Keith Morrison's Net Worth: A Comprehensive Review Of His Wealth

Keith Morrison Net Worth refers to the total value of Keith Morrison's financial assets, including investments, property, and earnings. For instance, if Morrison owns a house worth $500,000, stocks valued at $300,000, and has $100,000 in savings, his net worth would be $900,000.

Understanding net worth is valuable for financial planning and monitoring wealth accumulation. Historically, the concept of net worth can be traced back to 15th-century Italy, where it was used by merchants to assess their financial standing before engaging in trade.

This article explores Keith Morrison's financial success, discussing his career, earnings, and investment strategies.

- Skip The Games El Paso Texas

- Buffet De Mariscos Cerca De Mi

- Does Tiktok Have Seen

- Khamzat Shaved

- How Much Do Tommy The Clown Dancers Get Paid

Keith Morrison Net Worth

Keith Morrison's net worth encompasses multiple facets of his financial standing, including his earnings, assets, and investments.

- Income Sources

- Asset Allocation

- Investment Strategies

- Financial Planning

- Tax Implications

- Estate Planning

- Wealth Management

- Philanthropy

- Net Worth Tracking

- Financial Security

These aspects are interconnected, providing a comprehensive view of Morrison's financial well-being. Understanding each aspect enables informed decision-making and helps secure long-term financial stability. For instance, optimizing asset allocation and investment strategies can maximize returns, while effective tax planning minimizes financial obligations. Additionally, engaging in philanthropy aligns financial success with personal values.

