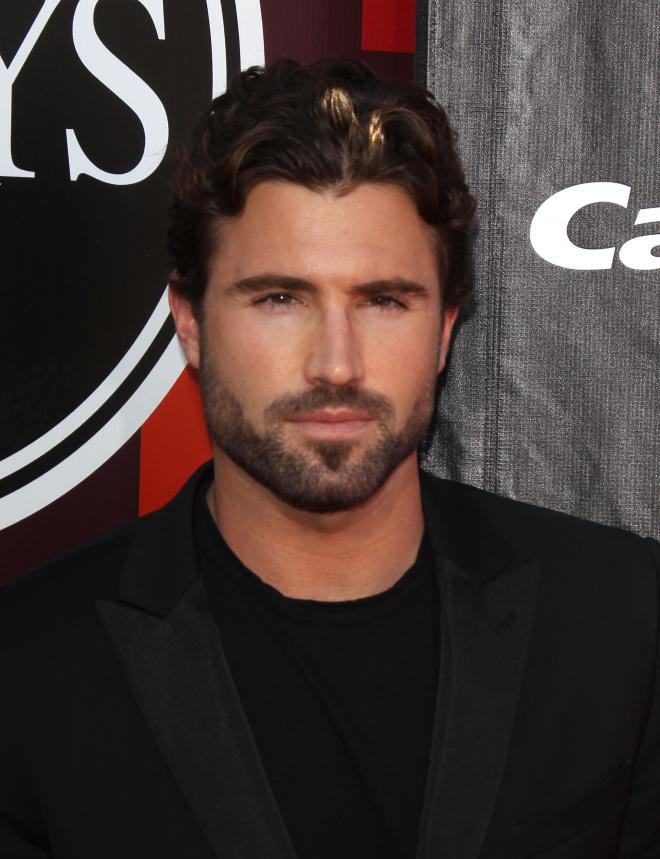

Brody Jenner Net Worth 2023 Wiki Bio, Married, Dating, Family, Height

What Is Adrien Brody's Net Worth? 'Midnight In Paris' Actor's Earnings

Brody Jenner Bio, Height, Weight, Girlfriend, Wife, Affair, Married