PM Dawn Net Worth: How Much Is The Duo Worth?

PM Dawn Net Worth, also known as net worth at dusk, is a financial measurement that calculates the value of a business, individual, or organization at the end of each day. It is calculated by subtracting liabilities from assets. For example, if a company has assets worth $1 million and liabilities of $200,000, its net worth would be $800,000.

Net worth at dusk is important because it provides a snapshot of a company's financial health. It can be used to assess the company's ability to pay its bills, make investments, and grow. It can also be used to compare the company to its competitors.

The concept of net worth has been around for centuries, but it became more widely used in the 19th century with the advent of modern accounting practices. Today, net worth is a key financial metric that is used by businesses, investors, and individuals.

- Marine Brian Brown Easley

- Khamzat Chimaev Without Bear

- Brian Easley Daughter Now

- Watch Your Back 2 Tubi Release Date

- Is Dd And Notti Brothers

PM Dawn Net Worth

The essential aspects of PM Dawn net worth are important for understanding the financial health of the company. They include:

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

- Profitability

- Cash flow

- Debt

These aspects are all interconnected and provide a comprehensive view of the company's financial performance. For example, a company with high assets but also high liabilities may not be as financially healthy as a company with lower assets but also lower liabilities. Similarly, a company with high revenue but also high expenses may not be as profitable as a company with lower revenue but also lower expenses.

Personal details and bio data of that person or celebrity in the form of table

- Nomi Leasure

- Notti Osama Brothers

- Breckue Hill Shower Vid

- Buffet De Mariscos Cerca De Mi

- Fotos De Black Friday Deals Charlotte

Assets

Assets are anything of value that a company owns or controls. They can be tangible assets, such as property, plant, and equipment, or intangible assets, such as patents, trademarks, and goodwill. Assets are important because they represent the resources that a company can use to generate revenue and profits. The more assets a company has, the greater its potential for growth.

PM Dawn Net Worth is the value of all of the assets that PM Dawn owns or controls. This includes everything from the company's cash on hand to its intellectual property. PM Dawn Net Worth is important because it is a measure of the company's financial health. A company with a high net worth is more likely to be able to withstand economic downturns and make investments for the future.

There are many different types of assets that can contribute to PM Dawn Net Worth. Some of the most common include:

- Cash

- Accounts receivable

- Inventory

- Property, plant, and equipment

- Investments

- Intangible assets

PM Dawn Net Worth is a critical component of the company's financial health. By understanding the relationship between assets and net worth, investors can make informed decisions about whether or not to invest in the company.

Liabilities

Liabilities are debts or obligations that a company owes to others. They can be short-term liabilities, such as accounts payable, or long-term liabilities, such as bonds. Liabilities are important because they represent the claims of creditors against a company's assets. The higher a company's liabilities, the less equity the owners have in the company.

PM Dawn Net Worth is the value of all of the assets that PM Dawn owns or controls, minus the value of all of its liabilities. Therefore, liabilities have a direct impact on PM Dawn Net Worth. The more liabilities a company has, the lower its net worth will be. This is because liabilities represent claims against the company's assets. When a company has to pay off its liabilities, it reduces the amount of assets that it has available to generate revenue and profits.

There are many different types of liabilities that can affect PM Dawn Net Worth. Some of the most common include:

- Accounts payable

- Notes payable

- Bonds payable

- Leases

- Taxes payable

Understanding the relationship between liabilities and PM Dawn Net Worth is important for investors. By understanding how liabilities can impact the company's financial health, investors can make informed decisions about whether or not to invest in the company.

Equity

Equity is the portion of a company's assets that are owned by its shareholders. It is calculated by subtracting liabilities from assets. Equity is important because it represents the ownership interest in a company. The higher a company's equity, the more its owners have invested in the company and the more they stand to gain from its success.

PM Dawn Net Worth is the value of all of the assets that PM Dawn owns or controls, minus the value of all of its liabilities. Therefore, equity is a critical component of PM Dawn Net Worth. The more equity a company has, the higher its net worth will be. This is because equity represents the ownership interest in the company. When a company has more equity, it means that its owners have more invested in the company and have more to gain from its success.

There are many different ways that a company can increase its equity. Some of the most common include:

- Selling stock

- Retaining earnings

- Reducing liabilities

PM Dawn can use its equity to fund its operations, invest in new projects, or pay dividends to its shareholders. Understanding the relationship between equity and PM Dawn Net Worth is important for investors. By understanding how equity can impact the company's financial health, investors can make informed decisions about whether or not to invest in the company.

Revenue

Revenue is a critical aspect of PM Dawn Net Worth. It represents the income that the company generates from its operations. The higher the revenue, the more resources the company has to invest in its business and grow its net worth.

