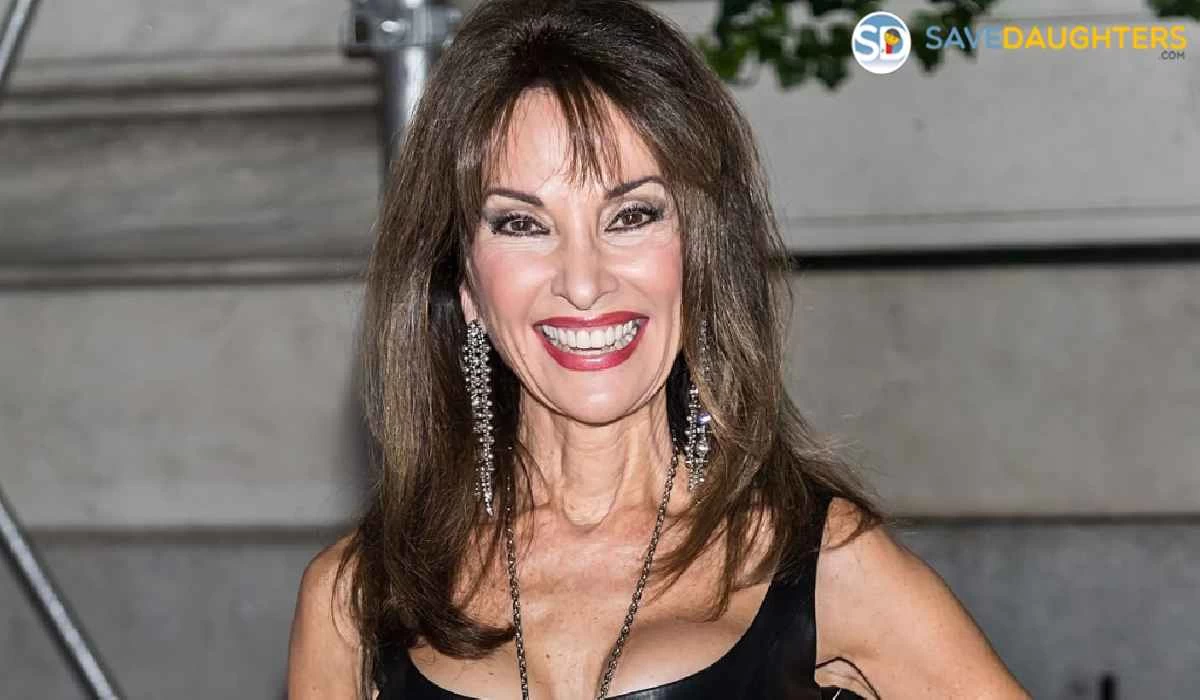

Unveiling Susan Lucci's Net Worth: A Comprehensive Guide

The susan lucci net worth, referring to the financial assets and wealth of the actress Susan Lucci, is a commonly searched term. For instance, as of 2023, her net worth is estimated to be around $80 million.

Understanding an individual's net worth provides insights into their financial status, investment strategies, and overall wealth management. It plays a significant role in assessing an individual's financial health and success.

The concept of net worth has been used throughout history, with early developments tracing back to ancient Greece, where individuals' wealth was measured in terms of land, livestock, and other assets.

- No Internet Connection Tiktok

- Khamzat Shaved

- Brekie Hill Shower Leaks

- What Is Dd Osama Real Name

- Breckie Hill Shower Leak Video

Susan Lucci Net Worth

The multifaceted nature of "Susan Lucci net worth" encompasses a wide range of essential aspects that provide a comprehensive understanding of her financial status and wealth management strategies.

- Total Assets

- Liquid Assets

- Property Portfolio

- Investment Portfolio

- Income Streams

- Endorsements

- Philanthropy

- Tax Implications

- Financial Advisors

- Estate Planning

Examining these aspects reveals the complexities of managing substantial wealth, including asset allocation, investment strategies, tax optimization, and legacy planning. Susan Lucci's financial journey serves as a prime example of how wealth can be accumulated, preserved, and utilized for personal and social impact.

| Born | December 23, 1946 |

|---|---|

| Birthplace | Pelham, New York, U.S. |

| Occupation | Actress, author, entrepreneur |

| Net Worth | $80 million (estimated) |

Total Assets

Total assets form the foundation of Susan Lucci's net worth, representing the combined value of everything she owns. These assets encompass a diverse range of tangible and intangible resources, contributing significantly to her overall financial standing.

