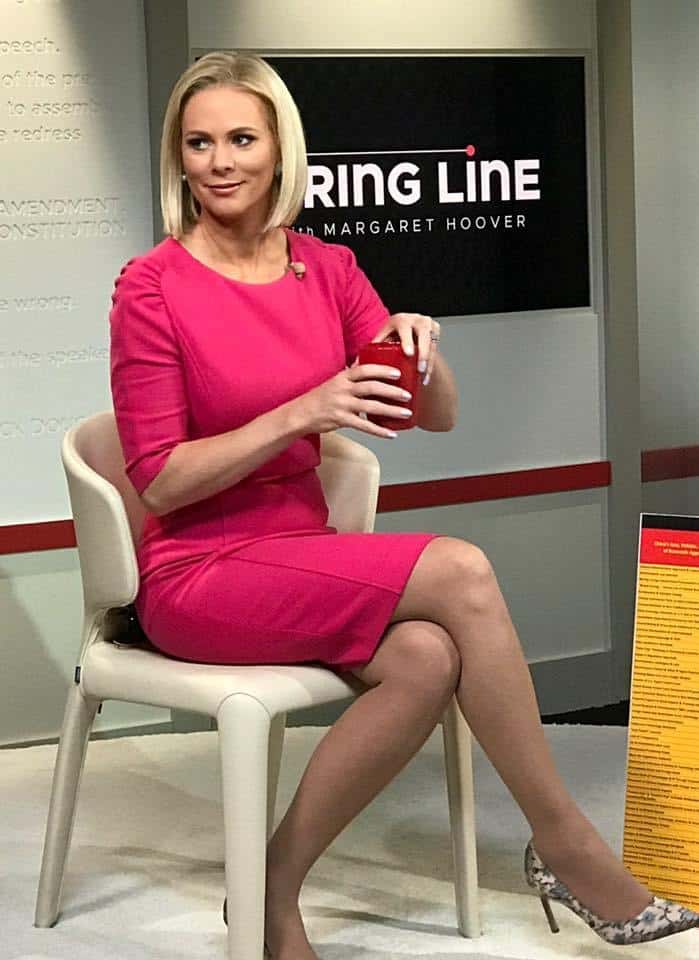

Margaret Hoover Net Worth: Unveiling The Wealth Of A Political Commentator

Margaret Hoover's net worth is an indicator of her financial wealth, including assets and income. For instance, if Margaret Hoover holds stocks valued at $1 million, owns a $2 million home, and has $500,000 in cash, her net worth would be $3.5 million.

Understanding net worth is crucial for financial planning and assessing an individual's financial status. Historically, the concept has evolved from simple wealth accumulation to a more comprehensive measure of financial well-being.

This article will delve into the details of Margaret Hoover's net worth, exploring its sources, growth, and implications for her financial future.

- Why Did Bunnie Fire Hallie

- Taylor Crying On Ellen

- Khamzat Chimaev Without Beard

- When Is Peysoh Getting Out Of Jail

- Breckue Hill Shower Vid

Margaret Hoover Net Worth

Margaret Hoover's net worth is a reflection of her financial wealth and success. Key aspects that contribute to her net worth include:

- Income from her career as a political commentator and author

- Investments in stocks, bonds, and real estate

- Earnings from speaking engagements and endorsements

- Assets such as her home and vehicles

- Liabilities such as mortgages or loans

- Business ventures and investments

- Inherited wealth or gifts

- Tax considerations and financial planning

Understanding these aspects provides insights into Margaret Hoover's overall financial well-being and her ability to generate and manage wealth. It also highlights the importance of financial literacy, investment strategies, and tax optimization in building and preserving net worth.

| Name | Margaret Hoover |

|---|---|

| Occupation | Political commentator, author |

| Net Worth | $4 million (estimated) |

| Birth Date | December 11, 1977 |

| Birth Place | Denver, Colorado |

| Education | Master's degree in public policy from Harvard University |

Income from her career as a political commentator and author

As a renowned political commentator and author, Margaret Hoover has established a significant source of income through various channels related to her professional endeavors. These include:

- Breckie Hill Showers

- Dd Osama Brothers

- Why Does Tiktok Say No Internet Connection

- Breckie Hill Shower Leak Video

- Taylor Swift Cry

- Television Appearances: Hoover's regular appearances on prominent television networks, such as CNN, MSNBC, and Fox News, contribute to her income. Her expertise and insights on political issues attract lucrative contracts and guest hosting opportunities.

- Book Sales: Hoover has authored several books, including "American Individualism: How a New Generation of Conservatives Can Save the Republican Party" and "Barracoon: The Story of the Last "Black Cargo" Slave." Royalties from book sales add to her net worth.

