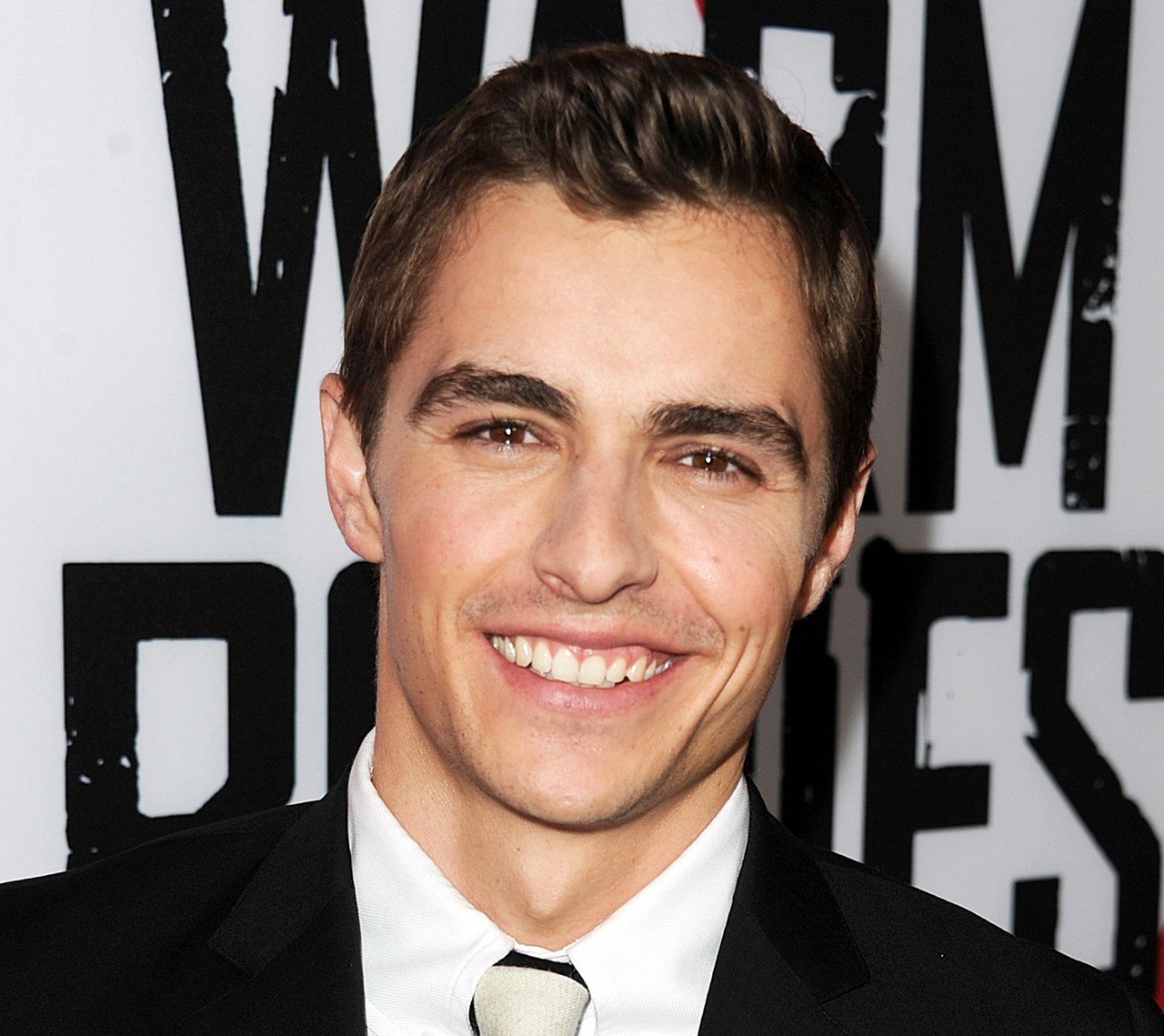

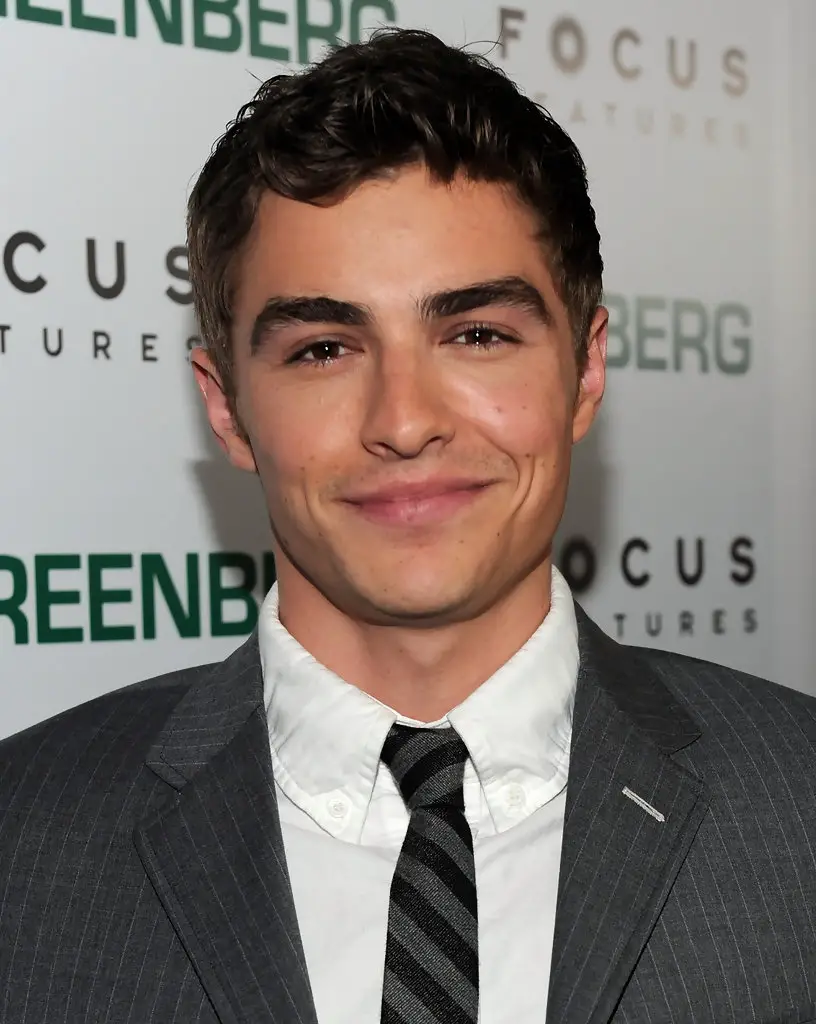

Dave Franco's Impressive Net Worth: How He Amassed His Fortune

Dave Franco's net worth is a quantitative measure of his financial assets. It represents the total value of his possessions, including cash, investments, and property. For instance, if Dave Franco has $10 million in the bank, $5 million in stocks, and a $2 million house, his net worth would be $17 million.

An individual's net worth is a significant indicator of their financial well-being and can provide insights into their spending habits, investment strategies, and overall financial management. It can be used by banks and lenders to determine creditworthiness, by employers to assess financial stability, and by individuals to track their financial progress over time.

The concept of net worth has been used for centuries, with early variations appearing in ancient Greece and Rome. In modern times, it has evolved to become a cornerstone of personal finance and a key metric for financial advisors and wealth managers.

- Brian Easely

- Why Does Tiktok Say No Internet Connection

- Khamzat Shaved

- How Much Do Tommy The Clown Dancers Get Paid

- Khamzat Beard

Dave Franco Net Worth

The various aspects of Dave Franco's net worth provide insights into his financial well-being and overall financial management:

- Assets

- Investments

- Income

- Expenditures

- Debt

- Taxes

- Financial Goals

- Estate Planning

These aspects are interconnected and influence each other. For example, a change in income may lead to changes in expenditures or investments. Similarly, financial goals can drive investment decisions and tax planning strategies. Understanding these relationships is crucial for effectively managing net worth and achieving financial stability.

| Name | Occupation | Net Worth |

|---|---|---|

| Dave Franco | Actor | $12 million |

Assets

Assets are a crucial component of Dave Franco's net worth, representing the value of what he owns. They can be categorized into various types, including:

- Osama Brothers

- Marine Brian Brown Easley

- You Like My Voice It Turn You On Lyrics

- Taylor Crying On Ellen

- Hobby Lobby Wood Arch Backdrop

- Cash and cash equivalents: This includes physical cash, money in checking and savings accounts, and short-term investments that can be easily converted into cash, such as money market accounts and certificates of deposit.

- Investments: These are assets that are expected to generate income or appreciate in value over time, such as stocks, bonds, mutual funds, and real estate.