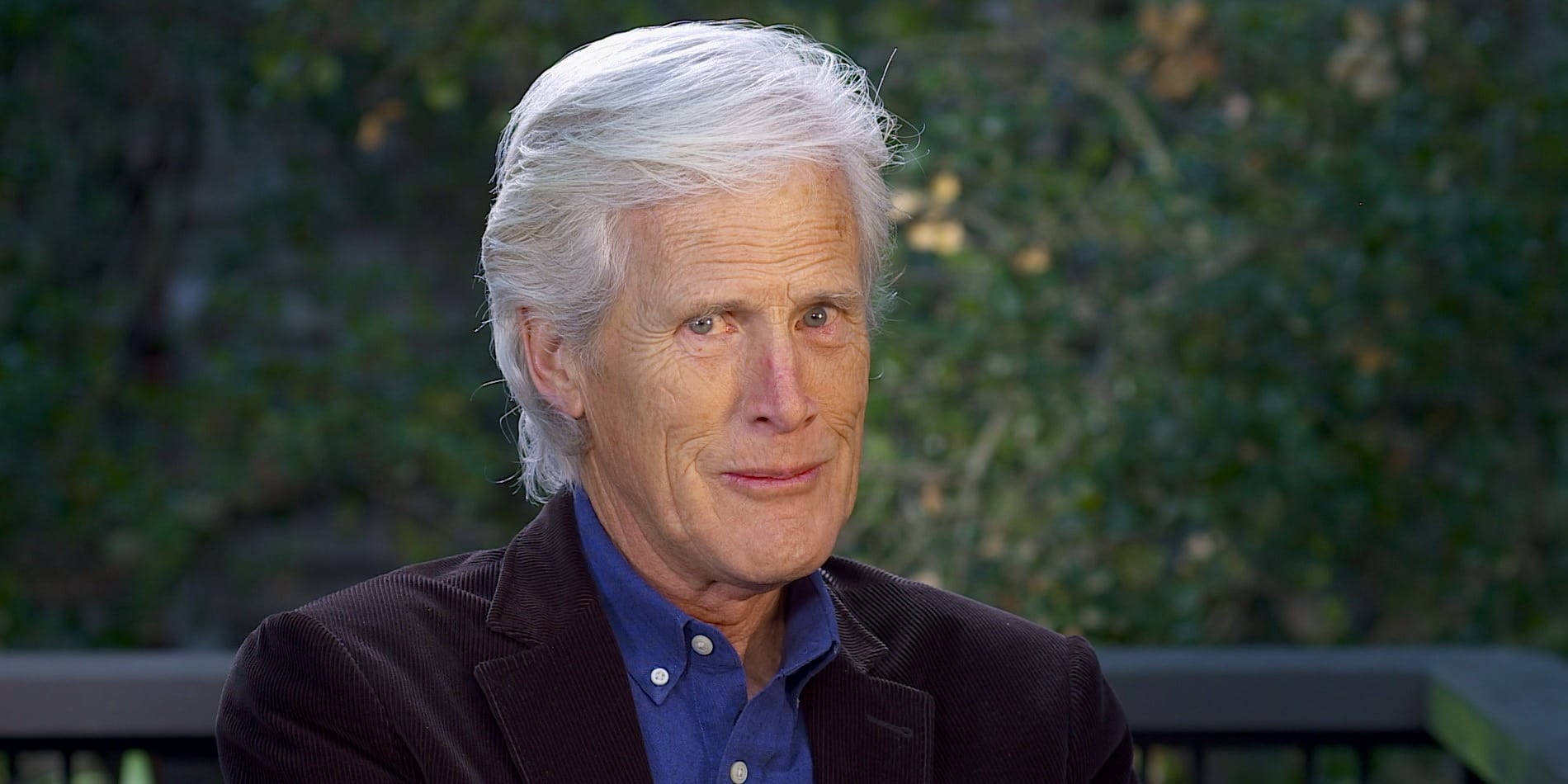

| Name | Birth Date | Birth Place | Occupation |

|---|---|---|---|

| Keith Morrison | July 2, 1949 | Regina, Saskatchewan, Canada | Journalist, Author, Television Host |

Income Sources

Income Sources constitute a fundamental pillar of Keith Morrison's net worth, influencing its growth and stability.

- Breckue Hill Shower Vid

- Dd Osama Brothers

- Why Is Peysoh In Jail

- Peysoh Wallpaper

- Template How We See Each Other

- Journalism: Morrison's primary income source stems from his illustrious journalism career, spanning decades of reporting and anchoring for reputable media outlets such as NBC News and Dateline NBC.

- Authoring: Beyond journalism, Morrison has authored several bestselling books, including "The Final Witness" and "The Murder of Meredith Kercher," generating additional revenue streams.

- Public Speaking: Morrison's captivating storytelling abilities and expertise in true crime have made him a sought-after public speaker, commanding fees for appearances and lectures.

- Investments: Morrison's net worth is further bolstered by savvy investments, including real estate and stocks, diversifying his income portfolio.

These diverse Income Sources have collectively contributed to Keith Morrison's substantial net worth, enabling him to enjoy financial security and pursue his passions both professionally and personally.

Asset Allocation

Asset Allocation plays a crucial role in Keith Morrison's net worth, influencing its growth and stability. It involves distributing investments across different asset classes, such as stocks, bonds, and real estate, to manage risk and optimize returns.

Effective Asset Allocation aligns with Morrison's financial goals and risk tolerance. By diversifying his portfolio, he reduces the impact of market fluctuations on his net worth. For instance, when stock prices decline, the value of his bond investments may increase, mitigating overall losses.

A well-diversified portfolio, as part of a comprehensive Asset Allocation strategy, has contributed to Morrison's financial success. It has allowed him to weather economic downturns and capitalize on market upswings, preserving and growing his net worth over time.

Understanding the connection between Asset Allocation and keith morrison net worth underscores the importance of sound investment strategies for long-term financial well-being. By carefully managing his portfolio, Morrison has secured his financial future and maintained a substantial net worth.

Investment Strategies

Investment Strategies form the cornerstone of Keith Morrison's net worth, shaping its growth and stability. Through prudent decision-making and a keen understanding of financial markets, he has amassed a substantial portfolio that contributes significantly to his overall wealth.

- Diversification: Morrison's portfolio is well-diversified across different asset classes, including stocks, bonds, and real estate. This strategy reduces risk by spreading investments across uncorrelated markets, ensuring that downturns in one sector do not significantly impact his overall net worth.

- Long-Term Focus: Morrison adopts a long-term investment horizon, avoiding short-term market fluctuations and focusing on the potential for sustained growth over time. This approach allows him to ride out market volatility and capitalize on compounding returns.

- Value Investing: Morrison seeks out undervalued companies with strong fundamentals, believing that their intrinsic value will eventually be recognized by the market, leading to substantial gains. This strategy requires patience and a deep understanding of financial analysis.

- Alternative Investments: In addition to traditional investments, Morrison explores alternative asset classes such as private equity and hedge funds to enhance returns and further diversify his portfolio. These investments often carry higher risks but also have the potential for higher rewards.

By employing these sophisticated Investment Strategies, Keith Morrison has built a robust financial foundation that supports his current lifestyle and secures his future financial well-being. His success serves as a testament to the importance of prudent investment decision-making in achieving and maintaining a substantial net worth.

Financial Planning

Financial planning plays a critical role in Keith Morrison's net worth, ensuring the preservation and growth of his wealth. Through meticulous planning and execution, he has established a financial roadmap that aligns with his financial goals and objectives.

