How To Calculate Van Jones' Net Worth

"How much is van jones worth" is an interrogative phrase in which "much" is a quantifier and "worth" is a noun. It refers to the total value of someone's assets, minus their liabilities. For example, if someone owns a house worth $500,000 and has $100,000 in debt, their net worth would be $400,000.

Knowing someone's net worth can be important for a variety of reasons. For example, it can help you assess their financial stability, creditworthiness, and investment potential. It can also be helpful for estate planning and tax purposes.

Historically, the concept of net worth has been used for centuries to measure an individual's financial well-being. In the early days of capitalism, net worth was often used to determine a person's social status. Today, net worth is still considered an important indicator of financial success.

- Khamzat Beard

- What Is Ddot Real Name

- When Does Peysoh Get Out Of Jail

- Breckie Hill Shower Leaked

- Brown Easley

How Much Is Van Jones Worth

Understanding the various aspects of "how much is van jones worth" is crucial for assessing an individual's financial well-being, investment potential, and overall financial stability.

- Net worth

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Debt

- Credit score

- Financial goals

- Estate planning

These aspects provide a comprehensive view of an individual's financial situation and can help inform important decisions such as investment strategies, retirement planning, and major purchases. By understanding the interconnections between these aspects, individuals can make informed choices and work towards achieving their financial goals.