- Physical assets: These are tangible assets, such as Dave Franco's house, cars, and jewelry.

- Intellectual property: This includes patents, trademarks, copyrights, and other forms of intangible assets that have commercial value.

The composition and value of Dave Franco's assets provide insights into his financial strategy, risk tolerance, and investment preferences. They also play a key role in determining his borrowing capacity, as lenders consider assets when assessing an individual's ability to repay loans.

Investments

Investments play a crucial role in building and preserving Dave Franco's net worth. They represent a portion of his assets that are expected to generate income or appreciate in value over time, providing potential returns on his capital.

- Stocks: Stocks represent ownership shares in publicly traded companies. They offer the potential for capital appreciation and dividend income, but also carry varying levels of risk.

- Bonds: Bonds are fixed-income securities that pay regular interest payments and return the principal amount at maturity. They generally offer lower returns than stocks, but are considered less risky.

- Real estate: Real estate investments can include residential and commercial properties, land, and rental units. They can provide rental income, potential capital appreciation, and tax benefits.

- Private equity and venture capital: These investments involve investing in privately held companies, often at earlier stages of their development. They offer the potential for high returns, but also carry higher risks.

The composition and performance of Dave Franco's investment portfolio provide insights into his risk tolerance, investment goals, and overall financial strategy. Diversifying his investments across different asset classes helps mitigate risk and potentially enhance returns. By actively managing his investments, Dave Franco can aim to preserve and grow his net worth over the long term.

Income

Income is a critical component of Dave Franco's net worth. It represents the money he earns from various sources, such as acting, endorsements, and investments. Income plays a direct role in determining his net worth, as it increases the value of his assets and reduces his liabilities. A steady and growing income allows Dave Franco to invest, save, and build his wealth over time.

One of the most significant sources of income for Dave Franco is his acting career. His roles in movies and television shows have earned him substantial compensation. For example, his portrayal of Cole Aaronson in the "Neighbors" film series reportedly earned him $8 million. Additionally, Dave Franco has endorsement deals with brands such as Gucci and Montblanc, which further contribute to his income.

Understanding the relationship between income and net worth is crucial for financial planning and wealth management. By maximizing his income through various sources, Dave Franco can increase his net worth and achieve his financial goals. Furthermore, managing his income wisely, including saving, investing, and minimizing expenses, allows him to preserve and grow his wealth over the long term.

Expenditures

Expenditures, also known as expenses, play a critical role in determining Dave Franco's net worth. They represent the money he spends on various goods and services, including living expenses, entertainment, and investments. Understanding the relationship between expenditures and net worth is essential for effective financial management and wealth preservation.

High expenditures can reduce Dave Franco's net worth, while minimizing unnecessary expenses can help him accumulate wealth over time. For example, if Dave Franco spends excessively on luxury items or impulse purchases, his net worth may decrease. Conversely, by practicing mindful spending habits, such as budgeting, negotiating expenses, and seeking discounts, he can save more money and increase his net worth.

The practical application of this understanding allows Dave Franco to make informed financial decisions and prioritize his spending. By tracking his expenditures and identifying areas where he can reduce expenses without compromising his lifestyle, he can optimize his financial resources and achieve his financial goals more efficiently. Furthermore, understanding the impact of expenditures on net worth empowers Dave Franco to make strategic investment decisions that align with his financial objectives.

Debt

Debt represents borrowed funds that must be repaid with interest, potentially impacting Dave Franco's net worth. Understanding the types and implications of debt is crucial for effective financial management and wealth preservation.

- Outstanding Loans: Personal loans, mortgages, and auto loans create debt obligations that reduce Dave Franco's net worth until they are fully repaid.

- Credit Card Balances: Accumulated unpaid credit card balances accrue interest and can significantly decrease Dave Franco's net worth if not managed responsibly.

- Investment Debt: Loans taken to finance investments, such as margin loans, can amplify both potential gains and losses, impacting Dave Franco's net worth.

- Tax Debt: Owed taxes, if not paid promptly, can result in penalties and interest charges, reducing Dave Franco's net worth.

Managing debt effectively is essential for Dave Franco's financial well-being. By prioritizing high-interest debts, negotiating favorable repayment terms, and avoiding excessive borrowing, he can minimize the impact of debt on his net worth and maintain his financial stability.