A comprehensive financial plan encompasses various aspects, including budgeting, savings, investments, retirement planning, and estate planning. By addressing each of these components, Morrison has created a holistic approach to managing his finances. His financial plan serves as a guiding framework, helping him make informed decisions and navigate financial challenges effectively.

Real-life examples of financial planning within Keith Morrison's net worth include his diversified investment portfolio, strategic asset allocation, and long-term investment horizon. These strategies have contributed to the growth and stability of his net worth, allowing him to maintain financial security and pursue his personal and professional endeavors.

Understanding the connection between financial planning and Keith Morrison's net worth underscores the significance of prudent financial management for individuals seeking to achieve and maintain financial well-being. By implementing a comprehensive financial plan, Morrison has secured his financial future and set an example for effective wealth management.

Tax Implications

Tax Implications play a significant role in understanding Keith Morrison's net worth as they affect the overall value and growth of his financial assets.

- Taxable Income: Morrison's taxable income includes earnings from journalism, book sales, public speaking, and investments. Understanding tax brackets and deductions is crucial to optimizing his tax liability.

- Capital Gains Taxes: When Morrison sells investments or assets, such as real estate or stocks, he may be subject to capital gains taxes. The tax rate depends on the holding period and the amount of profit realized.

- Retirement Accounts: Morrison can utilize tax-advantaged retirement accounts like 401(k)s and IRAs to reduce his current tax liability and save for the future.

- Estate Planning: Tax implications extend beyond Morrison's lifetime. Estate planning strategies, such as trusts and wills, can minimize estate taxes and ensure the orderly distribution of his assets.

Managing Tax Implications requires careful planning and professional advice. By understanding the applicable tax laws and implementing appropriate strategies, Morrison can maximize his net worth and secure his financial future.

Estate Planning

Estate Planning is an integral aspect of Keith Morrison's net worth management, ensuring the orderly distribution and preservation of his assets after his lifetime. It involves a comprehensive set of strategies aimed at minimizing taxes, maximizing the value of his estate, and honoring his wishes for the distribution of his wealth.

- Wills: A will is a legal document that outlines Morrison's wishes for the distribution of his assets upon his death. It allows him to specify who will inherit his property, appoint an executor to manage his estate, and establish guardians for any minor children.

- Trusts: Trusts are legal entities that can hold and manage assets for the benefit of designated beneficiaries. Morrison can use trusts to reduce estate taxes, protect assets from creditors, and provide for specific needs, such as supporting a disabled child.

- Powers of Attorney: Powers of attorney allow Morrison to appoint individuals to make financial and healthcare decisions on his behalf if he becomes incapacitated. This ensures that his affairs are managed according to his wishes, even if he is unable to do so himself.

- Charitable Giving: Estate planning can also involve charitable giving, allowing Morrison to make donations to organizations or causes that he supports. This can reduce estate taxes and leave a lasting legacy.

By implementing a comprehensive Estate Plan, Keith Morrison can ensure that his wealth is managed and distributed according to his wishes, minimizing the burden on his family and maximizing the impact of his legacy.

Wealth Management

Wealth Management plays a pivotal role in Keith Morrison's net worth, encompassing the strategies and decisions that have shaped and sustained his financial well-being. It involves the professional management of his financial assets, investments, and overall financial plan to achieve his long-term financial goals. Effective wealth management requires a comprehensive approach that considers various factors, including risk tolerance, investment objectives, and tax implications.

A key aspect of wealth management for Keith Morrison is asset allocation, which involves distributing his investments across different asset classes such as stocks, bonds, and real estate. This diversification strategy helps mitigate risk and optimize returns, ensuring that his net worth is not overly reliant on any single investment or asset class. Morrison's wealth management team also focuses on long-term growth, employing investment strategies that aim to outpace inflation and generate sustainable returns over time.

Real-life examples of wealth management within Keith Morrison's net worth include his diversified investment portfolio, which includes a mix of domestic and international stocks, bonds, and real estate holdings. This portfolio is actively managed to adjust to changing market conditions and Morrison's evolving financial goals. Additionally, Morrison utilizes trusts and other estate planning tools to minimize taxes and ensure the orderly distribution of his wealth after his lifetime.

Understanding the connection between wealth management and Keith Morrison's net worth highlights the importance of professional financial guidance and strategic planning in achieving and maintaining financial success. Wealth management is not merely a reactive approach to managing finances but a proactive strategy that can help individuals like Morrison navigate complex financial landscapes, make informed decisions, and secure their financial futures.

Philanthropy

Philanthropy plays a significant role in shaping Keith Morrison's net worth, extending beyond financial contributions to encompass a deep commitment to social causes and charitable giving. His philanthropic endeavors have not only enhanced his legacy but also influenced the allocation and impact of his wealth.

