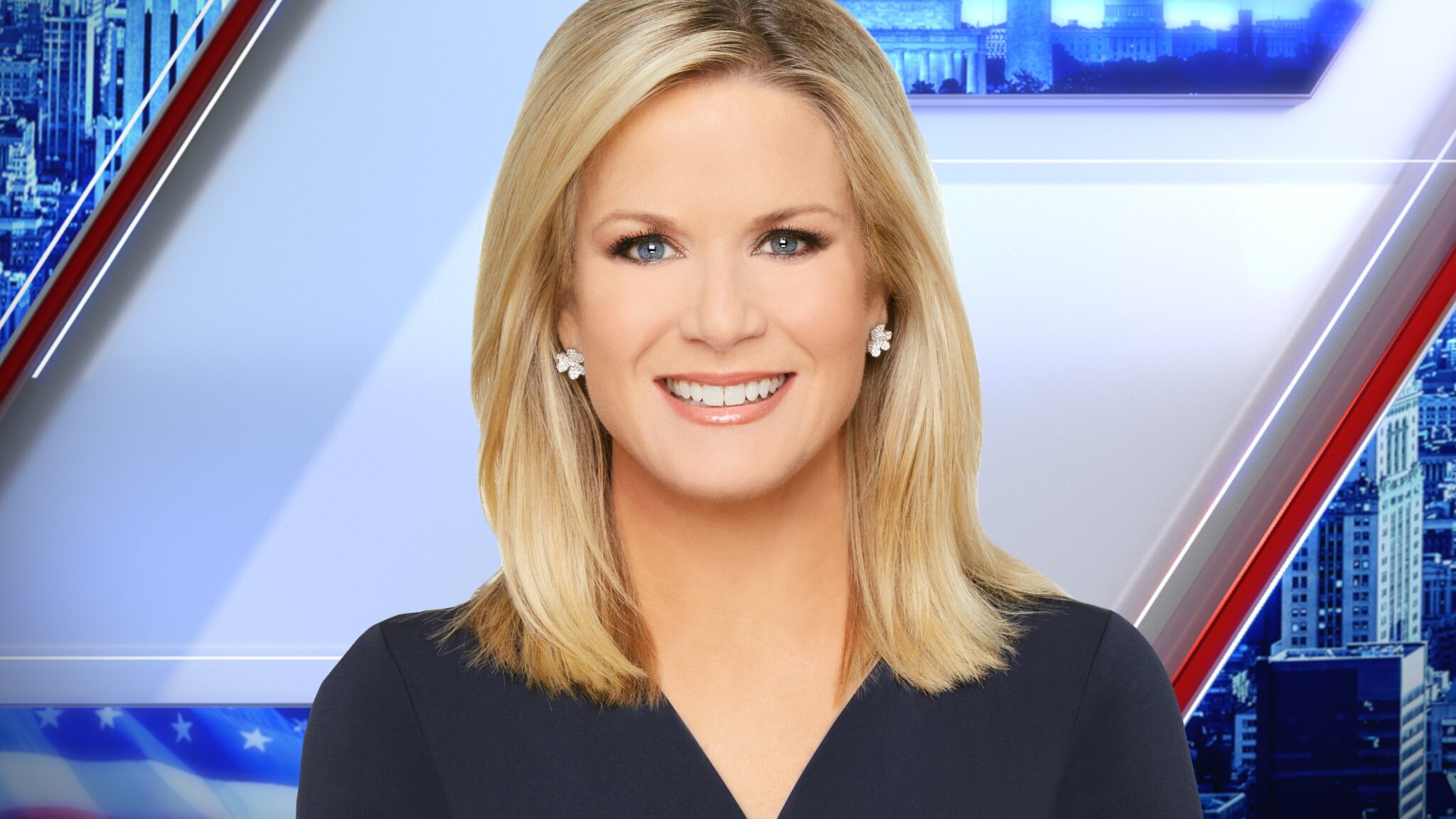

Martha Maccallum Net Worth: A Detailed Breakdown

Martha Maccallum net worth is the total value of Martha Maccallum's assets and income minus her liabilities. For instance, if she has $5 million in assets and $1 million in liabilities, her net worth would be $4 million.

Martha Maccallum net worth is important because it provides an indication of her financial health. It can also be used to compare her wealth to other individuals or to track her progress over time. Historically, the concept of net worth can be traced back to the 14th century, when it was used to assess the financial status of merchants and traders.

This article will delve into Martha Maccallum net worth in greater detail, exploring its various components, how it has changed over time, and what it means for her overall financial situation.

- Bad Bunny Before

- Skipthe Games El Paso

- Influencer Guillermo

- Is Bloom Safe To Drink While Pregnant

- Khamzat Chimaev With No Beard

Martha Maccallum Net Worth

Understanding the various aspects that contribute to Martha Maccallum net worth is crucial for gaining a comprehensive view of her financial situation. These key aspects can be categorized as follows:

- Income

- Assets

- Investments

- Liabilities

- Taxes

- Expenses

- Debt

- Savings

By examining each of these aspects in detail, we can gain a deeper insight into Martha Maccallum's financial health and make informed assessments about her overall wealth.