| Name | Birth Date | Birth Place | Occupation | Net Worth |

|---|---|---|---|---|

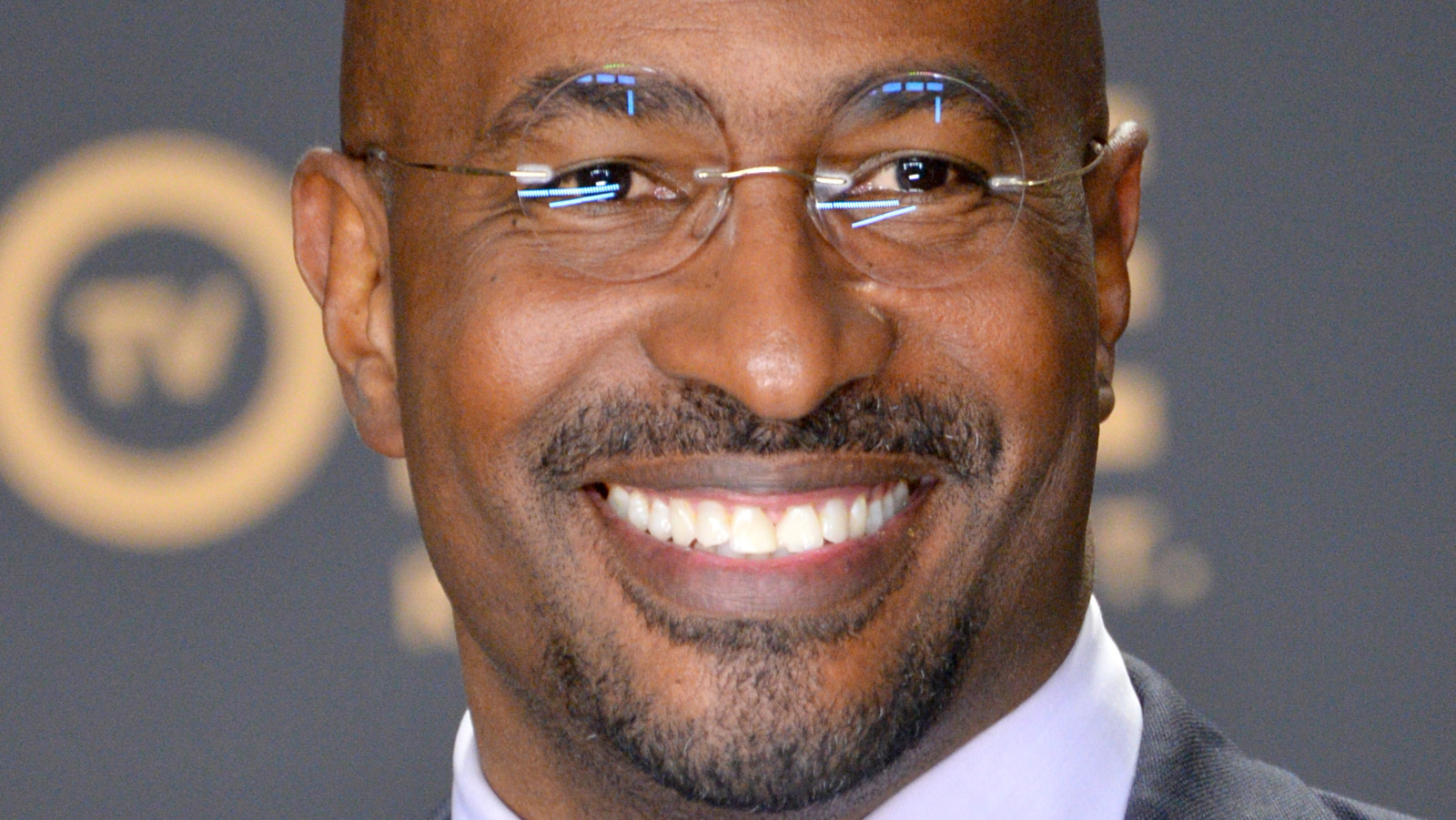

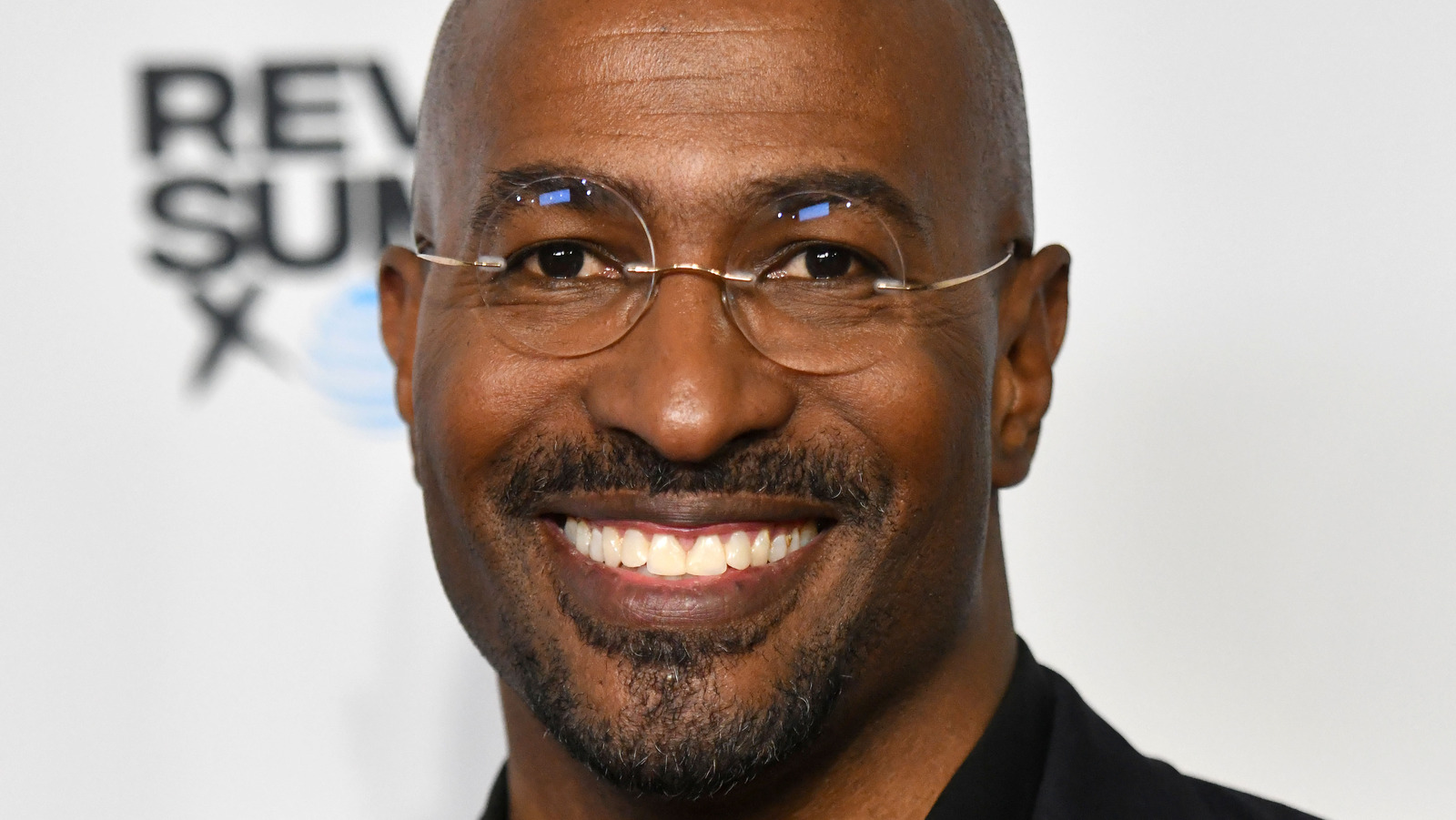

| Van Jones | September 20, 1968 | Jackson, Tennessee | Lawyer, Author, Activist | $5 million |

Net worth

Net worth is a crucial component of "how much is van jones worth" because it represents the total value of an individual's assets minus their liabilities. It provides a snapshot of an individual's financial well-being and can be used to assess their creditworthiness, investment potential, and overall financial stability.

- Khamzat Chimaev Without Bears

- Khamzat Chimaev With No Beard

- Is Lana Rhoades Pregnant

- Peysoh Wallpaper

- When Is Peysoh Getting Out Of Jail

For example, if Van Jones has assets worth $10 million and liabilities of $5 million, his net worth would be $5 million. This information is valuable to lenders, investors, and other parties who want to assess Van Jones's financial health.

Understanding the connection between net worth and "how much is van jones worth" is important for a variety of reasons. First, it can help individuals make informed decisions about their financial future. For example, if Van Jones knows that his net worth is $5 million, he can make informed decisions about how to invest his money and plan for retirement. Second, it can help individuals avoid financial pitfalls. For example, if Van Jones knows that his net worth is low, he can take steps to improve his financial situation and avoid getting into debt.

Assets

Assets play a crucial role in determining "how much is van jones worth". They represent the total value of everything Van Jones owns, minus any debts or liabilities. Assets can include a variety of items, both tangible and intangible.

- Cash and cash equivalents: This includes physical cash, money in bank accounts, and money market accounts.

- Investments: This includes stocks, bonds, mutual funds, and real estate.

- Personal property: This includes cars, jewelry, art, and other valuable possessions.