- Sales of Products or Services

This is the most common type of revenue for businesses. PM Dawn generates revenue by selling its products or services to customers.

- Interest Income

This is revenue that is earned from lending money to others. PM Dawn may earn interest income if it has invested in bonds or other interest-bearing assets.

- Dividend Income

This is revenue that is earned from owning stock in other companies. PM Dawn may earn dividend income if it has invested in stocks that pay dividends.

- Other Income

This is revenue that is not generated from the core operations of the business. PM Dawn may earn other income from activities such as renting out property or selling assets.

Revenue is essential for PM Dawn's financial health. The company needs to generate enough revenue to cover its expenses and generate a profit. The higher the revenue, the more profitable the company will be and the greater its net worth will be.

Expenses

Expenses are an essential component of PM Dawn Net Worth. They represent the costs that the company incurs in order to generate revenue. The higher the expenses, the less profit the company will make and the lower its net worth will be.

There are many different types of expenses that can affect PM Dawn Net Worth. Some of the most common include:

- Cost of goods sold: This includes the costs of the materials, labor, and overhead that are required to produce the company's products or services.

- Selling, general, and administrative (SG&A) expenses: These are the costs of marketing, sales, and administration that are not directly related to the production of the company's products or services.

- Interest expense: This is the cost of borrowing money. PM Dawn may incur interest expense if it has borrowed money to finance its operations.

- Taxes: These are the taxes that the company is required to pay to the government.

Understanding the relationship between expenses and PM Dawn Net Worth is important for investors. By understanding how expenses can impact the company's financial health, investors can make informed decisions about whether or not to invest in the company.

Profitability

Profitability is a critical component of PM Dawn Net Worth. It measures the company's ability to generate profits from its operations. The higher the profitability, the more resources the company has to invest in its business and grow its net worth.

There are many factors that can affect profitability, including sales volume, cost of goods sold, and operating expenses. PM Dawn can improve its profitability by increasing sales, reducing costs, or both. By understanding the factors that affect profitability, PM Dawn can make informed decisions to improve its financial performance.

For example, PM Dawn may decide to increase sales by investing in marketing and advertising. This could lead to increased sales and profits. Alternatively, PM Dawn may decide to reduce costs by negotiating lower prices with suppliers or by reducing its workforce. This could also lead to increased profitability.

Understanding the relationship between profitability and PM Dawn Net Worth is important for investors. By understanding how profitability can impact the company's financial health, investors can make informed decisions about whether or not to invest in the company.

Cash flow

Cash flow is a critical component of PM Dawn Net Worth. It measures the amount of cash and cash equivalents that a company generates and uses over a period of time. A positive cash flow indicates that a company is generating more cash than it is using, while a negative cash flow indicates the opposite. Cash flow is important because it can be used to fund operations, invest in new projects, or pay dividends to shareholders. A company with a strong cash flow is more likely to be able to weather economic downturns and make investments for the future.

There are many different factors that can affect cash flow, including sales, expenses, and investments. PM Dawn can improve its cash flow by increasing sales, reducing expenses, or both. By understanding the factors that affect cash flow, PM Dawn can make informed decisions to improve its financial performance.

For example, PM Dawn may decide to increase sales by investing in marketing and advertising. This could lead to increased sales and cash flow. Alternatively, PM Dawn may decide to reduce expenses by negotiating lower prices with suppliers or by reducing its workforce. This could also lead to increased cash flow. Understanding the relationship between cash flow and PM Dawn Net Worth is important for investors. By understanding how cash flow can impact the company's financial health, investors can make informed decisions about whether or not to invest in the company.

Debt

Debt is a critical component of PM Dawn Net Worth. It represents the amount of money that the company owes to others. Debt can be used to finance operations, invest in new projects, or pay dividends to shareholders. However, too much debt can be a burden on a company's financial health. It can lead to higher interest payments, lower credit ratings, and even bankruptcy.

The relationship between debt and PM Dawn Net Worth is complex. On the one hand, debt can help the company to grow and increase its net worth. On the other hand, too much debt can lead to financial distress and even bankruptcy. Therefore, it is important for PM Dawn to carefully manage its debt levels. The company should only borrow money if it is confident that it can repay the debt with interest.

There are many different types of debt that PM Dawn can use. Some of the most common types include:

- Long-term debt: This type of debt has a maturity of more than one year. It is typically used to finance major capital projects, such as the purchase of new equipment or the construction of a new factory.

- Short-term debt: This type of debt has a maturity of less than one year. It is typically used to finance working capital needs, such as the purchase of inventory or the payment of wages.

PM Dawn's debt levels are a key factor in its financial health. Investors should carefully consider the company's debt levels before investing in the company.