- Speaking Engagements: Hoover's reputation as a thought leader makes her a sought-after speaker for conferences, corporate events, and private gatherings. Honorariums from these engagements bolster her income.

- Endorsements and sponsorships: Hoover's credibility and influence have led to partnerships with organizations and brands that align with her values. Endorsement deals and sponsorships provide additional revenue streams.

The combination of these income sources has significantly contributed to Margaret Hoover's overall net worth. Her ability to leverage her expertise and engage with diverse audiences has allowed her to establish a successful and financially rewarding career in the media and political commentary industry.

Investments in stocks, bonds, and real estate

Investments in stocks, bonds, and real estate play a crucial role in building and diversifying Margaret Hoover's net worth. These investments represent a significant portion of her financial portfolio and contribute to her long-term financial security.

- Stock Market Investments: Hoover allocates a portion of her wealth to investing in stocks, which represent ownership shares in publicly traded companies. This strategy provides the potential for capital appreciation and dividend income.

- Bond Investments: Bonds are fixed-income securities that pay regular interest payments to investors. Hoover may invest in bonds to generate a steady stream of income and reduce the overall risk of her portfolio.

- Real Estate Investments: Hoover has invested in real estate properties, including residential and commercial buildings. Real estate can provide rental income, potential value appreciation, and tax benefits.

- Diversification: By investing in a mix of stocks, bonds, and real estate, Hoover diversifies her portfolio. This strategy aims to reduce risk and enhance overall returns by balancing the performance of different asset classes.

The combination of these investments contributes to Margaret Hoover's financial stability and growth. Regular income from dividends and rent, coupled with the potential for capital appreciation, provides a solid foundation for her net worth. Furthermore, diversification helps mitigate risk and optimize returns, ensuring the longevity of her financial wealth.

Earnings from speaking engagements and endorsements

Margaret Hoover's earnings from speaking engagements and endorsements contribute significantly to her overall net worth. These activities leverage her expertise, influence, and reputation to generate additional income streams.

- Honoraria: Fees paid for Hoover's appearances as a speaker at conferences, corporate events, and private gatherings. Her insights on political issues and current affairs command high demand.

- Endorsements: Partnerships with organizations and brands that align with Hoover's values and beliefs. She lends her credibility to products or services, receiving compensation in return.

- Consulting: Hoover provides expert advice and analysis to organizations seeking her knowledge and experience in political strategy and communications.

- Media Appearances: In addition to her regular television appearances, Hoover participates in paid interviews, podcasts, and webinars, sharing her perspectives on current events and political developments.

These earnings enhance Hoover's financial stability and allow her to pursue her interests and philanthropic endeavors. They also reflect her ability to monetize her expertise and influence, further solidifying her position as a respected commentator and thought leader.

Assets such as her home and vehicles

Assets such as her home and vehicles are tangible and valuable possessions that contribute to Margaret Hoover's net worth. These assets represent her ownership of physical property and provide financial security and stability.

- Real Estate: Hoover's primary residence and any additional properties she owns hold significant value and equity. These properties can appreciate over time and provide rental income, contributing to her overall net worth.

- Vehicles: Hoover's cars and other vehicles, while depreciating assets, represent a portion of her net worth. They facilitate her transportation and daily activities, and their value can vary depending on factors such as make, model, and condition.

- Collectibles and Artwork: Hoover may own valuable collectibles or artwork that hold both sentimental and monetary worth. These assets can appreciate in value over time and contribute to her net worth.

- Personal Belongings: Hoover's personal belongings, such as jewelry, watches, and designer items, may have significant value and contribute to her overall net worth. These items can be sold or liquidated to generate cash flow.

The value of Hoover's assets, particularly her real estate holdings, can fluctuate based on market conditions and economic factors. However, these assets play a crucial role in her financial well-being and provide a solid foundation for her net worth.

Liabilities such as mortgages or loans

Liabilities such as mortgages or loans represent financial obligations that can impact Margaret Hoover's net worth. Mortgages, in particular, are secured loans used to finance the purchase of real estate, while loans can cover various expenses such as education, vehicles, or personal needs.

When Hoover takes on a mortgage or loan, the amount borrowed increases her liabilities. This means that her net worth, calculated as assets minus liabilities, decreases. However, the impact on her net worth is not always straightforward. For instance, a mortgage can also be seen as an investment in an appreciating asset, as real estate values tend to increase over time. In this case, the potential growth in the property's value can offset the liability and contribute to Hoover's net worth in the long run.

The interest payments associated with mortgages or loans also affect Hoover's net worth. Interest payments reduce her disposable income and can strain her cash flow. However, if the interest rates are low and the investment returns on her assets exceed the interest expenses, the impact on her net worth may be minimal.