- Intellectual property: This includes patents, trademarks, and copyrights.

The value of Van Jones' assets can fluctuate over time, depending on market conditions and other factors. However, by understanding the different types of assets and their value, we can get a better picture of his overall financial health.

Liabilities

Liabilities represent the total amount of money that Van Jones owes to other individuals or organizations. They can include a variety of items, such as:

- Credit card debt

- Student loans

- Mortgages

- Car loans

- Personal loans

Liabilities are an important component of "how much is van jones worth" because they reduce his net worth. For example, if Van Jones has assets worth $10 million and liabilities of $5 million, his net worth would be $5 million. This information is valuable to lenders, investors, and other parties who want to assess Van Jones's financial health.

It is important to note that not all liabilities are created equal. Some liabilities, such as student loans, can be used to invest in one's future and may ultimately increase net worth. Other liabilities, such as credit card debt, can be a drag on net worth and should be avoided if possible.

By understanding the different types of liabilities and their impact on net worth, Van Jones can make informed decisions about how to manage his debt and improve his financial health.

Income

Income plays a critical role in determining "how much is van jones worth". Income is the total amount of money that Van Jones earns from all sources, including his salary, wages, bonuses, and investment income. Income is important because it allows Van Jones to pay his expenses, save for the future, and invest in his net worth. For example, if Van Jones has a high income, he can afford to buy a more expensive house, invest in more stocks, and save more money for retirement. Conversely, if Van Jones has a low income, he may have to live in a less expensive house, invest less money, and save less money for retirement.