This article has explored the various aspects of PM Dawn Net Worth, including assets, liabilities, equity, revenue, expenses, profitability, cash flow, and debt. We have seen that each of these factors plays a critical role in determining the company's overall financial health.

Two of the most important factors to consider are profitability and debt. Profitability measures the company's ability to generate profits, while debt measures the amount of money that the company owes to others. A company with strong profitability and low debt is more likely to be financially healthy and have a high net worth.

Investors should carefully consider all of the factors discussed in this article before investing in PM Dawn. The company's financial health is complex, and there are a number of factors that can impact its net worth. By understanding these factors, investors can make informed decisions about whether or not to invest in the company.

- Peysoh Jail

- Khamzat Beard

- How Much Does Tommy The Clown Charge

- Khamzat Chimaev With No Beard

- How To Open Bath And Body Works Hand Soap

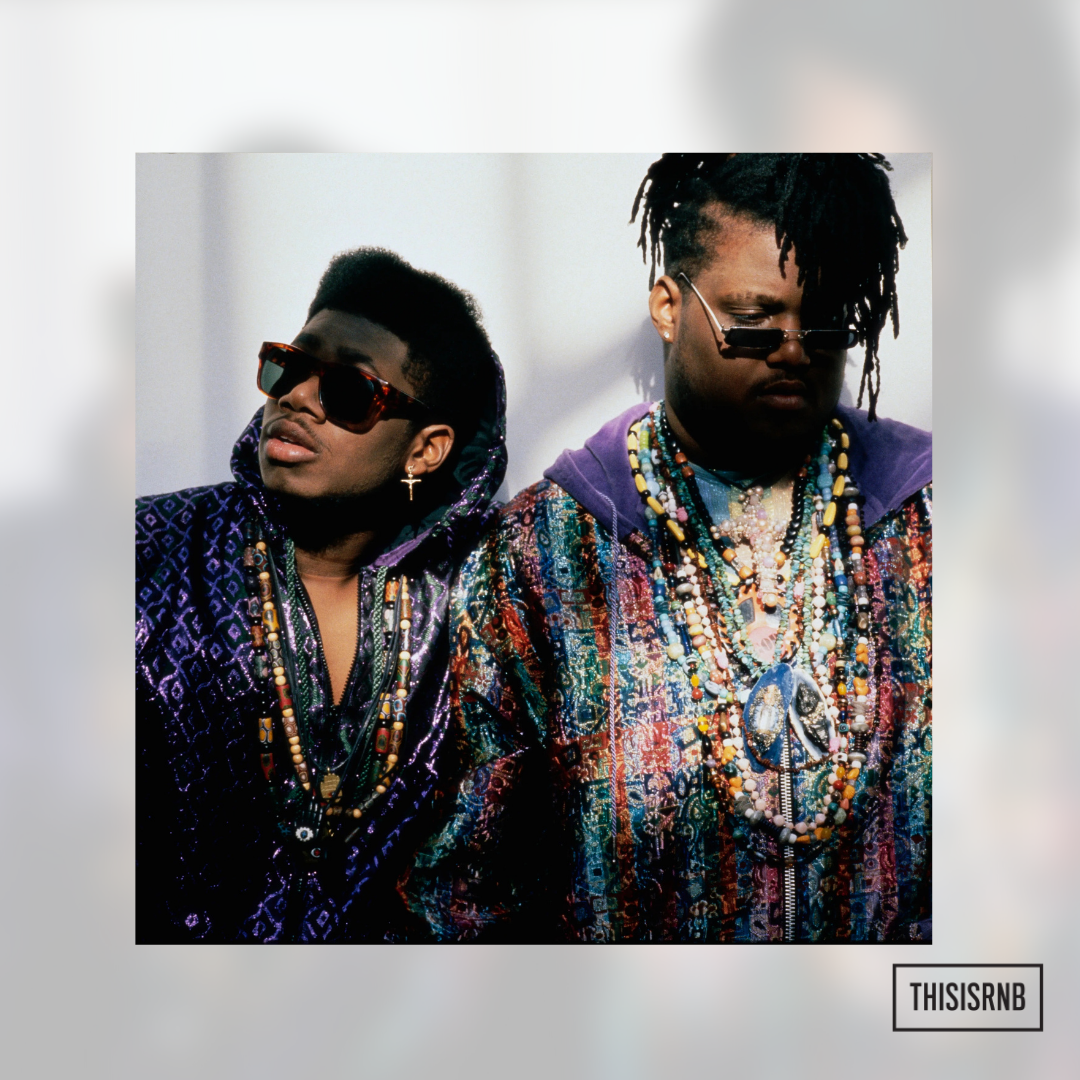

Exclusive Interview ThisIsRnBxEternal of PM Dawn

Remembering P.M. Dawn Photo 1

BOMB Magazine P.M. Dawn