- Brekie Hill Shower Video

- Jenna Ortega Net Worth

- Breckue Hill Shower Vid

- Taylor Crying On Ellen

- Breckie Hill Showers

- Cash and Cash Equivalents

This includes cash on hand, demand deposits, and other liquid assets that can be easily converted into cash. These provide immediate access to funds for short-term needs and financial emergencies.

- Investments

Lucci's investment portfolio likely includes stocks, bonds, mutual funds, and real estate. These investments generate income through dividends, interest, and capital appreciation, increasing her overall net worth.

- Property

Her real estate portfolio may include her primary residence, vacation homes, and rental properties. These assets provide potential rental income, tax benefits, and long-term appreciation.

- Intellectual Property

Lucci's creative works, such as books and television shows, may generate royalties and other forms of income. These intangible assets contribute to her net worth and provide ongoing financial benefits.

The total value of Susan Lucci's assets provides a snapshot of her financial strength and diversification. Understanding the composition and performance of these assets offers insights into her investment strategies and overall wealth management approach.

Liquid Assets

Liquid assets are a crucial component of Susan Lucci's net worth, providing her with immediate access to funds for various financial needs. These assets include cash, cash equivalents, and other investments that can be quickly converted into cash without significant loss of value.

Maintaining a healthy level of liquid assets is essential for financial stability and flexibility. It allows Lucci to cover unexpected expenses, seize investment opportunities, and manage cash flow effectively. Liquid assets also serve as a buffer against financial emergencies and market fluctuations, ensuring that she can meet her financial obligations and maintain her desired lifestyle.

Examples of liquid assets within Susan Lucci's net worth may include high-yield savings accounts, money market accounts, short-term certificates of deposit, and certain types of mutual funds. These investments provide a balance between liquidity and potential returns, allowing her to access funds while still earning interest or dividends.

Understanding the importance of liquid assets in Susan Lucci's net worth highlights the significance of financial planning and risk management. By maintaining a diversified portfolio that includes liquid assets, she can navigate financial challenges, pursue growth opportunities, and preserve her wealth over the long term.

Property Portfolio

Susan Lucci's property portfolio is an integral component of her net worth, contributing significantly to her overall financial standing. Real estate investments provide a stable foundation for her wealth, offering potential returns through appreciation, rental income, and tax benefits.

Lucci's property portfolio likely includes her primary residence, vacation homes, and rental properties. These assets provide a steady stream of passive income, helping her maintain her desired lifestyle and financial security. Additionally, real estate investments can serve as a hedge against inflation, as property values tend to rise over time.

Understanding the significance of a property portfolio within Susan Lucci's net worth emphasizes the importance of diversification and long-term investment strategies. By investing in a mix of property types and locations, she can mitigate risks and maximize potential returns. Furthermore, real estate investments can provide tax advantages, such as deductions for mortgage interest and property taxes.

In summary, Susan Lucci's property portfolio is a critical component of her net worth, providing financial stability, passive income, and potential for growth. By understanding the interplay between her property investments and overall wealth, we gain insights into the strategies and considerations involved in managing substantial assets.

Investment Portfolio

Susan Lucci's investment portfolio plays a significant role in her overall net worth, offering potential for growth and diversification. It encompasses a range of financial instruments and assets that generate income and appreciate in value over time.

- Stocks

Lucci's portfolio likely includes stocks of various companies, providing exposure to the equity market. Stocks offer the potential for capital appreciation and dividend income, contributing to her net worth's growth.

- Bonds

Bonds are another common component of investment portfolios, offering fixed income and lower risk compared to stocks. Lucci's bond investments generate regular interest payments and provide stability to her overall portfolio.

- Mutual Funds

Mutual funds provide diversification and professional management, allowing Lucci to invest in a basket of stocks or bonds. Through mutual funds, she can access a wider range of investment opportunities and reduce risk.