There are many different ways to increase income. Van Jones can negotiate a raise at his current job, get a second job, or start his own business. He can also invest in his education or training to increase his earning potential. By increasing his income, Van Jones can increase his net worth and improve his overall financial health.

Understanding the connection between income and "how much is van jones worth" is important for a variety of reasons. First, it can help Van Jones make informed decisions about his financial future. For example, if Van Jones knows that he needs to increase his income in order to reach his financial goals, he can take steps to do so. Second, it can help Van Jones avoid financial pitfalls. For example, if Van Jones knows that he has a low income, he can take steps to reduce his expenses and avoid getting into debt.

Expenses

Expenses are a critical component of "how much is van jones worth". They represent the total amount of money that Van Jones spends on a regular basis, including his housing costs, food, transportation, and entertainment. Expenses are important because they reduce his net worth. For example, if Van Jones has $100,000 in income and $50,000 in expenses, his net worth will increase by $50,000. Conversely, if Van Jones has $100,000 in income and $150,000 in expenses, his net worth will decrease by $50,000.

There are many different types of expenses. Some expenses, such as housing and food, are essential for survival. Other expenses, such as entertainment and travel, are discretionary. Van Jones can control his expenses by reducing his spending on discretionary items. He can also increase his income to offset his expenses.

Understanding the connection between expenses and "how much is van jones worth" is important for a variety of reasons. First, it can help Van Jones make informed decisions about his financial future. For example, if Van Jones knows that he needs to reduce his expenses in order to reach his financial goals, he can take steps to do so. Second, it can help Van Jones avoid financial pitfalls. For example, if Van Jones knows that he has high expenses, he can take steps to reduce his debt and avoid getting into financial trouble.

Investments

Investments play a critical role in determining "how much is van jones worth". Investments represent the total value of all the assets that Van Jones owns, minus any liabilities. These assets can include stocks, bonds, real estate, and other investments. Investments are important because they can help Van Jones grow his net worth and reach his financial goals. For example, if Van Jones invests $100,000 in the stock market and the market goes up by 10%, he will make a profit of $10,000. This profit will increase his net worth.

There are many different types of investments. Some investments, such as stocks and bonds, are traded on public exchanges. Other investments, such as real estate and private equity, are not traded on public exchanges. Van Jones can choose to invest in a variety of different assets to diversify his portfolio and reduce his risk.

Understanding the connection between investments and "how much is van jones worth" is important for a variety of reasons. First, it can help Van Jones make informed decisions about his financial future. For example, if Van Jones knows that he needs to increase his net worth in order to retire early, he can invest more money in stocks and bonds. Second, it can help Van Jones avoid financial pitfalls. For example, if Van Jones knows that he has a low risk tolerance, he can invest more money in bonds and less money in stocks. By understanding the connection between investments and "how much is van jones worth", Van Jones can make informed decisions about his financial future and reach his financial goals.

Debt

In the context of "how much is van jones worth", debt plays a crucial role in determining an individual's overall financial health and net worth. Debt refers to the amount of money owed by an individual or organization to another party, and it can significantly impact a person's financial situation.

- Outstanding Balances

This refers to the unpaid portion of borrowed funds, such as credit card debt, personal loans, and mortgages. High outstanding balances can strain an individual's cash flow and reduce their net worth.

- Interest Payments

Interest is the cost of borrowing money, and it can accumulate over time, increasing the overall debt burden. High interest rates can make it challenging to pay off debt and can further reduce net worth.

- Debt-to-Income Ratio

This ratio compares an individual's monthly debt payments to their monthly income. A high debt-to-income ratio can indicate financial distress and make it difficult to qualify for additional credit.

- Collateral

Collateral is an asset that is pledged as security for a loan. If an individual defaults on their loan, the lender may seize the collateral to recover their losses. The value of the collateral can impact the amount of debt that an individual can secure.

Understanding the various facets of debt is essential for assessing an individual's financial well-being and net worth. High levels of debt can limit an individual's financial flexibility, reduce their investment potential, and hinder their ability to achieve their financial goals. Therefore, it is important to manage debt responsibly and to seek professional advice if necessary.