Income

Income plays a critical role in determining Martha Maccallum net worth. Income refers to the amount of money an individual earns from various sources, such as employment, investments, or business ventures. In Martha Maccallum's case, her primary source of income is her salary as a news anchor and journalist for Fox News.

- Notti Osama Brothers

- Is Ddot And Dd Osama Brothers

- Breckue Hill Shower Vid

- Khamzat Chimaev Without Beard

- When Does Peysoh Get Out Of Jail

The amount of income Martha Maccallum generates directly impacts her net worth. Higher income levels allow her to accumulate more assets, invest in various opportunities, and increase her overall wealth. For instance, if Martha Maccallum receives a substantial salary increase, it would positively affect her net worth by increasing her available funds.

Understanding the relationship between income and net worth is crucial for financial planning and management. Individuals and organizations can use this knowledge to make informed decisions about income allocation, investment strategies, and long-term financial goals. By maximizing income and managing expenses effectively, individuals can work towards increasing their net worth and improving their financial well-being.

Assets

Assets are a crucial component of Martha Maccallum net worth. Assets refer to anything of value that an individual owns or controls, and they can be categorized into various types, such as tangible assets (e.g., real estate, vehicles) and intangible assets (e.g., intellectual property, investments). The total value of an individual's assets contributes directly to their net worth.

Martha Maccallum's net worth is positively impacted by her assets. The more valuable her assets are, the higher her net worth will be. For instance, if Martha Maccallum owns a house worth $1 million and a car worth $50,000, these assets would contribute $1.05 million to her net worth. By acquiring and managing valuable assets, individuals can increase their net worth and improve their overall financial health.

Understanding the connection between assets and net worth is essential for financial planning. By identifying and valuing their assets, individuals can make informed decisions about managing their wealth. Assets can be used as collateral for loans, sold to generate income, or passed on to heirs as part of estate planning. Therefore, it is important to have a clear understanding of the role of assets in personal and organizational finances.

Investments

Investments form a significant aspect of Martha Maccallum net worth, contributing to her overall financial standing. By allocating funds into various investment vehicles, she can potentially increase her wealth over time, generate passive income, and secure her financial future.

- Stocks

Stocks represent ownership shares in publicly traded companies. Martha Maccallum can invest in stocks to gain exposure to the growth potential of these companies and earn dividends from their profits.

- Bonds

Bonds are fixed-income investments that pay regular interest payments. By investing in bonds, Martha Maccallum can earn a steady stream of income and preserve her capital.

- Real Estate

Real estate encompasses land and buildings. Investing in real estate can provide rental income, potential capital appreciation, and diversification benefits for Martha Maccallum's portfolio.

- Alternative Investments

Alternative investments include assets like hedge funds, private equity, and commodities. These investments can provide diversification and potential for higher returns but also carry higher risks.

Martha Maccallum's investment strategy, asset allocation, and risk tolerance play a crucial role in determining the performance of her investments and their impact on her net worth. By carefully managing her investments, she can work towards achieving her financial goals and growing her wealth in the long run.

Liabilities

Martha Maccallum net worth encompasses not only her assets but also her liabilities, which represent her financial obligations. Understanding her liabilities is crucial for assessing her overall financial health and making informed decisions.

- Outstanding Loans

Outstanding loans, such as mortgages or car loans, represent a significant liability for Martha Maccallum. These loans require regular payments and can impact her cash flow and net worth.

- Credit Card Debt

Credit card debt, if not managed responsibly, can accumulate interest charges and damage Martha Maccallum's credit score. High levels of credit card debt can negatively impact her net worth.

- Taxes Payable

Taxes payable, such as income taxes or property taxes, are obligations that Martha Maccallum must fulfill. These taxes reduce her disposable income and can affect her overall net worth.

- Legal Liabilities

Legal liabilities, such as settlements or judgments, can arise from lawsuits or other legal proceedings. These liabilities can have a significant impact on Martha Maccallum's net worth and financial security.

In managing her liabilities, Martha Maccallum must carefully assess her financial obligations, prioritize debt repayment, and seek professional advice when necessary. By effectively managing her liabilities, she can maintain a healthy net worth and achieve her financial goals.

Taxes

Taxes represent a significant aspect of Martha Maccallum net worth, as they directly impact her financial obligations and overall wealth. Understanding the various components of taxes and their implications is crucial for assessing her financial health and making informed decisions.

- Income Taxes

Income taxes are levied on Martha Maccallum's earnings, including her salary, investments, and other sources of income. These taxes are calculated based on her taxable income and can vary depending on her tax bracket.

- Property Taxes

Property taxes are imposed on real estate owned by Martha Maccallum. These taxes are typically paid annually and are based on the assessed value of the property.

- Sales Taxes

Sales taxes are collected on goods and services purchased by Martha Maccallum. These taxes are usually included in the purchase price and can vary depending on the jurisdiction and type of goods or services.