- Real Estate

In addition to her property portfolio, Lucci may invest in real estate through real estate investment trusts (REITs) or direct ownership of rental properties. These investments offer potential income through rent and long-term appreciation, further diversifying her net worth.

Lucci's investment portfolio is a crucial part of her financial strategy, enabling her to grow her wealth and achieve long-term financial goals. By understanding the components and implications of her investment portfolio, we gain insights into the complexities of managing substantial net worth and the considerations involved in financial planning for high-net-worth individuals.

Income Streams

Income streams are the lifeblood of Susan Lucci's net worth, providing a steady flow of cash that contributes significantly to her overall financial well-being. Income streams can take various forms, including salaries, dividends, interest payments, and royalties, among others.

For individuals with a high net worth like Susan Lucci, diversifying income streams is essential to maintaining financial stability and mitigating risks. Lucci's income streams likely span multiple sources, such as her acting work, investments, business ventures, and endorsements. By having multiple sources of income, she reduces her reliance on any single revenue stream, ensuring a consistent flow of funds.

Understanding the connection between income streams and Susan Lucci's net worth highlights the importance of financial planning and risk management. By securing multiple sources of income, she can navigate financial challenges, pursue growth opportunities, and preserve her wealth over the long term. This approach provides a solid foundation for her financial future and allows her to maintain her desired lifestyle.

Endorsements

Endorsements play a significant role in shaping and enhancing Susan Lucci's net worth. Endorsements involve agreements between Lucci and various companies or brands, where she promotes their products or services in exchange for compensation. These partnerships leverage her fame, credibility, and reach to drive sales and brand awareness for the endorsing companies, while simultaneously contributing to Lucci's overall financial standing.

Endorsements serve as a critical component of Susan Lucci's net worth due to their lucrative nature. Companies are willing to pay substantial sums to secure her endorsement, recognizing the value she brings in terms of increased visibility and consumer trust. These endorsements can range from traditional advertising campaigns to social media collaborations, each contributing to her income streams and overall net worth.

One notable example of an endorsement within Susan Lucci's net worth is her partnership with the skincare brand Olay. Lucci has been the face of Olay for several years, appearing in numerous commercials and promotional campaigns for their products. This long-standing relationship has not only boosted Olay's sales but has also significantly contributed to Lucci's income and net worth.

Understanding the connection between endorsements and Susan Lucci's net worth highlights the importance of leveraging personal branding and influence to generate additional revenue streams. By carefully selecting endorsement opportunities that align with her values and audience, Lucci has been able to monetize her fame and establish a solid financial foundation.

Philanthropy

Philanthropy, the act of giving back to society, is an integral aspect of Susan Lucci's net worth, reflecting her commitment to making a positive impact beyond financial wealth.

- Charitable Donations

Lucci has generously donated to various charitable organizations throughout her career, supporting causes such as cancer research, animal welfare, and education. These donations not only make a direct impact on the organizations but also enhance her reputation as a socially responsible individual.

- Non-Profit Involvement

Lucci actively supports several non-profit organizations, serving on boards, attending fundraising events, and using her platform to raise awareness for their missions. By leveraging her influence, she amplifies the reach and impact of these organizations.

- Cause-Related Partnerships

Lucci has partnered with businesses and brands to promote and support charitable causes. These collaborations often involve donating a portion of sales or using her endorsement power to raise funds and awareness for specific initiatives.

- Personal Volunteering

Beyond financial contributions, Lucci dedicates her time to volunteering and hands-on involvement with charitable organizations. Her personal commitment demonstrates her genuine passion for giving back and making a tangible difference.

Susan Lucci's philanthropic efforts not only reflect her personal values but also contribute to her overall net worth by enhancing her reputation, strengthening her community ties, and creating a positive legacy that extends beyond monetary wealth.

Tax Implications

Tax implications play a crucial role in shaping Susan Lucci's net worth, as they significantly impact the management and distribution of her wealth. Understanding these implications is essential for comprehensive financial planning and wealth preservation.

Susan Lucci's income and assets are subject to various taxes, including income tax, capital gains tax, and property tax. The tax rates and regulations applicable to her financial transactions have a direct impact on her net worth. For instance, higher tax rates on investment income can reduce her overall returns and affect her ability to accumulate wealth.

