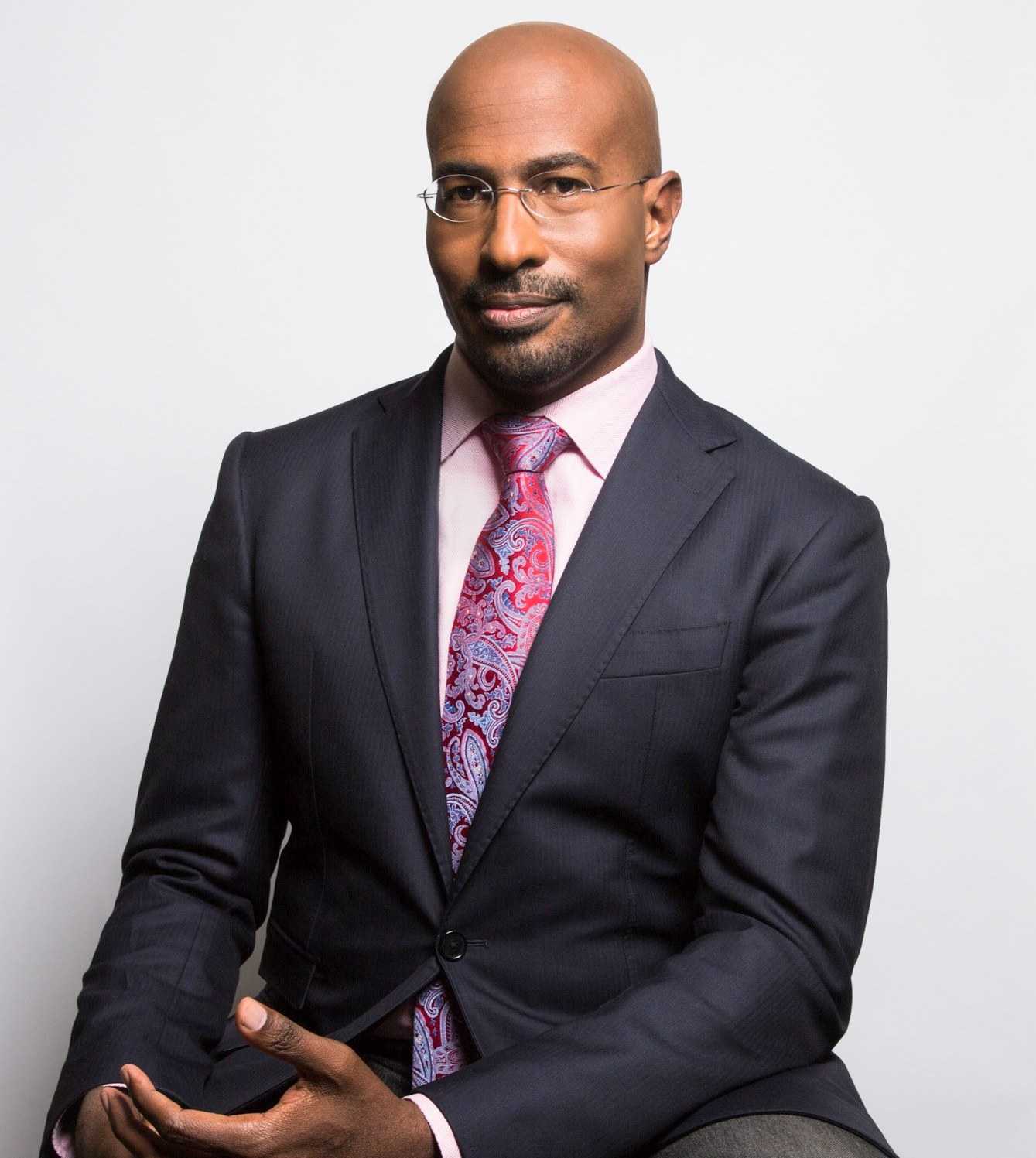

Unveiling Van Jones' Net Worth: Income, Investments, And Philanthropy

Van Jones' net worth refers to the estimated total value of his financial assets and liabilities, including his income, investments, and property. It is a financial metric that represents an individual's overall financial health.