Credit score

A credit score is a numerical representation of an individual's creditworthiness, based on their credit history and behavior. It plays a significant role in determining "how much is van jones worth" because it affects access to credit, interest rates on loans, and insurance premiums. A high credit score indicates a lower risk to lenders, making it easier to qualify for loans and secure favorable terms.

Conversely, a low credit score can limit an individual's financial options and increase the cost of borrowing. For example, if Van Jones has a low credit score, he may be denied a loan or offered a loan with a high interest rate. This can make it more difficult for him to purchase a home, car, or other assets that contribute to his net worth.

Understanding the connection between credit score and "how much is van jones worth" is essential for managing personal finances effectively. By maintaining a good credit score, individuals can improve their access to credit, reduce borrowing costs, and increase their overall financial flexibility. Conversely, neglecting credit score management can lead to financial challenges and hinder an individual's ability to build wealth.

Financial goals

Financial goals are a crucial aspect of "how much is van jones worth" as they provide a roadmap for managing and growing one's wealth. These goals can encompass various objectives, ranging from short-term financial needs to long-term wealth accumulation strategies.

- Retirement Planning

Preparing for retirement involves setting aside funds to ensure financial security during the post-work years. Factors such as desired retirement age, lifestyle, and healthcare costs influence retirement planning goals.

- Saving for a Down Payment

Accumulating funds for a down payment on a home is a common financial goal. Saving consistently and exploring down payment assistance programs can help individuals achieve homeownership.

- Investing for Growth

Investing in stocks, bonds, or real estate with the aim of increasing wealth over time. Understanding investment strategies, risk tolerance, and long-term market trends are key considerations.

- Reducing Debt

Paying off high-interest debt, such as credit card balances or personal loans, can improve financial stability and increase net worth. Creating a debt repayment plan and exploring debt consolidation options are effective strategies.

By setting and working towards specific financial goals, individuals like Van Jones can take control of their financial future, increase their net worth, and achieve financial well-being. Understanding the different facets of financial goals empowers individuals to make informed decisions and prioritize their financial objectives.

Estate planning

Estate planning is an integral aspect of "how much is van jones worth" as it involves managing and distributing one's assets after death. By planning in advance, individuals like Van Jones can ensure their wishes are met and their loved ones are financially secure.

- Asset distribution

Estate planning allows individuals to specify how their assets, such as property, investments, and personal belongings, will be distributed after their death. This ensures that their wishes are respected, and their beneficiaries receive the intended inheritance.

- Tax minimization

Estate planning strategies can help reduce or eliminate estate taxes, which are levied on the value of an individual's assets at the time of death. This can result in significant savings for beneficiaries and preserve more of the deceased's wealth.

- Guardianship of children

For individuals with minor children, estate planning allows them to designate guardians who will care for their children in the event of their passing. This provides peace of mind and ensures the well-being of their loved ones.

- End-of-life care

Estate planning can also include provisions for end-of-life care, such as living wills and healthcare directives. These documents outline an individual's wishes regarding medical treatment, ensuring their preferences are honored.

Overall, estate planning is essential for managing "how much is van jones worth" as it provides a framework for distributing assets, minimizing taxes, ensuring the well-being of loved ones, and honoring an individual's wishes after their death.

In examining "how much is van jones worth," we've explored the various facets that contribute to an individual's financial well-being. Key factors include assets, liabilities, income, expenses, investments, debt, credit score, financial goals, and estate planning. Each of these elements plays a crucial role in determining net worth and shaping an individual's overall financial health.

Understanding the interconnectedness of these factors is essential for making informed financial decisions. By managing debt responsibly, setting achievable financial goals, and implementing a sound estate plan, individuals can maximize their net worth and secure their financial future. The concept of "how much is van jones worth" extends beyond a mere numerical value; it encompasses a holistic view of an individual's financial well-being and their ability to achieve their financial aspirations.

- Why Did Bunnie Fire Haley

- Notti Osama Brothers

- How Did Daryl Get The Scar On His Face

- Why Does Tiktok Say No Internet Connection

- Khazmat Without Beard

How Much Is Van Jones Actually Worth?

How Much Is Van Jones’ Net Worth?

Van Jones How Much Is The CNN Commentator Worth?