- Estate Taxes

Estate taxes are levied on the value of Martha Maccallum's assets upon her death. These taxes can significantly impact the distribution of her wealth to her heirs and should be considered in her estate planning.

Managing her tax obligations is crucial for Martha Maccallum to optimize her net worth. By understanding the different types of taxes, planning for tax deductions, and seeking professional advice when necessary, she can effectively reduce her tax burden and maximize her financial resources.

Expenses

Expenses play a crucial role in determining Martha Maccallum net worth. Expenses represent the costs incurred by Martha Maccallum in her daily life and business operations. These costs can significantly impact her overall financial situation and wealth accumulation.

Martha Maccallum's expenses can be categorized into various types, such as:

- Personal Expenses: These include costs related to her lifestyle, such as housing, transportation, food, and entertainment.

- Business Expenses: These include costs associated with her work as a news anchor and journalist, such as travel, research, and equipment.

- Taxes: These include various taxes that Martha Maccallum is obligated to pay, such as income taxes, property taxes, and sales taxes.

Understanding the relationship between expenses and net worth is crucial for effective financial management. High levels of expenses can deplete Martha Maccallum's financial resources and hinder her ability to accumulate wealth. Conversely, managing expenses effectively can maximize her disposable income and contribute to her net worth growth.

Practical applications of this understanding include creating a budget, tracking expenses, and identifying areas where costs can be reduced. By optimizing her expenses, Martha Maccallum can increase her savings, invest more wisely, and ultimately grow her net worth over time.

Debt

Debt, representing financial obligations that must be repaid, is an important aspect of Martha Maccallum's net worth. Understanding her debt situation provides insights into her financial health and ability to manage her wealth effectively.

- Outstanding Loans

Outstanding loans, such as mortgages or car loans, represent a significant portion of Martha Maccallum's debt. These loans require regular payments and can impact her cash flow and overall financial flexibility.

- Credit Card Debt

Credit card debt, if not managed responsibly, can accumulate interest charges and damage Martha Maccallum's credit score. High levels of credit card debt can negatively impact her net worth and financial standing.

- Tax Debt

Unpaid taxes, such as income taxes or property taxes, can result in penalties and legal consequences. Tax debt can significantly impact Martha Maccallum's financial resources and overall net worth.

- Business Debt

Business debt, incurred through her work as a news anchor and journalist, may include loans or lines of credit used to finance equipment, production costs, or other business-related expenses.

Managing debt effectively is crucial for Martha Maccallum to maintain a healthy net worth and achieve her financial goals. By carefully assessing her debt obligations, prioritizing debt repayment, and seeking professional advice when necessary, she can optimize her financial situation and maximize her wealth.

Savings

Savings represent an integral component of Martha Maccallum's net worth, playing a crucial role in her financial well-being. Accumulating savings allows her to build wealth over time, withstand unexpected expenses, and pursue financial goals.

The relationship between savings and net worth is direct and positive. Higher savings contribute directly to an increase in net worth. For instance, if Martha Maccallum saves $100,000 from her income, her net worth will increase by $100,000, assuming all other factors remain constant. Conversely, depleting savings can negatively impact net worth, highlighting the importance of prudent financial management.

In real life, Martha Maccallum's savings may be held in various forms, such as cash in a savings account, investments in stocks or bonds, or contributions to retirement accounts. Each of these savings vehicles offers varying levels of liquidity, risk, and return, allowing her to tailor her savings strategy to her individual needs and financial goals.

Understanding the connection between savings and net worth empowers Martha Maccallum to make informed financial decisions. By prioritizing saving and investing, she can grow her wealth, secure her financial future, and achieve her long-term financial objectives. This understanding is not only applicable to Martha Maccallum but also to individuals of all income levels and backgrounds, emphasizing the fundamental importance of saving for financial well-being.

In conclusion, this article has explored Martha Maccallum net worth, examining its various components and their impact on her financial standing. By analyzing her income, assets, investments, liabilities, and other factors, we have gained a comprehensive understanding of her overall wealth.

Several key points emerge from this exploration. Firstly, Martha Maccallum's net worth is influenced by both her income-generating activities and her ability to manage her assets and liabilities effectively. Secondly, her investment strategy plays a crucial role in growing her wealth over time, while taxes and expenses can impact her net worth negatively. Thirdly, understanding the relationship between these components allows Martha Maccallum to make informed financial decisions that support her long-term financial goals.

Ultimately, managing net worth is an ongoing process that requires careful planning and disciplined financial habits. By continuing to monitor her income, expenses, and investments, Martha Maccallum can maintain a healthy net worth and achieve her financial aspirations.

- Can Pregnant Woman Drink Bloom

- Khamzat Chimaev Bald

- Khamzat Without Beard

- Florida Baseball Coach Scandal

- Template How We See Each Other

Martha MacCallum Net Worth, Bio and Career NetWorthSize

Martha MacCallum Net Worth 2023, Salary Fox News, Husband Age, Parents

Martha MacCallum net worth, age, height, biography, career, and updates