Understanding the net worth of prominent figures like Van Jones is relevant because it provides insights into their financial success and investment strategies. It can also indicate their influence in the business and social sectors.

Historically, the concept of net worth has evolved. Initially used only by wealthy individuals, it is now a common metric for people of all financial backgrounds. This shift highlights the increasing importance of financial literacy and personal finance management.

- Breckie Hill Shower Leak Video

- Bryan Easley

- Hobby Lobby Wood Arch Backdrop

- When Does Peysoh Get Out Of Jail

- Is Dd And Notti Brothers

Van Jones Net Worth

Understanding the key aspects of Van Jones' net worth provides insights into his financial success and investment strategies. These aspects encompass various dimensions, including his income, assets, liabilities, and overall financial health.

- Income: Earnings from various sources, such as his career as a commentator and author.

- Investments: Stocks, bonds, and other financial instruments.

- Assets: Property, vehicles, and other valuable possessions.

- Liabilities: Debts, loans, and other financial obligations.

- Cash and Equivalents: Liquid assets that can be easily converted into cash.

- Net Worth: Total value of assets minus liabilities, representing his overall financial wealth.

- Investment Strategy: Approach and decisions regarding the allocation of financial resources.

- Financial Planning: Goals and strategies for managing and growing his wealth.

- Philanthropy: Involvement in charitable giving and social impact initiatives.

- Business Ventures: Entrepreneurship and investments in various business endeavors.

These aspects are interconnected and evolve over time, influenced by Jones' career trajectory, investment decisions, and personal circumstances. By analyzing these aspects, we gain a comprehensive understanding of his financial standing and how he manages his wealth.

| Full Name | Date of Birth | Place of Birth | Occupation |

|---|---|---|---|

| Anthony Van Jones | September 20, 1968 | Jackson, Tennessee, U.S. | Commentator, Author, Activist |

Income

Income serves as a crucial component of Van Jones' net worth. His earnings from diverse sources, including his roles as a commentator and author, have significantly contributed to his overall financial standing. The success of his books, such as "The Green Collar Economy" and "Beyond the Messy Truth," has generated substantial revenue for him.

- Teacher Crying At Wedding

- Brekie Hill Shower Leaks

- Skipthe Games El Paso

- Khamzat Chimaev Bald

- You Like My Voice It Turn You On Lyrics

As a commentator, Jones' regular appearances on news and talk shows, where he offers expert analysis on current events and social issues, have further boosted his income. His ability to articulate complex topics in an engaging manner has made him a sought-after voice in the media industry.

Understanding the relationship between Jones' income and net worth highlights the importance of establishing multiple streams of revenue. By leveraging his expertise and personal brand, he has created a diversified income portfolio that contributes to his overall financial growth.

Investments

Investments form a critical component of Van Jones' net worth, representing his portfolio of financial assets that generate passive income and contribute to his overall wealth growth. These investments encompass various instruments, each with its own risk-return profile.

- Stocks: Equities representing ownership in publicly traded companies. They offer the potential for capital appreciation and dividends, but also carry market risk.

- Bonds: Debt instruments issued by governments and corporations, offering fixed income payments over a specified period. They typically provide lower returns than stocks but are considered less risky.

- Mutual Funds: Professionally managed investment funds that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. They offer diversification and reduced risk.

- Real Estate: Physical property, such as land, buildings, or rental properties, that can generate rental income or appreciate in value over time. It requires significant capital and ongoing maintenance costs.

By carefully allocating his investments across these asset classes, Jones manages his risk and optimizes his returns. The performance of his investments directly impacts his net worth and contributes to his financial stability and long-term wealth accumulation.

Assets

Assets form a critical component of Van Jones' net worth, representing his ownership of valuable items that contribute to his overall financial health. These assets include property, vehicles, and other tangible possessions that hold monetary value and can be converted into cash if necessary.