Understanding the relationship between liabilities such as mortgages or loans and Margaret Hoover's net worth is crucial for her financial planning and decision-making. By carefully considering the potential impact on her cash flow, assets, and overall financial goals, Hoover can make informed choices about taking on debt and manage her liabilities effectively.

Business ventures and investments

Business ventures and investments are key contributors to Margaret Hoover's net worth. Through strategic investments and entrepreneurial endeavors, she has diversified her income streams and built a solid financial foundation.

- Real estate investments: Hoover has invested in residential and commercial properties, generating rental income and potential capital appreciation. This asset class provides stability to her portfolio.

- Private equity: Hoover participates in private equity investments, providing capital to early-stage companies with high growth potential. These investments offer the opportunity for significant returns but also carry higher risk.

- Venture capital: Hoover invests in startups and emerging businesses through venture capital funds. This asset class offers the potential for exponential returns but also involves a high risk of losing the invested capital.

- Angel investing: Hoover engages in angel investing, providing seed funding to promising startups in exchange for equity. This approach allows her to support innovative ventures while potentially generating high returns.

By actively managing her business ventures and investments, Margaret Hoover has expanded her wealth and enhanced her overall financial security. These endeavors demonstrate her acumen as an investor and her commitment to building a diversified and growing net worth.

Inherited Wealth or Gifts

Margaret Hoover's net worth may be influenced by inherited wealth or gifts. Inherited wealth refers to assets or money passed down from family members or relatives, while gifts are voluntary transfers of property or money without compensation. These sources can significantly impact an individual's financial standing.

In Hoover's case, inherited wealth or gifts could have provided a financial foundation, allowing her to invest and grow her net worth. For example, if she received a substantial inheritance, she could have used it to purchase real estate, invest in stocks or bonds, or start a business venture. These investments, if managed wisely, could have generated passive income and contributed to her overall wealth.

Understanding the role of inherited wealth or gifts in Hoover's net worth is important because it highlights the potential impact of financial resources on an individual's financial trajectory. It also emphasizes the importance of financial literacy and prudent investment strategies to preserve and grow inherited wealth or gifts. Additionally, this understanding can inform discussions on wealth inequality and the distribution of financial resources across generations.

Tax considerations and financial planning

Tax considerations and financial planning play a crucial role in shaping Margaret Hoover's net worth. By implementing strategic tax planning techniques and making informed financial decisions, Hoover can optimize her wealth and minimize her tax liability. One critical aspect of tax considerations for Hoover is the use of tax-advantaged accounts, such as 401(k)s and IRAs. These accounts allow her to contribute pre-tax dollars, which reduces her current taxable income and potentially increases her net worth in the long run. Additionally, Hoover may utilize tax deductions and credits to further reduce her tax liability. For example, charitable donations or mortgage interest payments can provide tax benefits that increase her disposable income and contribute to her net worth.

Another essential element of financial planning for Hoover is estate planning. By creating a comprehensive estate plan, she can ensure that her assets are distributed according to her wishes after her passing and minimize the potential tax burden on her beneficiaries. This involves making decisions about trusts, wills, and other legal arrangements designed to preserve and transfer wealth efficiently. Estate planning also allows Hoover to reduce or avoid estate taxes, which can significantly impact her net worth.

Understanding the practical applications of tax considerations and financial planning is crucial for Hoover's financial well-being. By implementing effective tax strategies and making informed financial decisions, she can maximize her net worth, achieve her financial goals, and secure her financial future. Furthermore, the insights gained from her financial planning can inform her investment decisions, retirement planning, and philanthropic endeavors.

Throughout this article, we have explored the multifaceted nature of Margaret Hoover's net worth, examining its various components and their impact on her overall financial well-being. Key insights include the significance of her income streams from her successful career, her strategic investments in stocks, bonds, and real estate, and her prudent financial planning and tax optimization strategies.

The article highlights how Hoover's net worth is not solely defined by the accumulation of wealth but encompasses her ability to generate income, manage liabilities, and plan for her financial future. Her success serves as a testament to the importance of financial literacy, strategic decision-making, and a commitment to long-term financial growth. Understanding the intricacies of Margaret Hoover's net worth provides valuable lessons for individuals seeking to build and preserve their own financial well-being.

- Is Peysoh In Jail

- Brian Easely

- Why Did Bunnie Fire Haley

- Brekie Hill Shower Video

- No Internet Connection Tiktok

Margaret Hoover Biography, Age, Wiki, Height, Weight, Boyfriend, Family

Margaret Hoover Bio, Net Worth, Salary, Married, Husband, Family, Age

Who is Margaret Hoover from CNN? Wiki Husband John Avlon, Net Worth