Taxes

Taxes are a critical component of Dave Franco's net worth, representing a significant financial obligation that can impact his overall wealth. Taxes are levied on various sources of income and assets, including personal income, investments, and property. Understanding the relationship between taxes and Dave Franco's net worth is crucial for effective financial planning and wealth management.

The amount of taxes Dave Franco pays directly affects his net worth. Higher tax liabilities reduce his disposable income and available capital for investments and savings. Conversely, tax deductions and exemptions can help minimize his tax burden, allowing him to retain more of his earnings and increase his net worth over time.

One practical application of understanding the connection between taxes and net worth is optimizing tax strategies. By utilizing tax-advantaged accounts, such as 401(k)s and IRAs, Dave Franco can reduce his current tax liability while saving for the future. Additionally, exploring tax credits and deductions related to charitable contributions, mortgage interest, and state and local taxes can further lower his tax bill and increase his net worth.

In summary, taxes are a significant factor that can impact Dave Franco's net worth. By understanding the relationship between the two, he can implement strategies to minimize his tax liability and maximize his wealth accumulation. Effective tax planning and management are essential components of any comprehensive financial plan.

Financial Goals

Financial goals play a significant role in managing and increasing Dave Franco's net worth. They provide a roadmap for his financial journey, guiding his financial decisions and shaping his investment strategies. Understanding the various facets of financial goals is crucial for effective wealth management and achieving long-term financial success.

- Retirement Planning: Dave Franco must plan for his retirement to ensure financial security in his later years. This involves setting aside a portion of his current income and investing it wisely to generate passive income and cover expenses during retirement.

- Wealth Accumulation: Growing his net worth is a key financial goal for Dave Franco. By investing his earnings and making sound financial decisions, he can increase the value of his assets and accumulate wealth over time.

- Financial Independence: Dave Franco may strive for financial independence, where his passive income covers his living expenses, allowing him to pursue his passions without relying on traditional employment.

- Legacy Planning: Preserving and passing on his wealth to future generations may be a financial goal for Dave Franco. This involves estate planning and charitable giving to ensure his assets are distributed according to his wishes.

These financial goals are interconnected and influence Dave Franco's overall financial strategy. By setting clear and achievable financial goals, he can make informed decisions about his income, investments, and spending habits, ultimately maximizing his net worth and securing his financial future.

Estate Planning

Estate planning is a crucial aspect of managing Dave Franco's net worth, ensuring that his assets are distributed according to his wishes after his passing. It involves various legal and financial strategies to preserve and transfer wealth while minimizing taxes and legal complications.

- Will: A legal document that outlines the distribution of Dave Franco's assets, including property, investments, and personal belongings, after his death.

- Trusts: Legal entities that hold and manage assets, providing flexibility in managing and distributing wealth, reducing taxes, and protecting assets from creditors.

- Tax Planning: Strategies to minimize estate taxes and maximize the value of Dave Franco's net worth that is passed on to beneficiaries.

- Charitable Giving: Planned donations to charitable organizations, allowing Dave Franco to support causes he cares about while potentially reducing estate taxes.

Estate planning allows Dave Franco to control the distribution of his wealth, provide for his loved ones, minimize the impact of taxes, and ensure his legacy is preserved according to his wishes. By implementing a comprehensive estate plan, he can protect and manage his net worth effectively, ensuring its preservation and distribution in a manner that aligns with his values and financial goals.

In conclusion, Dave Franco's net worth is a reflection of his successful career in the entertainment industry and his prudent financial management. Key to understanding his net worth is recognizing the interplay between his assets, investments, income, expenditures, debt, taxes, financial goals, and estate planning. By carefully managing each of these aspects, Dave Franco has built and preserved his wealth.

The various facets of Dave Franco's net worth provide valuable lessons for individuals aiming to achieve financial success. Understanding the relationship between income, expenses, and investments is crucial for wealth accumulation. Additionally, the importance of tax planning and estate planning cannot be overstated in preserving and distributing wealth effectively. Dave Franco's financial journey serves as a reminder that financial well-being is a product of careful planning, strategic decision-making, and a commitment to long-term financial goals.

- Florida Baseball Coach Scandal

- Why Does Tiktok Say No Internet Connection

- Skipthe Games El Paso

- Breckie Hill Shower Leaked

- How Much Does Tommy The Clown Charge

Dave Franco Net Worth Celebrity Net Worth

Dave Franco Net Worth Net Worth Lists

Dave Franco Net Worth Celebrity Sizes