Morrison's philanthropic efforts are driven by a belief in giving back to the community and supporting organizations that align with his values. He has generously donated to various charitable causes, including education, healthcare, and environmental protection. By directing a portion of his net worth towards philanthropy, Morrison demonstrates a commitment to using his wealth for positive social change.

Real-life examples of Morrison's philanthropy include his support for organizations such as the Leukemia and Lymphoma Society, the American Red Cross, and the National Audubon Society. These contributions have funded groundbreaking research, provided disaster relief, and protected endangered species. Morrison's philanthropic efforts extend beyond monetary donations, as he also dedicates his time and influence to raise awareness and advocate for important causes.

Understanding the connection between Philanthropy and keith morrison net worth underscores the power of wealth to drive positive social impact. By strategically allocating a portion of his net worth to charitable causes, Morrison has not only increased his personal fulfillment but also leveraged his financial resources to create lasting change in the world. This understanding highlights the broader social responsibility that comes with wealth and the potential for individuals to use their resources to make a meaningful difference.

Net Worth Tracking

Net Worth Tracking plays a crucial role in managing and assessing keith morrison net worth. It involves monitoring changes in the value of assets, liabilities, and ownership interests over time to provide a comprehensive view of financial health.

- Asset Valuation: Accurately valuing assets, such as real estate, investments, and collectibles, is essential for determining net worth. Regular appraisals and market research help ensure that asset values are up-to-date.

- Liability Management: Tracking liabilities, including mortgages, loans, and outstanding payments, is equally important. This information allows for informed decision-making regarding debt repayment and financial planning.

- Cash Flow Monitoring: Monitoring cash flow helps identify sources and uses of funds, providing insights into spending patterns and financial stability. This data is crucial for budgeting and forecasting future cash needs.

- Regular Reporting: Establishing a regular reporting schedule for net worth tracking enables timely identification of trends and potential issues. This information can be used to make adjustments to financial strategies and investments as needed.

By implementing a comprehensive Net Worth Tracking system, Keith Morrison gains a clear understanding of his financial position, can make informed decisions, and proactively manage his net worth. This process empowers him to identify opportunities, mitigate risks, and achieve his long-term financial goals.

Financial Security

Financial Security stands as a cornerstone of Keith Morrison's net worth, encompassing measures and strategies that safeguard his financial well-being and ensure long-term stability. It involves proactive planning, prudent investment, and disciplined financial management to secure a comfortable and fulfilling life.

- Emergency Fund: Morrison maintains a substantial emergency fund to cover unexpected expenses or financial emergencies, providing a safety net against unforeseen circumstances.

- Diversified Portfolio: His investment portfolio is strategically diversified across various asset classes, reducing risk and enhancing the stability of his net worth over time.

- Retirement Planning: Morrison has implemented a comprehensive retirement plan, ensuring financial security during his golden years through regular contributions and smart investment choices.

- Insurance Coverage: Adequate insurance policies protect Morrison against financial losses due to health issues, property damage, or liability, providing peace of mind and minimizing risks to his net worth.

By prioritizing Financial Security, Keith Morrison has created a solid financial foundation that supports his lifestyle, mitigates risks, and ensures his long-term well-being. His commitment to financial planning and prudent decision-making has contributed significantly to the stability and growth of his net worth.

In conclusion, this exploration of Keith Morrison's net worth has unveiled the complex interplay of income sources, asset allocation, investment strategies, and financial planning that have contributed to his financial success. His ability to diversify his income streams, allocate assets strategically, and make prudent investment decisions has been instrumental in building and maintaining his substantial net worth.

Crucially, Morrison's commitment to financial security, philanthropy, and net worth tracking underscores his long-term vision and responsible approach to wealth management. By prioritizing financial stability, giving back to the community, and monitoring his financial position, he has created a solid foundation for his future and established a legacy of financial well-being.

The insights gained from examining Keith Morrison's net worth serve as a reminder that financial success is not solely defined by the accumulation of wealth but also by the responsible management and use of resources to support personal goals, contribute to the greater good, and secure financial stability over the long term.

- Jenna Ortega Net Worth

- Breckie Hill Shower Leak Video

- Breckie Hill Shower Leaked

- Khamzat Chimaev Without Bears

- Khamzat Shaved

Keith Morrison Net Worth October 2023, Salary, Age, Siblings, Bio

Keith Morrison bio age, children, wife, Dateline NBC, podcast, salary

Keith Morrison talks 'Dateline' fame and his new 'Killer Role' podcast