To mitigate tax implications, Lucci likely employs tax planning strategies such as utilizing tax-advantaged accounts, maximizing deductions, and optimizing her investment portfolio. Effective tax planning enables her to minimize her tax liability and preserve a larger portion of her net worth. Additionally, Lucci's charitable donations may provide tax benefits, further reducing her tax burden and contributing to her philanthropic goals.

In summary, tax implications are an integral component of Susan Lucci's net worth, influencing her financial decisions and overall wealth management strategy. Understanding the interplay between tax laws and her financial situation is crucial for maintaining and growing her net worth over the long term.

Financial Advisors

Financial advisors serve as pivotal figures in the management and growth of Susan Lucci's net worth. They provide professional guidance, expert advice, and comprehensive wealth management services that contribute significantly to her financial well-being.

The relationship between financial advisors and Susan Lucci's net worth is multifaceted. Financial advisors help her navigate complex financial decisions, optimize her investment portfolio, minimize tax implications, and plan for her financial future. Their expertise enables Lucci to make informed choices that align with her financial goals and risk tolerance.

For instance, Lucci's financial advisors may recommend specific investment strategies that align with her long-term financial objectives. They conduct thorough research and analysis to identify potential investment opportunities that balance risk and reward, contributing to the growth of her net worth. Additionally, they provide tax planning advice to minimize her tax liability and maximize her after-tax returns.

In summary, financial advisors play a crucial role in Susan Lucci's net worth by providing professional guidance, expert advice, and comprehensive wealth management services. Their expertise enables her to make informed financial decisions, optimize her investment portfolio, minimize tax implications, and plan for her financial future. Understanding the connection between financial advisors and Susan Lucci's net worth highlights the importance of seeking professional financial advice to achieve financial success and preserve wealth over the long term.

Estate Planning

Estate planning is a crucial aspect of managing Susan Lucci's net worth, ensuring that her assets and wealth are distributed according to her wishes after her passing. It involves a comprehensive strategy that encompasses various legal and financial tools to preserve and transfer wealth while minimizing tax implications.

- Will

A will is a legal document that outlines the distribution of assets and appoints an executor to carry out the instructions. Susan Lucci's will likely specifies the beneficiaries of her estate, including family members, charities, and other individuals or organizations.

- Trusts

Trusts are legal entities that hold and manage assets for the benefit of designated individuals or purposes. Lucci may utilize trusts to reduce estate taxes, provide for specific beneficiaries, or manage assets for future generations.

- Power of Attorney

A power of attorney grants legal authority to another individual to make financial and legal decisions on behalf of Susan Lucci. This can be crucial in the event of her incapacity or absence.

- Beneficiary Designations

Beneficiary designations allow Susan Lucci to specify who will receive certain assets, such as life insurance policies or retirement accounts, upon her death. These designations override the distribution outlined in her will.

Estate planning is essential for Susan Lucci to maintain control over the distribution of her wealth, minimize taxes, and ensure that her wishes are respected. Through careful planning, she can protect her legacy and provide for her loved ones and charitable causes that are important to her.

In examining Susan Lucci's net worth, we gained insights into the intricacies of managing substantial wealth. A key takeaway is the importance of diversification across various asset classes, including real estate, investments, and liquid assets. This strategy helps mitigate risks and enhances the potential for long-term growth.

Another notable aspect is the role of professional advisors in wealth management. Susan Lucci's financial advisors provide expert guidance on investment strategies, tax planning, and estate planning, ensuring that her financial decisions are aligned with her goals and objectives.

Ultimately, Susan Lucci's net worth serves as a reminder of the significance of financial planning and prudent investment decisions. By understanding the complexities of wealth management, we can make informed choices that contribute to our financial well-being and secure our financial future.

- Taylor Swift Cry

- Is Dd And Notti Brothers

- Breckie Hill Shower Video Leak

- Peysoh Jail

- Breckie Hill Showers

Susan Lucci Net Worth 2024 From Erica Kane To Empire

What is Susan Lucci's net worth? The US Sun

Susan Lucci Net Worth, Height, Husband, Parents, Wiki