The connection between assets and net worth is straightforward: the value of Jones' assets directly impacts his net worth. For example, if he owns a house worth $500,000 and a car worth $50,000, these assets contribute a total of $550,000 to his net worth. As his assets appreciate in value or he acquires new ones, his net worth increases.

Understanding the relationship between assets and net worth is crucial for managing wealth effectively. By investing in appreciating assets, such as real estate or classic cars, Jones can grow his net worth over the long term. Additionally, maintaining a diversified portfolio of assets helps mitigate risk and protect against financial downturns.

In conclusion, assets play a vital role in determining Van Jones' net worth. By strategically acquiring and managing his assets, he can build and preserve his wealth, ensuring his financial stability and long-term success.

Liabilities

Liabilities represent a crucial component influencing Van Jones' net worth. As debts and financial obligations, they directly impact his overall financial standing and the calculation of his net worth. Understanding this connection is essential for assessing his financial health and long-term success.

Liabilities reduce an individual's net worth because they represent amounts owed to external parties. For instance, if Jones has a mortgage of $200,000 on his house, this liability reduces his net worth by $200,000. Similarly, outstanding loans, such as auto loans or credit card balances, further decrease his net worth.

Managing liabilities effectively is critical for financial stability. By prioritizing high-interest debts and creating a plan to pay them off, Jones can reduce the impact of liabilities on his net worth. Additionally, limiting new debt and exploring debt consolidation options can help him improve his overall financial position.

In conclusion, understanding the relationship between liabilities and net worth is essential for effective financial management. By carefully managing his liabilities, Jones can optimize his financial health, increase his net worth, and achieve long-term financial success.

Cash and Equivalents

In the context of Van Jones' net worth, cash and equivalents play a crucial role in determining his overall financial health. These highly liquid assets provide him with immediate access to funds, offering flexibility and security in managing his finances.

Cash and equivalents encompass various forms, including physical cash, demand deposits, money market accounts, and short-term government securities. Their primary characteristic is their immediate convertibility into cash, allowing Jones to meet short-term financial obligations, seize investment opportunities, or cover unexpected expenses without incurring penalties or delays.

Understanding the relationship between cash and equivalents and net worth is essential for effective financial planning. A healthy balance of these liquid assets ensures that Jones can maintain financial stability, avoid unnecessary debt, and capitalize on opportunities that may arise.

In conclusion, cash and equivalents form a critical component of Van Jones' net worth, providing him with liquidity, flexibility, and financial security. By carefully managing his cash and equivalent assets, Jones can optimize his financial health and achieve long-term financial success.

Net Worth

Within the context of "van jones net worth," understanding net worth is crucial. Net worth, calculated as the total value of assets minus liabilities, provides a comprehensive measure of an individual's financial well-being.

- Assets: These encompass all valuable possessions, such as real estate, investments, and cash, which contribute positively to net worth.

- Liabilities: Liabilities represent financial obligations, including debts and loans, which reduce an individual's net worth.

- Income: Income streams, such as earnings from employment or investments, impact net worth by increasing assets.

- Expenses: Expenses, such as living costs or loan repayments, decrease net worth by reducing assets or increasing liabilities.

By considering these factors together, net worth offers a holistic view of Van Jones' financial status. It provides insights into his financial stability, ability to generate income, and capacity to meet financial obligations. Understanding net worth is essential for informed decision-making, wealth management, and long-term financial planning.

Investment Strategy

In examining "van jones net worth," understanding his investment strategy is crucial. It encompasses the approaches and decisions he makes in allocating financial resources, directly influencing his overall wealth.

- Asset Allocation: Distributing investments across different asset classes, such as stocks, bonds, real estate, and commodities, to balance risk and return.

- Diversification: Spreading investments across various industries, sectors, and geographic regions to minimize risk and enhance returns.

- Risk Management: Implementing strategies to mitigate investment risks, such as hedging, stop-loss orders, and regular portfolio reviews.

- Investment Goals: Aligning investment decisions with specific financial objectives, such as retirement planning, wealth preservation, or generating passive income.

Van Jones' investment strategy is a combination of these facets, tailored to his unique risk tolerance, financial goals, and time horizon. By carefully allocating his resources and managing risk, he aims to grow his wealth and achieve long-term financial security.

Financial Planning

Within the context of "van jones net worth," financial planning plays a pivotal role in shaping his overall financial well-being. It encompasses a comprehensive set of goals, strategies, and tactics that guide the management and growth of his wealth.

Effective financial planning involves setting clear financial objectives, whether it's accumulating wealth for retirement, funding a child's education, or preserving assets for future generations. These objectives drive investment decisions, savings plans, and risk management strategies, ensuring that Jones' financial resources are aligned with his long-term goals.

A well-defined financial plan provides a roadmap for wealth creation and management, helping Jones prioritize investments, optimize tax strategies, and mitigate financial risks. It also serves as a benchmark against which he can track his progress and make necessary adjustments along the way. By proactively managing his finances, Jones can make informed decisions that contribute to the growth of his net worth and overall financial security.

Philanthropy

Within the context of "van jones net worth," philanthropy plays a significant role in understanding his values, social impact, and overall financial well-being. His involvement in charitable giving and social impact initiatives extends beyond financial contributions, encompassing a commitment to causes that align with his beliefs and passions.

- Charitable Donations: Jones has consistently donated a portion of his wealth to various charitable organizations, supporting causes such as education, environmental protection, and social justice.

- Non-profit Involvement: He is actively involved in several non-profit organizations, serving on boards and lending his expertise to initiatives that promote social change and economic empowerment.

- Impact Investing: Jones believes in the power of investing for social good. He has invested in companies and funds that prioritize sustainable practices, community development, and positive social outcomes.

- Social Advocacy: Beyond financial contributions, Jones uses his platform to raise awareness about important social issues, advocate for policy changes, and inspire others to engage in philanthropy.

Philanthropy is an integral part of Van Jones' financial landscape. It reflects his commitment to making a positive impact on society, leveraging his wealth to support causes he cares about, and inspiring others to do the same. By understanding this aspect of his net worth, we gain a more comprehensive view of his values, priorities, and overall financial philosophy.

Business Ventures

The business ventures and investments undertaken by Van Jones have a significant impact on his overall net worth. Entrepreneurship and strategic investments enable him to diversify his income streams, generate passive income, and potentially increase his wealth over time.

Van Jones's involvement in various business endeavors includes founding and investing in companies that align with his interests and values. For instance, his investment in the renewable energy sector through his company, Magic Johnson Enterprises, demonstrates his commitment to sustainability and environmental responsibility. Additionally, his involvement in tech startups and venture capital funds showcases his vision for innovation and industry disruption.

Understanding the connection between Van Jones's business ventures and his net worth is crucial for assessing his financial health and overall investment strategy. By diversifying his portfolio and engaging in ventures that have the potential for growth, he can mitigate risks and maximize returns, ultimately contributing to the growth of his net worth.

In conclusion, the exploration of "van jones net worth" unveils the multifaceted nature of financial well-being. This article highlights key aspects that contribute to Jones's financial success, including his diverse income streams, strategic investments, and philanthropic endeavors. By analyzing his assets, liabilities, and overall financial planning, we gain insights into how he manages and grows his wealth.

As we reflect on the interconnections of these components, several main points emerge. Firstly, Jones's ability to generate income from various sources, such as his career as a commentator and author, provides a solid foundation for his net worth. Secondly, his prudent investment strategy, encompassing asset allocation and risk management, allows him to grow his wealth effectively. Thirdly, his commitment to philanthropy and social impact initiatives demonstrates a holistic approach to financial well-being, extending beyond personal gain.

- Why Does Tiktok Say No Internet Connection

- Breckie Hill Showers

- Is Peysoh In Jail

- Nomi Mac Miller

- Breckie Hill Shower Video Leak

Van Jones

Van Jones Net Worth After Receiving 100 million From Jeff Bezos ABTC

Van Jones Net Worth 5 Interesting Facts You Should Know